Africa: Africa Calling

The growth potential for the telecommunications industry in Africa is massive and, as James Wood explains, this booming sector presents huge opportunities for both African and international operators

October 25, 2006 at 08:03 PM

6 minute read

Africa is a surprising source of not only growth in telecommunications but also of corporate activity and, as a result, opportunities for lawyers.

When compared to Europe, the penetration levels of telecoms in Africa are far lower. According to the International Telecommunication Union (ITU), 41 per 100 inhabitants in Europe had a fixed line telephone compared with slightly over three per 100 in Africa. The level of income per household is also lower; however, such statistics hide what many consider to be real prospects of growth for telecoms companies in Africa.

Mobile growth

Although the infrastructure for fixed-line telecommunications is scarce in Africa, in many countries, fixed-line technology is being leapfrogged as operators and consumers adopt mobile technologies. ITU estimates that between 2000 and 2005 cellular mobile subscriptions grew at a compound annual rate of almost 54% in Africa (albeit from a low base), compared with only 18.3% in Europe. There are predictions that in some African countries, cellular mobile technologies themselves will be leapfrogged by wireless broadband and voice-over internet protocol. Alongside such statistics, anecdotal evidence suggests that throughout Africa a mobile telephone is becoming, even for those with very low incomes, an essential item. Given the potentially large audience and the low penetration to date, Africa is therefore a source of potential growth for mobile operators.

These seemingly rosy prospects for revenue growth need to be balanced against the risks of doing business in many parts of Africa. The infrastructure necessary to build a telecommunications network – such as roads, electricity supply and backbone networks to which calls can be terminated – is often non-existent or unreliable. Political instability is still present in many countries, making the legal regimes unpredictable. Corruption, red tape and heavy local taxes can also add to the costs of doing business in the region. Much of the population lives in extreme poverty. However, the level of corporate activity in the region shows that, in spite of the risks, the opportunities afforded by telecoms in Africa are attractive to many parties.

For operators within Africa, expansion of their existing 'footprint' represents an opportunity to achieve economies of scale. By driving down the prices obtained from suppliers, operators set cheaper prices for the handsets and services offered, making them more affordable to a larger proportion of the population within range of their masts. Expansion also diversifies some of the risks of investment in Africa across countries with different political and economic drivers.

Targeting Africa

Operators outside Africa may see the continent as a potential source of revenue growth that is more difficult to obtain in their home markets. Vodafone, for example, has exposure to African mobile telecommunications through its 50:50 joint venture with Telkom, the incumbent telecoms operator in South Africa.

Initially, corporate activity took the form of bidding for licences offered by individual countries. In many cases, a requirement of such bids was that the consortium included local partners. Further corporate activity has been generated by the changes in these consortia over time, including, in some cases, such local partners being bought out by the lead investor or operator.

In recent years, some countries have offered additional licences to increase competition in the local market and minority stakes have also been offered in a number of incumbent operators (such as Tunisie Telecom in Tunisia and Mobile Telecommunications in Namibia). For an operator seeking to build a larger footprint, such opportunities are limited and the auctions are often hotly contested. As a result, other corporate activity has arisen.

This corporate activity has most commonly taken the form of the acquisition of individual local operators. Alongside participation in the licence auctions and privatisation processes, this activity has been a focus for pan-African players such as Celtel, Investcom, Millicom and MTN of South Africa. The end of 2005 saw the initial public offering of Investcom – which had been built by its principal shareholders in these ways – on the Dubai and London stock exchanges.

Local consolidation

In the past 18 months, the market has also seen the first moves in an expected larger-scale process of consolidation. The headline-grabbing transactions have been the acquisition of Celtel by MTC of Kuwait and the takeover of Investcom by MTN. These transactions have also demonstrated that real value is now being attributed to the growth opportunities available to telecoms operators in Africa.

Millicom also announced earlier this year that it was conducting a strategic review and was in discussions in relation to a possible sale of the company, but those talks ended without a transaction being announced.

Further activity is still rumoured in the sector, with suggestions that European mobile operators – with more restricted growth prospects in their home markets – and other Middle East operators may be seeking potential growth opportunities in Africa. Speculation even includes the possibility of large acquisitions of the companies that have led consolidation to date – which could provide a new entrant to Africa with considerable local scale and geographical diversity.

Technological advances

As individual markets mature, the adoption of new technologies seems likely to create new corporate opportunities and activity. Virtual mobile network operator arrangements could arise if the capacity of installed infrastructure exceeds demand and subscribers become more discerning about the services they are receiving. The adoption of further technologies, such as 3G and wireless broad-band, also open up the possibility of further rounds of licence offerings by governments and collaborations between traditional telecoms operators and media broadcasters or content providers.

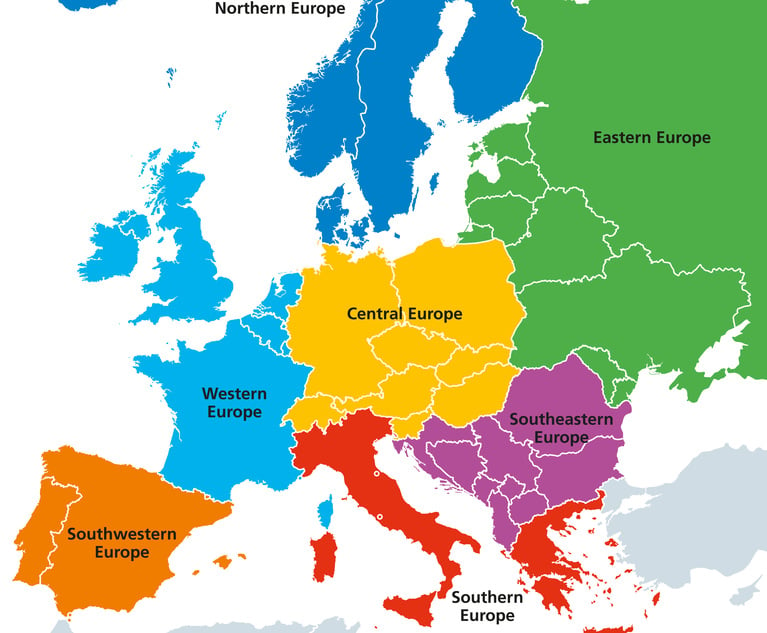

Although the corporate activity in African telecoms often involves laws unfamiliar to lawyers based in Europe, the fundamental principles of negotiating and concluding successful transactions remain the same. In addition, many local laws are based on European counterparts and local legislators and telecoms regulators can look to the European Union and its members states when benchmarking best practice.

In my experience, transaction values may factor in some discount for the risks faced by an African telecoms business and, indeed, it is difficult to protect against many of those risks in legal documents. However, a purchaser may still wish to seek higher levels of protection than would be commonplace in equivalent European transactions. However, in ensuring the maximum protection is obtained, there is undoubtedly value to be gained from past experience in transactions not just in Africa, but also outside it, in particular European markets.

James Wood is a corporate partner at Freshfields Bruckhaus Deringer in London.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of Game'

7 minute read

GOP's Washington Trifecta Could Put Litigation Finance Industry Under Pressure

Trending Stories

- 1Simpson Thacher Replenishes London Ranks With Latest Linklaters Defection

- 2Holland & Knight, Akin, Crowell, Barnes and Day Pitney Add to DC Practices

- 3Squire Patton Boggs Associate Among Those Killed in String of Methanol Poisonings

- 4Womans Suit Alleging Negligence to Sex Trafficking by Hotel Tossed by Federal Judge

- 5More Big Law Firms Rush to Match Associate Bonuses, While Some Offer Potential for Even More

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250