Africa: Over A Barrel

Oil is the lifeblood of Angola, providing 90% of the country's export revenues. Here, Luis Soares de Sousa explains changes to regulations governing open tenders in the industry

October 25, 2006 at 08:03 PM

7 minute read

Until November 2004, the landmark for Angolan petroleum legislation had been a law dating back to 1978, which established the basic principles regulating the exploration of the country's petroleum potential after independence.

Taking into account the natural growth of the Angolan oil industry and the development of new concepts and practices in petroleum concessions, the Angolan Government revised the law in November 2004.

This new law aims to safeguard national interests, promote and develop the country's employment market and allow the Government to fix and maintain a price for mineral resources and ensure their rational use, in conjunction with the increase of the country's general competitiveness on the international market.

However, contrary to the recommendations made by various international consultants, the new law has not yet fully taken into account the political risks perceived by investors, as it continues to grant the Government vast discretionary powers, which many potential investors may regard as being too great.

Currently, the law states that any company wishing to carry out petroleum-related operations in Angola outside the scope of a prospecting licence may only do so in association with the National Concessionaire, currently Sociedade Nacional de Combustivel de Angola, Empresa Publica (Sonangol) – the holder of all mining rights in Angola – under the form of a corporation, consortium or production sharing agreement.

In any case, the participating interest of the National Concessionaire in such a joint venture must exceed 50%, unless determined otherwise by the Government, and must include the right to take part in the management of petroleum operations, under the relevant contracts.

Before a potential investor can enter an agreement with the National Concessionaire, Sonangol must file an application with the Ministry of Oil requiring an authorisation to carry out the obligatory public tender.

It is only allowed to award the status of 'associate' through direct negotiation if a previously promoted tender did not result in the awarding of any concession decrees, or if all submitted bids have been deemed to be unsatisfactory.

Nonetheless, should the National Concessionaire decide not to associate itself with any other investor wanting to carry out petroleum operations in a given area, the National Concessionaire shall itself be awarded with the relevant concession decree by the Government.

Conversely, and specifically relating to the legal framework for contracting private companies for the supply of goods and services in oil-related activities, order number 127/03, of 25 November, provides for:

. an exclusivity system, related to businesses that do not require a high capital value, but merely a basic average and non-specialised know-how, in which any participation from foreign companies shall only take place on the initiative of Angolan companies;

. a system of semi-compliance, related to areas which require a reasonable level of capital and an in-depth (although not at all times) technical know-how, in which the participation of foreign companies shall only be permitted in association with national companies or on the initiative of the latter; or

. a straightforward competition system, relating to any activities that require a high level of capital and a specialised know-how, in which foreign companies are free to participate and present any bids, in equal terms with national companies.

Taking into full account these provisions, and bearing in mind the terms that have been introduced by a decree published in September 2006 – which regulates the procedures for carrying out open tenders in the oil industry – this article aims to provide a summarised insight on this topic.

Specific rules for the opening of public tenders

Two guiding principles lie behind the current legal framework for the contracting of goods and services from national state and/or private companies by companies in the oil sector. Those principles are:

. to guarantee that goods and services providers are mainly contracted through public tenders, with direct contracting generally only appearing in cases of urgent technical difficulties or market insufficiency; and

. to ensure the inclusion of the national business community and the use of national goods and services in the activities which support the demanding oil operations.

The main consequence of the second principle is that the Angolan state or private companies shall benefit from preferential rights, provided that the value of their proposal exceeds up to 10% of the value of the bids presented by the remaining candidates.

Furthermore, some goods and services may only be supplied by national companies, namely those that do not require a higher capital value and mainly demand a non-specialised technical know-how, such as pressure tests and oil storage, supply and transportation of equipment materials, supply of industrial and drinking water, catering, or maintenance of equipment and vehicles.

Should the investor carrying out petroleum operations in a given petroleum concession, in association with the National Concessionaire, or the National Concessionaire itself, require the supply of any type of goods and services, the relevant tender invitation must be made public through one of the country's major newspapers and the internet, with the identification of the goods and/or services that are required, along with the terms and conditions for the participation in the bid.

If the tender is also intended for foreign companies – when their participation is permitted – the invitation to bid has to be also published in a specialised international publication.

General legal requirements for participation in public tenders

To be able to participate in public tendering, and apart from any additional conditions included in the relevant tender documents, private national companies must:

. have more than 50% of their share capital subscribed and paid up by Angolan citizens;

. include in their corporate goals the provision of support services to oil activities;

. adapt their share capital to the requirements set out by the supervising ministry; and

. be registered and certified by the Ministry of Oil and the Chamber of Commerce and Industry of Angola.

No differences in regime have been determined in respect of public companies, which shall at all times compete in equal circumstances and with the same rights and obligations as national private companies.

Procedures for the adjudication of agreement proposals

With regard to agreements worth less than $250,000 (£134,000), the operator is generally free to negotiate and determine the terms for the resulting adjudications (provided that the National Concessionaire is informed of the terms of the relevant agreements, as well as of the identity of the suppliers each quarter).

However, decree number 48/06 specifically determines requirements in relation to public tenders worth more than $250,000. For agreements worth between $250,000 and $750,000 (£400,000), the operator shall be entitled to direct the public tenders to the investors which have been included in a specific list, approved by the National Concessionaire under proposal of the operator.

Once the operator is ready to select one of the proposals, the National Concessionaire shall be entitled to 30 working days for an objection to the adjudication, after which period the proposal shall be considered as approved.

If the value of the contract exceeds $750,000, the operator must:

. obtain prior consent from the National Concessionaire on the list of investors for which the public tender is to be directed;

. make sure that two of the received proposals are subsequently delivered in Luanda, after the necessary notification of the National Concessionaire (these proposals shall then considered to be the final official proposals); and

. conduct the inherent negotiations with the candidates and submit, in writing, a detailed evaluation of their proposals, together with a recommendation for the selected candidate, to the National Concessionaire.

To be selected, the proposal must be the lowest bid – determined from a tax, operational and technical point of view, taking into account relevant currency variations, schedules and direct production losses (and, in any case, the origin of the contracted goods and services, given the fact that the operator is obliged to give preference to national goods and services).

Luis Soares de Sousa is a partner at Goncalves Pereira Castelo Branco & Associados.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

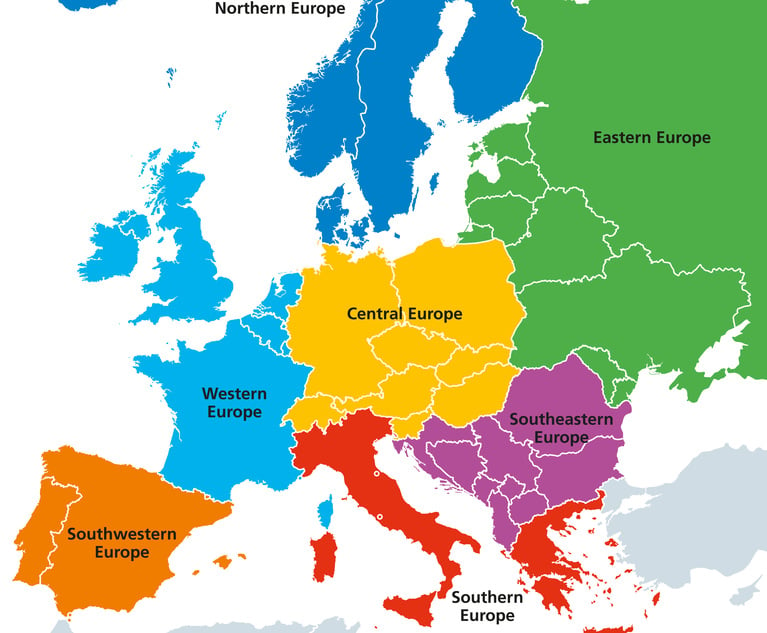

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of the Game'

7 minute read

GOP's Washington Trifecta Could Put Litigation Finance Industry Under Pressure

Trending Stories

- 1Gibson Dunn Sued By Crypto Client After Lateral Hire Causes Conflict of Interest

- 2Trump's Solicitor General Expected to 'Flip' Prelogar's Positions at Supreme Court

- 3Pharmacy Lawyers See Promise in NY Regulator's Curbs on PBM Industry

- 4Outgoing USPTO Director Kathi Vidal: ‘We All Want the Country to Be in a Better Place’

- 5Supreme Court Will Review Constitutionality Of FCC's Universal Service Fund

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250