Bigger isn't better

The rise of large, high-quality, global corporate law departments started more than 20 years ago. It was aimed, in part, at breaking up the monopolies that law firms had with corporations. Using a range of initiatives from requests for proposals to auctions, in-house counsel sought to end these cosy relationships and introduce a measure of competition into the law firm-client dynamic. The mantra of 'lawyers, not law firms' was uttered so often that it became a cliche.Because of these pressures - among others - law firms increasingly focused on becoming more effective business organisations. Some followed globalising clients and looked to provide cross-speciality, cross-border service, either through acquisitions or organic growth, or both.

November 19, 2008 at 08:07 PM

11 minute read

One-stop shopping at giant global law firms has its limit, says Ben Heineman, GE's former top lawyer

The rise of large, high-quality, global corporate law departments started more than 20 years ago. It was aimed, in part, at breaking up the monopolies that law firms had with corporations. Using a range of initiatives from requests for proposals to auctions, in-house counsel sought to end these cosy relationships and introduce a measure of competition into the law firm-client dynamic. The mantra of 'lawyers, not law firms' was uttered so often that it became a cliche.

Because of these pressures – among others – law firms increasingly focused on becoming more effective business organisations. Some followed globalising clients and looked to provide cross-speciality, cross-border service, either through acquisitions or organic growth, or both.

This trend led to the rise of global mega-firms – such as Clifford Chance, Linklaters, Jones Day, Freshfields Bruckhaus Deringer, Allen & Overy, White & Case, Latham & Watkins, and Skadden Arps Slate Meagher & Flom – with about 2,000 lawyers, a -significant proportion of whom practise outside their home country.

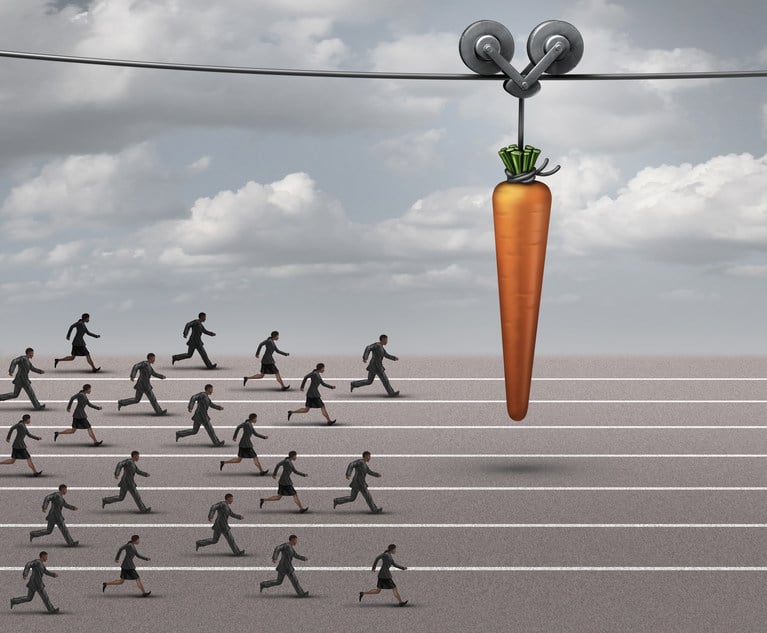

These firms have sought to regain monopoly positions with desirable multinational clients by aggressively asserting that they are a global 'brand' in various types of practices (such as capital markets, transactions, litigation or full service).

Until this year's economic downturn, many of these firms had rising revenues and profits per partner. As a result, many have argued that bigger is better and that consolidation for global one-stop shopping is inevitable in the business of law.

As general counsel of General Electric Company's global law department for many years (with approximately 1,100 in-house lawyers), I have been sceptical that the global mega-firms, in fact, provide the claimed superior service, quality, or price. Indeed, the relationship between the big law departments and big firms is often bedevilled by prickly issues relating to power, money, culture, and, ultimately, the foundational question of who controls the corporation's legal matters.

These questions have become more salient as the global economy turns down, but big firms' expenses and rates continue to rise. I recognise that GE may not be representative of in-house law departments, even big ones, and that global firms will point to paying clients as the best answer to doubts. I will return to these points at the end. But let me summarise the fundamental questions that potentially separate global law departments and large global law firms.

Does globalisation create higher costs? When firms expand, especially by acquisition, they are clearly taking on higher costs in people, space, and infrastructure. Yet, how many law firms have detailed, systematic integration policies, which identify 'synergies' that can lead to cost reductions? How many have relentless cost control programs? How often do we hear that many of the overseas offices or acquired firms are 'loss leaders'? Indeed, global firms may often finance part of their expansion with debt, leading to even higher annual costs and greater risk.

Do higher costs (and increased risks) put enormous pressure on firms to bill more per partner and per matter to cover the huge annual costs of a global firm – even before equity partners take home profits? My GE meetings with big-firm leaders usually began with a stark comparison of differing economic imperatives and worldviews.

I had to operate the legal department within a budget. They had to bill and collect like crazy for almost two-thirds of the year to feed all the mouths before they made any profit. Billing targets are red flags for clients. For example, didn't these pressures lead to overstaffing, unwarranted markups for paralegals and young associates – work that an inside department could outsource far less expensively – and strong incentives for overbilling?

Why do law firms take such a narrow view of productivity? In simplest terms, a total productivity increase in business is defined as more output with less input. To maintain margins in fierce global competition, the corporation has to lower costs along with price. But for law firms, productivity increases mean leverage – more lawyers per partner or per matter – or more hours billed per lawyer. Both of these measurements speak to increases in firm hours and revenues. But, with rising compensation and operating expenses, they do not, in and of themselves, remotely speak to more product for clients with less cost and less price.

For the largest firms, with their cost problems and billing pressures, this productivity disconnect with clients can be acute. A truly productive law firm could get the same result with fewer lawyers and less total cost (and free up hours for other efficient work for other clients). Indeed, at GE I came to believe generally that small was beautiful, and big was wasteful.

Until the big, global firms candidly address the -ultimate issue of productivity on a 'total cost' (single price) per matter basis, they will have a hard time being on the same economic page as many -corporate clients.

How can the vast global firms avoid a large mediocre middle and sustain a culture of high performance? Can they hire, teach, and retain the best in a firm with thousands of lawyers? How can they evaluate and maintain quality control over the large numbers of more senior associates and non-equity partners? How, in fact, on large, international matters with huge staffing, do they have project management discipline to ensure quality and avoid billing for unnecessary work, poor work, and rework?

Creating a unified culture across boundaries and nationalities, when the international lawyers are not homegrown, is perhaps an even more significant problem than quality control – especially when law firm acquisition and integration planning may be unsophisticated.

Why should global clients buy the speciality cross-sell from name-brand global firms? Acquiring in-house specialists has been an important element in the growth of corporate legal departments. It gives companies the capacity to evaluate and find the best outside specialists and not blindly accept a cross-sell from firms.

Thus, for the global law legal department with a high level of specialisation, the cross-sell by the global firm is no more compelling than before (and because of cost and quality issues may be even less so).

This is true even for the biggest firms, which seek to profit from a particular practice area, such as cross-border transactions for major clients. Broken up into pieces, transactions, of course, involve different legal issues beyond basic deal questions of price and control: antitrust, litigation, environmental health and safety, improper payments, and a host of other issues relating to myriad national and international laws. If those issues are complex and difficult, it is questionable whether one firm has the capacity to address them.

Why should global clients buy the cross-border cross-sell from the biggest firms? The global law department may have as much as 50% of its lawyers practising in jurisdictions outside headquarters. These lawyers are often local nationals and are knowledgeable about outside lawyers in Shanghai or Mumbai or Berlin or Tokyo. Sophisticated purchasers of international legal services will not be persuaded by a cross-border cross-sell on the basis of a firm's brand.

An antitrust issue under China's new competition laws, environmental due diligence when purchasing Russian assets, a target's improper payment problems in the Middle East, accounting issues in Japan, political issues in Poland – these may be critical to the cross-border transaction and require separate counsel with special expertise.

Again, the task of putting together the right inside and outside teams on a major cross-border matter almost always, if properly done, involves far more than simply signing up with a big global law firm.

This may be especially so because some global firms, such as Linklaters, boast about charging higher rates on cross-border matters.

Under new accounting rules, the requirement that deal costs be 'expensed', not 'capitalised' will increase the sensitivity to the mega-firms' high legal costs on cross-border transactions.

A Financial Accounting Standards Board rule – and a similar International Accounting Standards Board rule – will take effect in 2009. These rules require that legal costs on transactions be treated as 'expenses' in the year incurred, not as costs of the acquisition that can be capitalised and amortised over many years (or deferred indefinitely as goodwill).

If they weren't sensitive to deal costs already (because they were capitalised), in-house lawyers and business people will become much more so now because all annual legal costs will affect annual profitability.

l Do the inevitable conflicts of interest make retaining global firms problematic? For a large multinational corporation with many interests in many countries, it is hard to work through the technical conflicts posed by other clients of a big global firm. But the problem is even more complicated when the firm is on the other side of some general legislative, regulatory, litigation, or political issue, which is not a technical conflict, but is anathema to the corporation.

These issues are true land mines, which big firms may not find until they have exploded.

Ultimately, the question for in-house law departments is: do they want to manage their major global matters – or do they want to cede management to outside counsel?

This question of control – who really is directing the specific legal matters of the corporation – affects the answers to many of the questions raised above. The sophisticated corporate purchaser of legal services, with high-quality in-house lawyers, will often choose to oversee the important cross-border matter – whether it is a deal, arbitration, litigation, investigation, public policy issue, etc.

The corporation's general counsel may choose to work with smaller, more efficient firms – and piece together the necessary legal team through the smaller firms' few global offices, their ties with local firms, the corporation's own extensive law firm contacts and, importantly, its bluechip in-house talent.

But some businesses may not have the desire or capacity to be so aggressive. And this doubtless accounts, in part, for the global firms' rising economic numbers prior to the current slowdown. Corporate law departments may not have a tradition of an independent and activist role.

Until recently, this was especially so in the UK and Europe, where many of the big global firms are located. Midsize legal departments may not have the size, resources, and international reach to manage global matters actively.

So, too, in the tradition of hiring 'lawyers, not law firms', corporate law departments may be attracted to superstar senior partners, and then defer to them on staffing complementary matters that, in some cases, may be as effective and efficient as the alternatives.

At the end of the day, the continued rise of big global law firms will turn on a related trend. Are the CEOs in large and medium-size international companies (the big firms' targets) willing to invest in in-house legal departments? Are they willing to create global, specialised in-house groups to direct the legal work of the company and save total legal (and business) costs and play a central role in ensuring high performance with high integrity?

These high-calibre departments are a potent counterweight to the global firms, driving them to address hard questions about cost, quality, and productivity.

The rise of such departments, in Europe and Asia, not just in the US, is necessary to ensure meaningful competition among outstanding firms small, medium, and large; national and international – which has been one of the enduring goals of the 'inside counsel' movement, now more than a generation old.

Ben Heineman is former GE senior vice president and general counsel and a senior fellow at Harvard Law School's Program on the Legal Profession. He is also senior counsel to Wilmer Cutler Pickering Hale and Dorr.Sign up to receive In-house News Briefing, Legal Week's new digital newsletter

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid To Practice Law in US On Hold As Arizona Court Exercises Caution

Law Firms 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Trending Stories

- 1AIAs: A Look At the Future of AI-Related Contracts

- 2Litigators of the Week: A $630M Antitrust Settlement for Automotive Software Vendors—$140M More Than Alleged Overcharges

- 3Litigator of the Week Runners-Up and Shout-Outs

- 4Linklaters Hires Four Partners From Patterson Belknap

- 5Law Firms Expand Scope of Immigration Expertise, Amid Blitz of Trump Orders

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250