The right strategy

When one newly-appointed finance director took up his new role, he reportedly said: “If a manufacturing business ran itself like we do, they would go bust in one day”. The statement reflects a call to arms from finance directors, human resources and clients alike for law firm IT departments to help them out as the recession hits.

July 02, 2009 at 05:03 AM

14 minute read

The original version of this story was published on Law.com

How IT departments can best assist their companies to survive during the recession was the main topic of conversation at Legal Week’s Strategic Technology forum, held last month in Spain. Charlotte Edmond reports

When one newly-appointed finance director took up his new role, he reportedly said: “If a manufacturing business ran itself like we do, they would go bust in one day”.

The statement reflects a call to arms from finance directors, human resources and clients alike for law firm IT departments to help them out as the recession hits.

Speaking at Legal Week’s annual Strategic Technology Forum last month, Linklaters’ chief operating officer and conference co-chair, Simon Thompson, told delegates to think about what support functions should be doing to support the wider business: “What, as service providers in IT, do we need to provide to the business in order to make it survive? It is a huge time of change. We have got a huge challenge from a product point of view; from a geography point of view; from a people point of view; from a technology perspective… it is absolutely unprecedented.

“The one thing we do know is we don’t know what is going to happen next… flexibility has got to be the key.”

Many delegates are seeing their IT departments coming under exceptional scrutiny as law firms look to tighten costs and cut down on unnecessary expenses.

Freshfields Bruckhaus Deringer finance director Laurence Milsted is likely to have echoed the sentiment across many firms when he said: “IT has always been considered a cost and we need to see the return. It is always easy to see the costs and difficult to see the returns.”

Joking about how the average financial director views large IT projects, he added: “I sit in my room and IT come up with a budget for a whole bunch of things they want to spend money on in the next year. And it’s actually quite easy, because you just have to say ‘no’.

“And in a way that is the right answer, because law firms have a history of delivering IT projects with a success rate that would rival vetting English members of Parliament’s expense claims.”

Major projects

But Milsted is among a large contingent of people who believe that this is set to change. Law firms as a whole are starting to sit up and pay attention to what their IT departments are able to deliver them as organisations are sufficiently scared about the current environment that they are prepared to swallow radical change. “That is a huge opportunity for us in the back bit of the business to deliver something for the front bit of the business that will help support clients,” he said.

Linklaters chief financial officer Peter Hickman agreed, saying although IT was not the reason a client would appoint the firm, the firm would not be able to function without it. He cited Linklaters’ recent appointment as advisers to administrators PricewaterhouseCoopers on the collapse of Lehman Brothers: “We didn’t get that work because of our IT systems. We got it because of relationships and reputation; global coverage, brand etc. But there is no doubt that our ability to set up an office in Lehman’s building in double-quick time so our lawyers could be effective from the first moment and access documents and engage internationally was critical to being successful in that assignment.”

Lawyers’ typically conservative nature can often prove a headache for IT departments, because even leaving cost aside, many would rather err on the side of caution and introduce new technologies only after other firms have trialled them first.

Hickman summarises: “In terms of innovative technology I would always rather go second than first – I would rather be trailing edge rather than leading edge. I think that by going second – not last – someone else will have spent more money, the bugs will be ironed out and you can learn from their errors.”

Finding the cash

But with regards to finding funding for large IT projects and similar, could the opportunities provided for outside investment under the Legal Services Act provide the answer? Opinion is divided.

The managing partners of three of the world’s largest law firms – Clifford Chance’s David Childs, Freshfields’ Ted Burke and Linklaters’ Simon Davies – were all in agreement in their opening interview with HSBC group general manager for legal and compliance Richard Bennett that outside investment was not for them.

The trio were dismissive of a theory, primarily voiced by Richard Susskind, that much of a lawyer’s job could be replaced by technology given sufficient investment in IT systems.

Childs commented: “I am in no doubt that there are tasks that you can automate, but we don’t really want to be in the business of providing commodity services. We want to be in the business of providing services with real intellectual power behind them and using the knowledge of the organisation.”

Burke argued that although forms and documents could be standardised, it was not possible to commoditise judgment and analysis. He acknowledged that while there was pressure, particularly at the moment, to reduce costs the majority of law firms would shy away from high-volume work in preference for high-value work.

However, many of the delegates disagreed with this stance, with one delegate commenting: “When we talk about the impact of the regulatory change, it doesn’t matter too much how many firms take up funding. It doesn’t really matter whether the largest firms do it – I don’t think they really need to – it just takes a high-profile, successful firm for a short period to do it “If you’ve got people buying up your talent you have to respond somehow. There may be three or four or five law firms in London that don’t get threatened by that and will survive the US firms coming into the market, but there are probably another 95-100 who will be very severely impacted by it and I think that will drive big change through the market.”

Coming out the other side

Where delegates were split on funding however; they converged on one opinion: with the downturn pushing change the industry is going to see more developments in the coming years.

And if law firms take up the baton, the pace of change and development seen in IT departments over the last 10 years is likely to go up another gear. As Childs reminisced: “I remember when personal computers first came in and the secretaries kissed them good night.”

To view a video of a discussion between HSBC's Richard Bennett and three magic circle managing partners about the impact of technology on their firms, click here.

How IT departments can best assist their companies to survive during the recession was the main topic of conversation at Legal Week’s Strategic Technology forum, held last month in Spain. Charlotte Edmond reports

When one newly-appointed finance director took up his new role, he reportedly said: “If a manufacturing business ran itself like we do, they would go bust in one day”.

The statement reflects a call to arms from finance directors, human resources and clients alike for law firm IT departments to help them out as the recession hits.

Speaking at Legal Week’s annual Strategic Technology Forum last month,

“The one thing we do know is we don’t know what is going to happen next… flexibility has got to be the key.”

Many delegates are seeing their IT departments coming under exceptional scrutiny as law firms look to tighten costs and cut down on unnecessary expenses.

Joking about how the average financial director views large IT projects, he added: “I sit in my room and IT come up with a budget for a whole bunch of things they want to spend money on in the next year. And it’s actually quite easy, because you just have to say ‘no’.

“And in a way that is the right answer, because law firms have a history of delivering IT projects with a success rate that would rival vetting English members of Parliament’s expense claims.”

Major projects

But Milsted is among a large contingent of people who believe that this is set to change. Law firms as a whole are starting to sit up and pay attention to what their IT departments are able to deliver them as organisations are sufficiently scared about the current environment that they are prepared to swallow radical change. “That is a huge opportunity for us in the back bit of the business to deliver something for the front bit of the business that will help support clients,” he said.

Lawyers’ typically conservative nature can often prove a headache for IT departments, because even leaving cost aside, many would rather err on the side of caution and introduce new technologies only after other firms have trialled them first.

Hickman summarises: “In terms of innovative technology I would always rather go second than first – I would rather be trailing edge rather than leading edge. I think that by going second – not last – someone else will have spent more money, the bugs will be ironed out and you can learn from their errors.”

Finding the cash

But with regards to finding funding for large IT projects and similar, could the opportunities provided for outside investment under the Legal Services Act provide the answer? Opinion is divided.

The managing partners of three of the world’s largest law firms –

The trio were dismissive of a theory, primarily voiced by Richard Susskind, that much of a lawyer’s job could be replaced by technology given sufficient investment in IT systems.

Childs commented: “I am in no doubt that there are tasks that you can automate, but we don’t really want to be in the business of providing commodity services. We want to be in the business of providing services with real intellectual power behind them and using the knowledge of the organisation.”

Burke argued that although forms and documents could be standardised, it was not possible to commoditise judgment and analysis. He acknowledged that while there was pressure, particularly at the moment, to reduce costs the majority of law firms would shy away from high-volume work in preference for high-value work.

However, many of the delegates disagreed with this stance, with one delegate commenting: “When we talk about the impact of the regulatory change, it doesn’t matter too much how many firms take up funding. It doesn’t really matter whether the largest firms do it – I don’t think they really need to – it just takes a high-profile, successful firm for a short period to do it “If you’ve got people buying up your talent you have to respond somehow. There may be three or four or five law firms in London that don’t get threatened by that and will survive the US firms coming into the market, but there are probably another 95-100 who will be very severely impacted by it and I think that will drive big change through the market.”

Coming out the other side

Where delegates were split on funding however; they converged on one opinion: with the downturn pushing change the industry is going to see more developments in the coming years.

And if law firms take up the baton, the pace of change and development seen in IT departments over the last 10 years is likely to go up another gear. As Childs reminisced: “I remember when personal computers first came in and the secretaries kissed them good night.”

To view a video of a discussion between

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

BCLP Mulls Merger Prospects as Profitability Lags, Partnership Shrinks

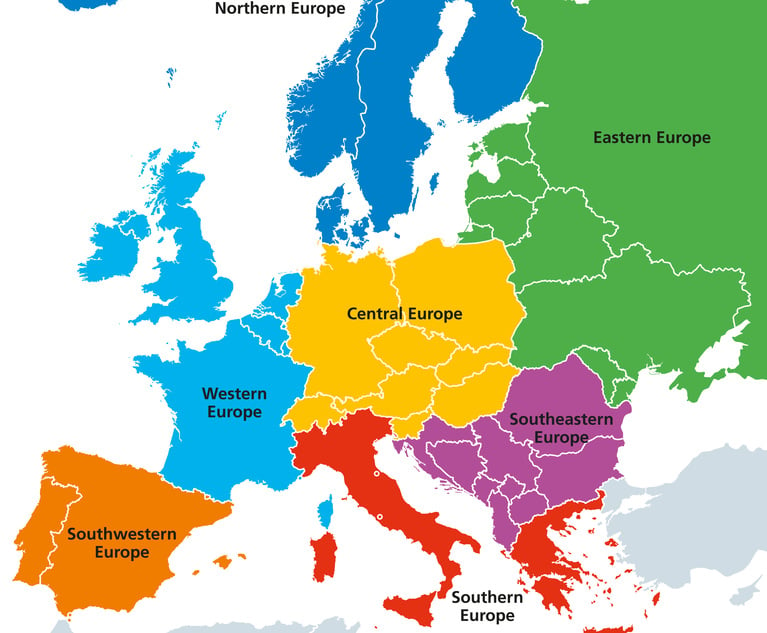

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of the Game'

7 minute readTrending Stories

- 1Cars Reach Record Fuel Economy but Largely Fail to Meet Biden's EPA Standard, Agency Says

- 2How Cybercriminals Exploit Law Firms’ Holiday Vulnerabilities

- 3DOJ Asks 5th Circuit to Publish Opinion Upholding Gun Ban for Felon

- 4GEO Group Sued Over 2 Wrongful Deaths

- 5Revenue Up at Homegrown Texas Firms Through Q3, Though Demand Slipped Slightly

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250