Norton Rose

The last decade has seen some tough times at the venerable Norton Rose. Still, a move to shiny new offices at More London should help morale, while financial performance is now back on the up.

December 13, 2009 at 07:16 PM

12 minute read

Click here to post your comments (anonymously) and help build an insider's profile of the top 20 City firm, using the categories listed below as a guideline, or email [email protected] with any information you think should be added to this page.

Overview

Until fairly recently written off by many as a once-proud City brand doomed to fall further behind larger and more aggressive firms, Norton Rose has staged something of a revival in recent years. A firm that was once defined by a struggling international network, an uncertain strategy and a steady stream of senior departures has more than stabilised, exuding a more confident mood.

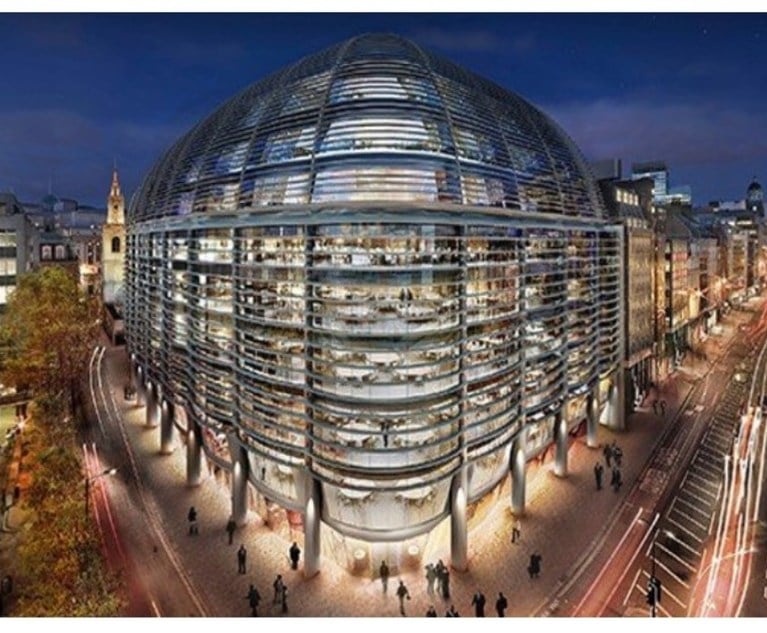

One element of its revival was ditching its worn Kempson House offices for the state-of-the-art More London site in Tower Bridge several years back. Even more significant has been finally getting its extensive international network into shape, reversing a major problem for the firm in the late 1990s. With three years of solid financial performance behind it, Norton Rose looks to be once again on the front foot. Even during the tough financial year of 2008-09 Norton Rose maintained its growth, with fee income up 5.7% to hit £314m.

The 264-partner firm, which is now the 10th largest legal practice in the UK in revenue terms, is typically classed in the tier of firms just below the magic circle, along with the likes of Herbert Smith and Lovells. Much is now resting on the firm's audacious tie-up with Australian practice in Deacons, which Norton Rose is hoping will provide a springboard for its ambitions in Asia.

History

As mentioned above, Norton Rose has one of the proudest histories in City. The firm can trace its origins back to 1794 and grew to prominence through two highly influential inventions of the Victorian age: railways and investment funds. The firm's peerless establishment credentials are underlined by the record of one of its founders, Sir Phillip Rose, who was politically active and an adviser to Benjamin Disraeli. Then as now, Norton Rose was identified with finance, especially the finance of infrastructure.

The firm's progress was suitably stately over the next 150 years or so, yet it was to be dealt a near-crippling blow just as the City legal market started to go through radical change when its London headquarters was severely damaged by an IRA bomb in 1992. Being forced to operate with temporary office space and shoulder substantial refurbishment costs between 1993 and 1995 decimated the firm's profits for a spell, just as the UK legal services market was becoming far more competitive.

Having fought to stabilise the ship, Norton Rose in 1996 turned to consultant Bain & Co for advice. The result was that Norton Rose was to split from the M5 grouping of regional firms with which it was aligned at the time, largely to pursue international expansion and refocus its practice at the top end of the market. Buoyed by its top-tier banking practice, the firm's strategy seemed reasonable but closing the gap with larger rivals proved difficult. Some favoured going for a swift US merger (the firm was reported to have discussed a tie-up with White & Case, among others), while others wanted to build up Europe alone.

What is certain is that international expansion was costly in the early years. Nowhere was this more obvious than in Germany, where Norton Rose merged with a substantial chunk of national practice Gaedertz in 2000. The deal was to prove expensive, with a team of partners exiting the firm in 2002. Finally, the unhappy union was resolved in late 2004 when the Cologne office transferred to CMS Hasche Sigle, leaving Norton Rose to focus its efforts on Munich and Frankfurt. The firm was also forced to leave the key Hong Kong market for three years thanks to a non-compete clause with a former ally.

There were also challenges at home, where Norton Rose lost a number of lawyers, most notably a four-partner acquisition finance that quit in 2002 for Allen & Overy (see analysis). The firm's profitability also fell considerably during the lean commercial years of 2002 and 2004. Nevertheless, the last two years have been more successful, in no small part because its sizeable international network is beginning to mature. During 2007-08, the firm posted a dramatic 27% rise in turnover to reach a new high of £297m, with partner profits also increasing by an impressive 22% to reach £625,000.

Even during the recession, the firm in 2008-09 managed to grow its revenues by 5.7% to £314m, while profits per equity partner fell back by 17.4% to £517,000, which will be viewed as a respectable performance. The firm also attracted attention for introducing an unusual flexi-time scheme in 2009 as a means of avoiding the kind of redundancies that were being implemented by many of its City rivals.

There was also much interest in June 2009 when the firm announced it had secured a merger with the sizeable Australian law firm Deacons. The deal, which comes into force on 1 January 2010, which will increase the combined turnover of the Norton Rose Group to £420m and give the firm 700 lawyers in Asia.

Click here to read a commentary on the move.

News, deals and comment on Norton Rose

Culture

While Norton Rose might lag behind the magic circle in profitability, the firm offers other advantages for its lawyers – including a meritocratic but convivial atmosphere. "Norton Rose is a class act," says one contributor. "I've worked for a magic circle firm and a US firm and can assure all that Norton Rose is one of the fairest firms in the City. This doesn't just include remuneration (where bonuses can be more than competitive), but also everything else that contributes to a happy work-life balance."

Overall, you would have to put culture as one of the firm's stronger cards. Norton Rose is typically ranked very well in terms of collegiality and partner treatment of staff in surveys. The firm is also viewed as more supportive than the typical City practice.

This has been underlined by Legal Week Intelligence's annual Employee Satisfaction Report, in which the firm has consistently been one of the most highly-rated City law firms on the standards of its own assistants' satisfaction. In 2009, the firm received particularly good reviews for making staff feel valued and having a positive culture. Understandably, the recent decision to avoid redundancies via a flexi-time scheme has been very well received internally.

Key departments

Norton Rose still packs its biggest punch in finance, particularly asset finance, projects-related work and structured finance, where it would be regarded as top-tier in Europe or close to it. Also capable in loans and leveraged finance. New areas that the firm has developed in recent years include its AIM practice and an interesting niche in renewable energy and carbon trading. The firm has also been one of the most committed to Islamic finance. As a full service practice, has more than competent teams in competition, property, tax and corporate.

The firm formally focuses its business around five sectorial areas (dubbed 'headlights'). They are:

- corporate finance;

- financial institutions;

- transport;

- energy & infrastructure; and

- technology.

National/international coverage

Very wide. Norton Rose has 21 offices in 16 countries before the tie-up with Deacons goes live, giving it considerable coverage of Europe, the Middle East and Asia.

The full list of its offices is: Abu Dhabi, Amsterdam, Athens, Bahrain, Bangkok, Beijing, Brussels, Dubai, Frankfurt, Hong Kong, Jakarta (associate office), London, Milan, Moscow, Munich, Paris, Piraeus, Prague, Rome, Riyadh (associate office), Shanghai, Singapore, Tokyo and Warsaw.

After the Deacons union, the firm will have one of the largest practices in the wider Asian region with around 700 fee earners locally and well over £100m in revenue, with offices in Sydney, Melbourne, Perth, Canberra and Brisbane.

Key clients

The firm has a fairly heavy bias toward banking clients, as illustrated by its long-standing relationship with HSBC. However, recent years have seen it expand its corporate practice, including building an active Alternative Investment Market business. Its most active current clients include HSBC, Nestle, SocGen, BNP Paribas, Calyon, easyJet, AIG, Trinity Mirror, Carlsberg and BMW.

Leading partners

Key practitioners include:

- Simon Currie (energy, renewables);

- Chris Brown (infrastructure);

- James Bateson (corporate insurance);

- Martin Coleman (competition);

- Neil Miller (Islamic finance);

- Mike Rebeiro (outsourcing);

- Jonathan Herbst (regulatory);

- Gordon Hall (transport, asset finance);

- Martin Scott (corporate); and

- Anthony Hobley (climate change and carbon finance).

Career prospects

"If you want the opportunity to make partnership within eight-10 years, then Norton Rose is the place to do it.," says one contributor. "Why? Because they allow you to develop your own client base." Every cloud, eh?

As the firm itself says, it is in expansion mode, as can be seen from Norton Rose's last two partnership rounds, which totalled 45 partner promotions. The firm also introduced an 'of counsel' role in 2006 as an alternative career track. Has so far appointed 24 to the role. The firm promoted 12 new partners in 2009, only slightly down on 2008 despite the global slump.

Salaries

Norton Rose drastically raised its pay for junior lawyers in 2007, before freezing NQ pay in 2008 as market conditions tightened.

Current levels are:

- training contract: £37,000 (year one), £40,200 (year two);

- newly-qualified: £63,500;

- 1yr PQE: £69,000;

- 2yr PQE: £77,000; and

- 3yr PQE: £85,000.

There have been more mixed reports regarding the firm's generosity for paying bonuses, even though its current scheme can theoretically be worth up to 30% of salary for top-billers.

Certainly, one Norton Rose contributor is not a happy bunny. "Bonuses are non-existent," he writes succinctly. Another points to a distinct lack of "perks" as evidence of the firm's 'careful' approach to splashing the cash.

However, this contrasts with the experiences of one in-house lawyer formerly of the top 10 City firm. "The earlier comment about bonuses is quite simply wrong," he rails. "I did quite well out of Norton Rose bonuses. Perhaps the problem for the earlier contributor is that bonuses are based on merit!"

Legal Week Intelligence's 2009 Employee Satisfaction Report also found the firm's bonus scheme was not that popular with the troops.

Recruitment

Key recruitment contacts are graduate recruitment manager Karen Potts ([email protected]) and graduate recruitment partner Sam Eastwood ([email protected]).

The firm made headlines in 2008 with it announcement that it was considering axing the minimum requirement of a 2:1 degree from training contract applicants.

Click here to watch an exclusive legalweek.com interview with Sam Eastwood on getting your foot in the door at a leading firm and impressing at interview.

Work/life balance

Not the worst but, as a City firm with a major banking practice, Norton Rose expects you to clock up considerable hours, especially if you want to unlock much of that bonus. Set against that, the firm does get credit for allowing staff to work flexibly. Standard billing target is 1,500 hours a year. The firm gets good reviews for not being excessively focused on billable hours.

Diversity

Norton Rose is proud of its record on diversity, citing a high ranking from a recent diversity index by the Black Solicitors' Network. The firm, which created a diversity committee in 2005, says that it is still the only major City law firm to make equal opportunities and anti-harassment training compulsory for all staff (including lawyers). Also complied with a recent Government request for law firms to produce diversity statistics.

Pro bono/corporate social responsibility

Norton Rose has an excellent reputation for pro bono, according to Legal Week research, with the firm requiring all lawyers to take part in pro bono work. Ventures currently supported include evening drop-in legal advice surgeries at the Tower Hamlets Law Centre in Whitechapel. Also works with Wandsworth & Merton Law Centre, enabling the centre to provide an additional weekly evening surgery at its Tooting office. These surgeries concentrate on advice in employment, consumer, private tenancy and small claim matters. Other ventures the firm supports include the Royal Courts of Justice Citizens' Advice Bureau Panel and the Free Representation Unit, which provides representation before tribunals where legal aid is not available.

The firm gives priority support to one charity, Barretstown, which provides a programme of therapeutic recreation for children with cancer and other serious illnesses.

Click here to post your comments on the firm, or alternatively email [email protected] with any information you think should be added to this page.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

A&O Shearman, Cleary Gottlieb Act on $700M Dunlop Tire Brand Sale to Japan's Sumitomo

Stewarts and DAC Beachcroft Lead on £2B Leicester City Helicopter Crash Litigation

Trending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250