Hard to handle - the challenges presented by Russia's bustling legal market

Buoyed by high energy prices but hamstrung by corruption fears, Russia remains a key market – and challenge – for law firms. Rose Orlik reports

May 17, 2012 at 07:03 PM

10 minute read

Buoyed by high energy prices but hamstrung by corruption fears, Russia remains a key market – and challenge – for law firms. Rose Orlik reports

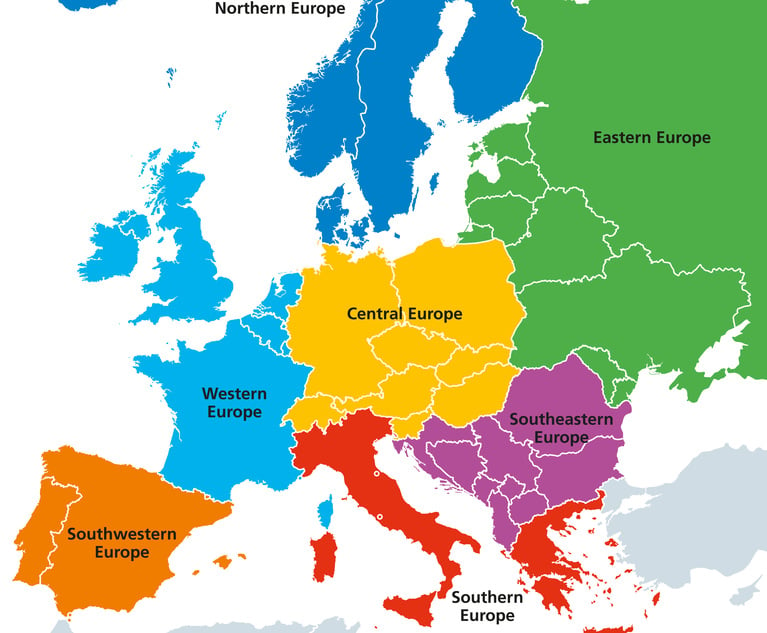

Rich in natural resources, state-owned super companies and oligarchs, Russia has traditionally been a tempting but tough nut for international businesses to crack. It provides a hub for many companies throughout Central and Eastern Europe and, while many European economies have stagnated, has proved relatively resilient throughout the downturn.

Little surprise, then, that the UK Government in recent months has pushed to improve Anglo-Russian relationships after a frosty period. Prime Minister David Cameron's trade delegation to Moscow at the end of last year even saw Allen & Overy senior partner David Morley and Eversheds managing partner Lee Ranson included, in a rare example of lawyers joining politicians on such trips.

While the country remains challenging to foreign companies, this hasn't stopped the trickle of law firms opening offices and expanding in the region. The latest entrants include Quinn Emanuel Urquhart & Sullivan, which launched in the capital with the hire of a pair of litigators from Dechert, while Eversheds recently announced a new best friend association with Capital Legal Services.

While the country remains challenging to foreign companies, this hasn't stopped the trickle of law firms opening offices and expanding in the region. The latest entrants include Quinn Emanuel Urquhart & Sullivan, which launched in the capital with the hire of a pair of litigators from Dechert, while Eversheds recently announced a new best friend association with Capital Legal Services.

International and local firms widely agree on the importance of an in-country presence to win both inbound and outbound Russian work. Salans Moscow managing partner Florian Schneider observes: "Even if you team up with a local firm, there are so many legal and cultural peculiarities that you really can't understand them unless you're on the ground. You need experienced Russian lawyers with knowledge of the history and customs to really succeed."

In this vein, Eversheds, with its best friends alliance, stands out as the exception. "Having a presence in Russia should not just be about having a flag on the map," says Ranson, adding: "The key for us was to ensure that any inbound Russian work from our international corporate clients was serviced to the highest possible standards. In relation to outbound work, Russian clients like the continuity of a contact on the ground, as well as our ability to meet their needs in the important international growth markets in which they invest."

Linklaters and Clifford Chance (CC), two of the leading international players in Russia, are clear about the importance of a local base. Managing partner for CC Moscow, Jan ter Haar, says a Russian presence has been key in recent major deals, including the ongoing joint venture between Gazprom, Statoil and Total to develop the Shtokman offshore gas field, on which CC advised the JV Shtokman Development.

Deal flow

Although not immune to Europe's economic quagmire, high global energy prices have provided much support to the local economy, with gross domestic product predicted to grow 3.5% in 2012. Vassily Rudomino, senior partner of Moscow law firm ALRUD, has seen investor interest in the country grow rapidly in recent months: "Russia is one of the last growing markets in Europe." He points to the construction and manufacturing industries as being particularly active for law firms.

The real estate and pharmaceutical sectors have also seen growth recently, throwing up work for both local and international firms. However, the biggest generator by far remains the natural resources sector. Sergey Pepeliaev, managing partner of the Pepeliaev Group, says Russian firms' traditional strength in regulatory issues "keeps them busy compared to international law firms".

For Linklaters, acting on PepsiCo's recent $3.8m (£2.3m) acquisition of Russian dairy giant Wimm-Bill-Dann – Pepsi's largest-ever transaction outside the US – hinged upon having a presence in the country, as did advising on Total's $4bn (£2.5bn) acquisition of a 12% stake in gas producer Novatek. "There were significant Russian law issues related to both, so working out of the Moscow office was absolutely essential," says local projects partner Matthew Keats.

Exporting disputes

When it comes to outbound work, Russia is mainly known for budget-busting litigation between oligarchs such as Boris Berezovsky and Roman Abramovich, currently fighting over billion-pound damages related to the sale of shares in Russian oil company Sibneft.

The prominence of Russian litigation and dispute resolution cases in London is attributable to a number of factors, according to partners in domestic and international firms. "Every second deal is carried out under English law; it is a very popular one to work in," says Schneider. Contracts, M&A and joint ventures tend to be drawn up under English law, "so it's logical to choose London as a venue for disputes", he continues.

Many Russian companies are structured around UK or Jersey-based trusts, and a number of defendants and plaintiffs – especially high-profile oligarchs – live in London, reinforcing its position as a natural destination for arbitration.

Businesses are also pushing to have cases centred in Russia heard in the London courts, according to Moscow-based Gide Loyrette Nouel counsel Tim Theroux. Insolvencies and restructurings are a classic example: "People strategically choose to bring claims to London, notwithstanding the fact that insolvency proceedings tend to depend on the location of the company," he comments.

This trend points to lack of confidence in Russia's rule of law and judicial independence, a concern that has been arguably the biggest drag on Russia's development as a thriving legal hub. Tales of corruption and a disregard for company law paint a poor image of Moscow as a place to do business, with several partners claiming the lack of new international entrants to the market is a symptom of the perceived heightened risk.

"Russia is not alone in facing these challenges," says Eversheds' Ranson (pictured). "There exists a huge gap between the haves and the have-nots and a general feeling that corruption is the norm within society. This undermines confidence in the judiciary and the wider court system and causes investor concern, particularly among US and UK businesses."

"Russia is not alone in facing these challenges," says Eversheds' Ranson (pictured). "There exists a huge gap between the haves and the have-nots and a general feeling that corruption is the norm within society. This undermines confidence in the judiciary and the wider court system and causes investor concern, particularly among US and UK businesses."

The enforcement problem

Notwithstanding these fears, domestic and foreign lawyers alike underline the straightforwardness of Russian business law, describing it as "comparable to the West". "The laws are relatively simple and clear", says Rudomino. "It is enforcement that is the major problem. The courts are very busy; it is possible to bring cases against big business and the government, but it is true that the quality needs further improvement."

Lack of enforcement can create an uneven playing field for international and local advisers, according to one Moscow-based partner at an international firm. "The legal market consists of lawyers following Western practices and lawyers who conduct litigation and arbitration in a more local way. Working the Western way, you kill yourself to see results, but some lawyers are considered just as successful even though they have altogether different tactics," he observes.

Whether using foreign or domestic laws, several developments have the potential to improve Russia's business environment in the medium to long term. The revamped Civil Code – on course for implementation before the end of the year – is widely expected to simplify and strengthen existing laws, with local firms in particular underlining its importance for companies and investors.

Berwin Leighton Paisner's Russia practice, Goltsblat BLP, is one of a number advising the Government on changes to the Civil Code, which is effectively a rulebook governing contract and company law, among other things.

"The Civil Code is quite advanced compared to where it started out," says managing partner Andrey Goltsblat (pictured). "We need to make transactional and corporate laws more flexible, but this is mainly for the benefit of Russian businesses using local law." International businesses, he continues, are more concerned with "the legal atmosphere and rule of law", where: "To attract more foreign business you just need consistent, reliable application of law."

"The Civil Code is quite advanced compared to where it started out," says managing partner Andrey Goltsblat (pictured). "We need to make transactional and corporate laws more flexible, but this is mainly for the benefit of Russian businesses using local law." International businesses, he continues, are more concerned with "the legal atmosphere and rule of law", where: "To attract more foreign business you just need consistent, reliable application of law."

Russia's forthcoming accession to the World Trade Organisation (WTO) should make it a more attractive place to do business, according to CC's Jan ter Haar: "Currently, we're mainly seeing instructions from companies with experience of doing business here. It will be interesting to see whether joining the WTO makes Russia more inviting to potential market entrants," he comments.

Moscow-based partners agree the Government is striving to make Russia a more attractive place to do business, with Rudomino noting that Dmitry Medvedev, who was replaced as president by Vladimir Putin earlier this year and is now prime minister, is "very concerned about the attractiveness and competitiveness of the Russian economy".

However, the country's reputation for corruption and state interference remains a problem. "There's lots of interest and investors do want to come here," comments Schneider, "but they're waiting for Russia's image to change."

Putin's recent election to the presidency has also boosted investor confidence, argues Rudomino. "It is a signal to Russian and international companies that for the next six years, the business environment will be quite predictable and they will know what to expect," he observes.

Government efforts to accelerate the privatisation of state-owned companies might also spur international law firms considering a move to the region. Pepeliaev group managing partner Sergey Pepeliaev observes: "The Russian Government is pushing the formal privatisation plan. Earlier this year Medvedev reminded the Government to apply itself to this agenda, and we expect a number of significant deals this year as a result."

However, as Ranson cautions: "Genuine confidence in a legal system doesn't happen overnight. Russia is a young democracy with many challenges. If Putin is truly committed to the business agenda, then ultimately he will have to introduce reforms that will make it a more stable place to operate for Western companies and law firms alike."

———————————————————————————————————————————————–

A regional giant

Last year, Russian leader Egorov Puginsky Afanasiev & Partners merged with Central and Eastern European practice Magisters, creating the largest local firm in the former Soviet Union area with combined revenues of around £101m, 27 partners and more than 300 lawyers.

Local market chatter suggests the tie-up is strategically sound, but the practicalities of bedding it down have proven challenging.

Egorov chairman Dimitry Afanasiev comments: "We aim to fully utilise the synergies of the merger and retain the strongest lawyers while letting go of the less strong.

"This is exactly what should be happening in a good merger. And the net result of this process is us having higher calibre lawyers.

"We aim to remain the mean, lean fighting machine while also being the largest law firm in Russia and the Commonwealth of Independent States."

One local partner observes: "It's in line with their strategy of trying to become the number one regional law firm, but the question is whether they can integrate fully and exploit the resources they've acquired."

The consensus is that the newly merged firm will be commandingly placed strategically in the region if management succeeds in bedding down the deal.

———————————————————————————————————————————————–

Top-ranked corporate and M&A firms in CEE

- Band 1 – Clifford Chance, White & Case

- Band 2 – Allen & Overy, Baker & McKenzie, CMS, Freshfields Bruckhaus Deringer, Linklaters, Weil Gotshal & Manges

- Band 3 – DLA Piper, Salans, Wolf Theiss

- Band 4 – Gide Loyrette Nouel, Noerr, Schoenherr

Top-ranked projects and energy firms in CEE

- Band 1 – Clifford Chance, CMS, White & Case

- Band 2 – Allen & Overy, Freshfields Bruckhaus Deringer, Linklaters

- Band 3 – Baker & McKenzie, DLA Piper, Gide Loyrette Nouel, AARPI, Salans

- Band 4 – Chadbourne & Parke

Source: Chambers and Partners

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of the Game'

7 minute read

GOP's Washington Trifecta Could Put Litigation Finance Industry Under Pressure

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250