UK top 50 on course to report 4% growth in tough trading conditions

Preliminary results show revenue growth outstripping growth in profit per equity partner in difficult market conditions

July 12, 2016 at 04:14 AM

4 minute read

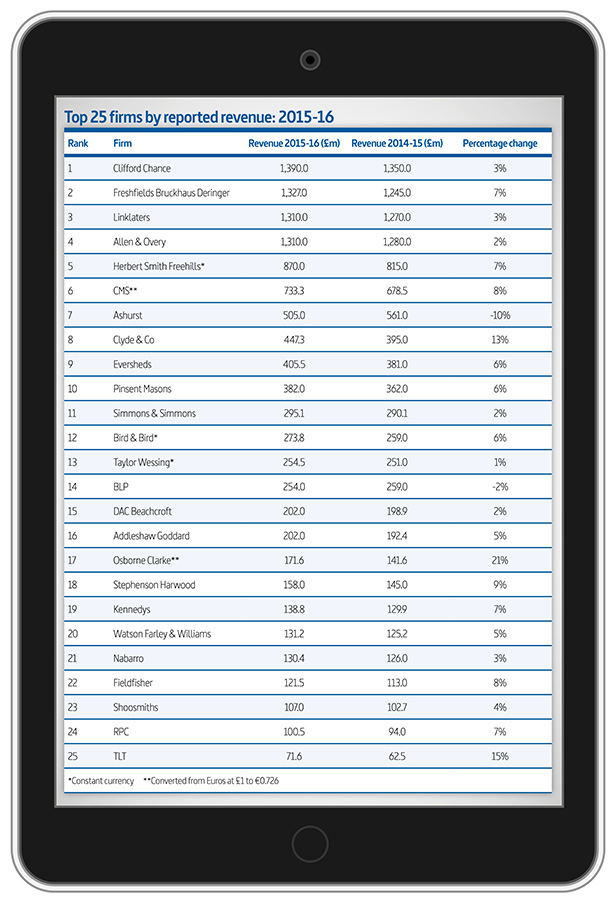

The early financial results of the UK top 50 show a 4% revenue increase in 2015-16, analysis by Legal Week has revealed.

The early financial results of the UK top 50 show a 4% revenue increase in 2015-16, analysis by Legal Week has revealed.

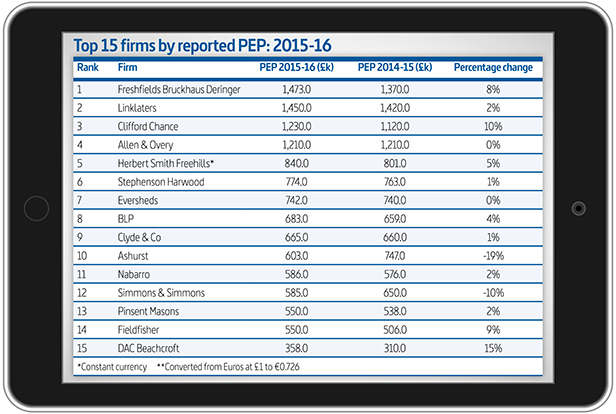

An examination of the results of the 25 top 50 firms to have released their results at this point show that revenue has grown by 4% across the group. Profitability has also grown by 2%, according to the results of the 16 firms that have given profit per equity partner (PEP) figures.

The magic circle had a much better year in 2015-16 than in 2014-15, with both revenue and profitability ticking upwards across the group after stagnating last year.

The magic circle had a much better year in 2015-16 than in 2014-15, with both revenue and profitability ticking upwards across the group after stagnating last year.

Setting aside Slaughter and May, which does not release financial results, the magic circle firms grew by 4% in 2015-16, compared to an anaemic 1% in 2014-15.

PEP also grew across the group by 5%, whereas it remained static in 2014-15.

The big winners out of the magic circle firms were Freshfields Bruckaus Deringer, which grew revenue by 7% and PEP by 8%, and Clifford Chance, which grew revenue by 3% and added 10% to its PEP figure, taking it to £1.23m in 2015-16.

Allen & Overy delivered the most modest performance of the group, with just 2% revenue growth and flat profit. The firm was overtaken by Freshfields in revenue terms and is now neck and neck with Linklaters, with both firms reporting revenue of £1.31bn in 2015-16.

Alan Hodgart, a consultant at Hodgart Associates, said: "The overall 4% rise doesn't surprise me – outside the magic circle you are talking 2%-6% growth, which is about right in a tough market."

Tony Williams of Jomati Consultants said the slow M&A market in the first half (H1) of 2016 would have had a dampening effect on the results of the top 50 in 2015-16.

Mergermarket data released last week showed that the UK had been particularly affected, with M&A values falling by nearly 70% in H1 compared to the equivalent period last year, falling to $59.6bn this year from $185.3bn last year.

Williams said: "Firms normally have a surge towards the year-end and that probably petered out because of Brexit and economies cooling generally."

The performance of the City-based firms was mixed, with the some of the best performances coming from Fieldfisher, which delivered growth of 8% and boosted its PEP by 9%, and Stephenson Harwood, which grew revenue by 9% and kept PEP steady at 1%.

Two firms reported a revenue decline in 2015-16. BLP's revenue contracted by 2%, but the firm managed to increase PEP by 4% to £683,000; and Ashurst shrank by 10%, with PEP plunging 19%.

Hodgart said: "It looks like generally people are getting revenue up but not profit, which suggests they are cutting prices to get the work but not getting the costs down."

The firms that delivered the strongest revenue growth were Osborne Clarke (OC) which saw revenue jump by 21% to £171.6m, and Clyde & Co, which grew revenue by 13% to £447.3m.

The firms that delivered the strongest revenue growth were Osborne Clarke (OC) which saw revenue jump by 21% to £171.6m, and Clyde & Co, which grew revenue by 13% to £447.3m.

Both firms have benefited from a programme of international expansion during the past few years, with OC opening offices across Europe and the US in recent years and Clydes launching in Scotland this year through a merger with local firm Simpson & Marwick, and bringing onboard a 30-lawyer team in Australia from Lee & Lyons.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Is KPMG’s Arizona ABS Strategy a Turning Point in U.S. Law? What London’s Experience Reveals

5 minute read

KPMG Moves to Provide Legal Services in the US—Now All Eyes Are on Its Big Four Peers

International Arbitration: Key Developments of 2024 and Emerging Trends for 2025

4 minute readTrending Stories

- 1'A Death Sentence for TikTok'?: Litigators and Experts Weigh Impact of Potential Ban on Creators and Data Privacy

- 2Bribery Case Against Former Lt. Gov. Brian Benjamin Is Dropped

- 3‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

- 4State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

- 5Invoking Trump, AG Bonta Reminds Lawyers of Duties to Noncitizens in Plea Dealing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250