Nowhere to hide: UK top 50 LLP accounts analysed

With the 2015-16 reporting season nearly over, we take an in-depth look at the LLP accounts for the UK's largest firms for the previous year

August 11, 2016 at 12:00 AM

8 minute read

What's the best measure of financial success for law firms? Fee income? Profit margin? An average profit per equity partner number that fails to give any indication of how many partners are actually receiving anything close to that figure, due to the way the firm shares out its equity?

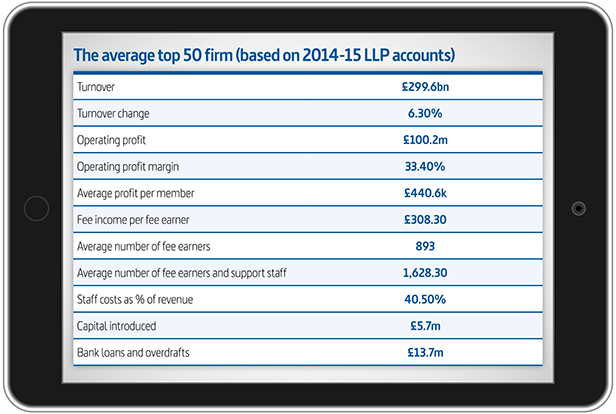

Our analysis of the limited liability partnership (LLP) accounts of the UK's 50 largest law firms – carried out in conjunction with professional services firm Smith & Williamson – means you can take your pick. The research, based on the most recent accounts filed with Companies House (which cover the 2014-15 financial year rather than the 2015-16 figures still being announced by some firms), ranks the 47 firms within the UK top 50 that are registered as LLPs, on a host of metrics.

Click here to see the full table of results

Whichever metric you prefer to base your judgement of performance on, the measures combined paint a picture of an approach to financial management that continues to differ markedly across a relatively small group of commercial law firms.

In numerical terms, the biggest gap may well be the £1.2bn-plus difference between the fee income brought in by the largest firm in the group (Clifford Chance) and the smallest (Browne Jacobson), but other metrics highlight differences that say far more about how law firms are run financially.

Here we take a look at some of these disparities. But first, a few explanations. The table is based on the consolidated group accounts for the LLP containing the UK arm of these firms. That means they do not reflect the full firm accounts of verein (or similar) structured firms like DLA Piper, Hogan Lovells, CMS Cameron McKenna and Norton Rose Fulbright.

And because the numbers are simply taken from the audited accounts, which should in theory put everyone on the same footing, it means they do not offer at first glance the context behind some of the figures.

For example, a handful of mergers took place during the 2014-15 financial year that skew some year-on-year comparisons. Most notably, Wragge & Co's merger with Lawrence Graham, CMS Cameron McKenna's May 2014 combination with Dundas & Wilson, and the mergers that created Blake Morgan and Charles Russell Speechlys. Meanwhile, Irwin Mitchell's corporate structure means the group holding company is registered in Jersey and therefore no numbers for this business are available, limiting the numbers here to the LLP accounts.

The basics

Overall, the accounts present a healthy picture of the UK's largest law firms. Looking at the 47 firms included in this table, all bar 12 saw fee income increase year on year in 2014-15, with a similar number (13) also seeing operating profit decline by some degree.

However, with 10 firms seeing operating profit increase by 20% or more, average operating profit across the firms rose by around 9%, with this increase falling to a little more than 2% at the four magic circle firms that are LLPs, and down to nearer 1% when looking at the top 10 firms. It was driven up by some incredibly large increases at a handful of firms, with Stephenson Harwood and Fieldfisher for example both seeing operating profit climb by roughly 40%.

However, with 10 firms seeing operating profit increase by 20% or more, average operating profit across the firms rose by around 9%, with this increase falling to a little more than 2% at the four magic circle firms that are LLPs, and down to nearer 1% when looking at the top 10 firms. It was driven up by some incredibly large increases at a handful of firms, with Stephenson Harwood and Fieldfisher for example both seeing operating profit climb by roughly 40%.

The borrowers

Fifteen firms out of the 47 do not have any loans or overdrafts – a slight improvement on last year, when 13 firms sat debt-free.

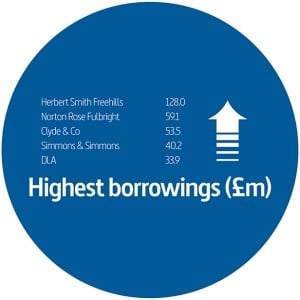

Within the group the variance is significant and highlights the different approach firms are taking towards capitalising their business. At the top of the borrowing tree, for example, Herbert Smith Freehills (HSF) is sitting with a £128m bank loan after consolidating its former overdraft and loan into a larger loan instead.

Within the group the variance is significant and highlights the different approach firms are taking towards capitalising their business. At the top of the borrowing tree, for example, Herbert Smith Freehills (HSF) is sitting with a £128m bank loan after consolidating its former overdraft and loan into a larger loan instead.

With borrowings of more than twice the next most indebted firm (Norton Rose Fulbright at £59.1m), at face value the number could be an ominous sign of its financial management. However, it reflects the fact HSF borrows at a firm-wide level rather than through individual partners, which affects both bank borrowings and members' capital (HSF also has one of the lowest percentages of members capital compared with revenue).

The decision to finance itself predominantly through debt rather than partner loan capital is different, rather than necessarily worse. Other firms with high debt levels (some for the same reason as HSF) include Clyde & Co, Simmons & Simmons and DLA Piper.

Giles Murphy, head of professional practices at Smith & Williamson, comments: "Looking at the UK top 50 as a whole and this year's table, we see an overall drop in borrowing for 2014-15. Taken together, we calculate that bank loans and overdrafts decreased from around £703m to about £643m (across all 50 firms), so a fall of around £60m. At the same time, capital from members increased by £54m (across all firms) over the period. This arguably reflects that 2014-15 was a good year, supported by an increase in fee incomes and profitability. However, with clouds gathering on the economic horizon, law firms' confidence may be short-lived, exposing weaknesses and raising the level of competition still further."

Salary shocks

The 2014-15 accounts show staff numbers increased by roughly 3% across the group, with member numbers growing by the same amount and lawyer numbers edging up 2% – despite the mergers that took place.

In total, the UK top 50 paid out £5.8bn on staff costs and salaries in 2014-15, with this money split across 70,774 members of staff, including just under 42,000 fee earners.

In total, the UK top 50 paid out £5.8bn on staff costs and salaries in 2014-15, with this money split across 70,774 members of staff, including just under 42,000 fee earners.

People are generally the biggest cost for many businesses and law firms are no different in this regard, but across individual firms in this group the differences are stark.

Looking at staff costs as a percentage of revenue provides a better indication of how much these firms are spending on their people than salaries alone.

Three firms in the group – BLM, DAC Beachcroft and Shoosmiths – all paid out more than 50% of their revenue to staff. Not far behind was Linklaters, which paid out 48.8% of its revenue on staff costs – a slightly higher percentage than TLT – and bringing up the average across the magic circle to 43%.

In contrast, Allen & Overy had significantly lower staff costs as a percentage of revenue at 34%, putting it not far outside the five firms with the lowest staff costs as a percentage of revenue – Stephenson Harwood, Irwin Mitchell, CMS Cameron McKenna, Fieldfisher and Macfarlanes – the last of which paid out only 28% of its revenue on salaries.

Spreading total staff costs out across fee earners, Linklaters has the highest staff costs per fee earner figure at £258,600 per lawyer, compared to an average across the top 50 as a whole of £122,000, and across the magic circle of £216,700.

Operating profit

Bearing in mind these figures are based on salaries set before this May's significant jump in associate pay, the figures offer a warning indicator of how firms could quickly see their profits hit – particularly if revenues fall as a result of Brexit, as many are predicting.

A quick glance at operating profit margin shows the firms with more room for manoeuvre in this regard. At the top end of this ranking Macfarlanes' operating profit margin for 2014-15 stood at 58.3%, almost 10% ahead of its closest peer in this category – Travers Smith, which posted a profit margin of 49.5%.

A quick glance at operating profit margin shows the firms with more room for manoeuvre in this regard. At the top end of this ranking Macfarlanes' operating profit margin for 2014-15 stood at 58.3%, almost 10% ahead of its closest peer in this category – Travers Smith, which posted a profit margin of 49.5%.

In contrast, three firms in the group had a profit margin of under 20% – Shoosmiths, DAC Beachcroft and BLM.

In this context, the decision of firms such as Berwin Leighton Paisner, Addleshaw Goddard and Gowling WLG to delay salary reviews until later in the year, when it is clearer how Brexit will impact activity levels, looks pretty sensible.

Click here to see the full table of results.

Related: Financing the law firm of tomorrow: why external funding is here to stay.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

DeepSeek and the AI Revolution: Why One Legal Tech Expert Is Hitting Pause

4 minute read

What Happens When a Lateral Partner's Guaranteed Compensation Ends?

Lawyers React To India’s 2025 Budget, Welcome Investment And Tax Reform

Russia’s Legal Sector Is Changing as Western Sanctions Take Their Toll

5 minute readTrending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250