Allen & Overy climbs FTSE 100 adviser rankings as Slaughters retains top spots

A&O's haul of FTSE 100 clients rises by two as Slaughters leads across the board

August 30, 2016 at 05:18 AM

3 minute read

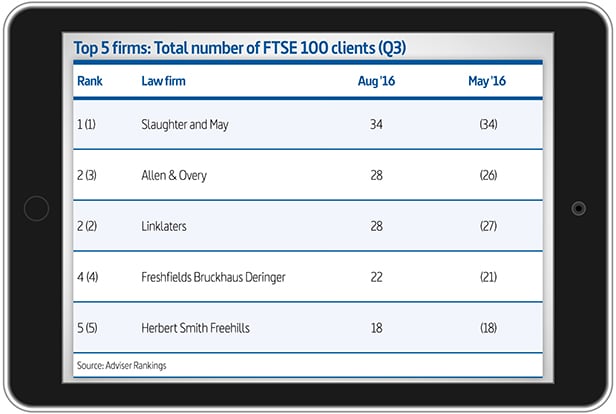

Allen & Overy (A&O) gained two new FTSE 100 clients to reach joint second place with Linklaters, behind Slaughter and May, in the latest quarterly adviser rankings.

A&O's list of FTSE 100 clients grew to 28 in the three months to 6 August, while Linklaters added one client to retain its place.

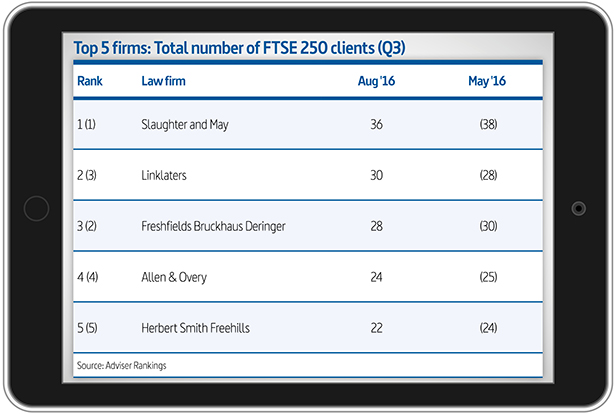

Linklaters also reached second place in the FTSE 250 adviser rankings after gaining two clients, pushing Freshfields Bruckhaus Deringer – whose roster fell by two – into third.

Linklaters also reached second place in the FTSE 250 adviser rankings after gaining two clients, pushing Freshfields Bruckhaus Deringer – whose roster fell by two – into third.

The rankings, compiled by Adviser Rankings in association with audit firm Crowe Clark Whitehill, show that Slaughters retained the the top slot in the FTSE 100 with 34 clients, without any new additions. The firm also continued to lead the way in terms of total number of stockmarket clients, which stood at 107, and total number of FTSE 250 clients at 36, despite both rosters shrinking by two clients.

Pinsent Masons retained second place in the all-stockmarket table, adding three clients during the quarter; it also stayed joint top in the AIM ranking table, tied with Gowling WLG on 55 clients.

Pinsent Masons retained second place in the all-stockmarket table, adding three clients during the quarter; it also stayed joint top in the AIM ranking table, tied with Gowling WLG on 55 clients.

Other highlights include Clifford Chance rising from 19th to 15th place in the total stock market ranking and from ninth to sixth place in the FTSE 250. In both cases, the firm added four new clients. In addition, Pinsents climbed to the top of the oil and gas ranking table, gaining four clients to move to 14 in total, pushing Memery Crystal into second place.

Commenting on market conditions, Slaughters head of corporate Andy Ryde said the firm's transactional practices are still feeling the effects of the UK's vote to leave the European Union (EU) in late June. "There has been a Brexit impact. M&A volumes have suffered through the whole calendar year after the hot streak in 2015. The deal lethargy we saw in the first half has continued since the Brexit vote."

However, he points to some exceptions such as Softbank's £24bn takeover of UK smartphone chip designer ARM, announced in July. "We are now feeling a return in business confidence, which offers encouragement." The deal saw a handful of firms gain roles, with Slaughters acting for ARM alongside Davis Polk & Wardwell and Morrison & Foerster taking the lead for Softbank alongside Freshfields.

Linklaters corporate partner Roger Barron added that despite the immediate "shock and uncertainty" after the UK voted to leave the EU on 23 June, which caused deals to pause, "the overwhelming majority" of those deals put on ice have gone ahead.

A handful of other UK takeovers agreed since the Brexit vote have provided some optimism. In July, Pinsents acted for US cinema company AMC on its acquisition of cinema chain Odeon and UCI for $1bn from private equity firm Terra Firma. The same month, Steinhoff snapped up Poundland for £597m. Linklaters acted for the South African homeware conglomerate, while Freshfields advised Poundland.

However, there have been a few casualties. William Hill turned down a £3.6bn bid for the company from 888 Holdings and Rank Group, saying that the offer significantly undervalued the bookmaker. Slaughters acted for William Hill, while A&O advised 888 and Norton Rose Fulbright acted for Rank.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Jones Day, BCLP & Other Major Firms Boost European Teams with Key Partner Hires

4 minute read

$13.8 Billion Magomedov Claim Thrown Out by UK High Court

Ropes & Gray, Mori Hamada, Nishimura & Asahi Act on Bain Capital’s $634M Aircraft Business Acquisition in Japan

Trending Stories

- 1Judge Rejects Walgreens' Contractual Dispute Against Founder's Family Member

- 2FTC Sues PepsiCo for Alleged Price Break to Big-Box Retailer, Incurs Holyoak's Wrath

- 3Greenberg Traurig Litigation Co-Chair Returning After Three Years as US Attorney

- 4DC Circuit Rejects Jan. 6 Defendants’ Claim That Pepper Spray Isn't Dangerous Weapon

- 5Quiet Retirement Meets Resounding Win: Quinn Emanuel Name Partner Kathleen Sullivan's Vimeo Victory

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250