UK top 50 firms achieve sixth year of revenue growth as partner profits stall

Combined revenue for top 50 hits £18.2bn; eight largest firms bring in more than £10bn

September 06, 2016 at 07:56 AM

6 minute read

Despite the looming uncertainty of the European Union (EU) referendum and the resulting impact on deal markets, the UK's 50 largest law firms achieved a sixth consecutive year of revenue growth in 2015-16, but translating this into bottom-line gains proved more difficult to achieve.

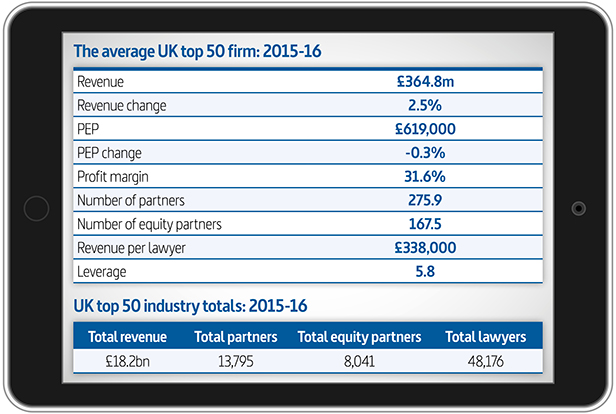

Together, the 50 firms brought in a total of £18.24bn, up from £17.45bn in 2014-15 – an increase of 4.5%. Only nine firms within the group saw revenue decline – an improvement on the previous year when 12 firms saw fee income decrease, including five within the top 10.

Total lawyer numbers climbed to 48,176, with partner numbers nudging up 1.3% to 13,795. Driven in part by moves to bring more partners into the equity to meet recent HMRC tax changes, equity partner numbers soared 15%, with Taylor Wessing and Shoosmiths converting to all-equity partnerships during the period.

While fee income increased in 2015-16, with average turnover standing at £364.8m, up from £356m last year, the research shows many firms struggled to convert this into bottom-line gains – a problem that is only likely to worsen in the wake of the UK vote to leave the EU.

While fee income increased in 2015-16, with average turnover standing at £364.8m, up from £356m last year, the research shows many firms struggled to convert this into bottom-line gains – a problem that is only likely to worsen in the wake of the UK vote to leave the EU.

Click here to view the full table of top 50 firm results

Hogan Lovells chief executive Steve Immelt comments: "We all know Brexit had a dramatic impact on the UK deal market. It's hard to know what the post-Brexit environment will look like; we are seeing some resumption of transactional activity but I think people are now adjusting to the understanding that Brexit will have a dragging impact."

PEP trouble

Fifteen firms within the group saw average profit per equity partner (PEP) fall during the year, 16 including Irwin Mitchell, which maintains it no longer uses PEP but posted a 25% plunge in net profit in the wake of its merger with Thomas Eggar. Including Irwin Mitchell, 10 firms saw double-digit drops in PEP, compared with two of the 12 firms that saw revenue fall in 2014-15 posting a double-digit decline that year.

Increases at 28 firms were not enough to cancel out the decline across the group overall, with average PEP falling marginally from £620,000 to £619,000.

While five firms saw double-digit partner profit rises – led by Addleshaw Goddard's 38.9% hike – the average change in PEP was markedly down on last year's 7.9% gain.

Besides Irwin Mitchell, BLM, Weightmans, Ashurst, Macfarlanes and Withers were the poorest performers from a PEP perspective, with all seeing drops of at least 16.9%.

Ashurst's 19.3% tumble to £603,000 means average PEP at the firm is at its lowest point since 2004-05. The drop means the average partner at Ashurst now receives less than the top 50 average.

The magic circle put in an improved performance on 2014-15, with Freshfields Bruckhaus Deringer and Clifford Chance (CC) the strongest performers. CC remains the second largest UK firm by revenue, with Freshfields climbing from fifth place to third thanks to a 6.6% hike in turnover to £1.327bn.

Commenting on the results, CC managing partner Matthew Layton says: "This year, there are a number of important factors affecting our clients and particularly their appetite for transactional activity. While this uncertainty means we remain cautious for the months ahead, last year's strong performance illustrates the value our clients place on our offer across practices and geographies, and the benefits of our continued focus on the firm's strategic priorities."

In contrast to last year, the larger firms suffered less impact from currency conversions, though firms reporting in euros – Osborne Clarke and Bird & Bird – did see revenue hit as a result of the exchange rate fluctuations.

Shipping and insurance firms once again struggled to find their way in the unsettled markets, with the group posting an average increase in revenue of 2.8% and four of the 11 firms seeing PEP fall.

Consolidation

After a flurry of mergers in recent years, the results highlight the extent to which the market is ripe for further consolidation. The eight largest firms within the top 50 brought in more than £10bn of the entire group's revenue – more than three times the combined fee income of the firms in the bottom 25, which brought in £2.75bn between them.

Though several top 50 firms are currently in merger talks – most notably Olswang and CMS, and Addleshaws and Hunton & Williams in the US – the 2015-16 results reflect very little merger activity.

Shakespeare Martineau is the only new entrant to the group after the June 2015 merger of SGH Martineau and Shakespeares, while Irwin Mitchell's results only include around four months of revenue from its merger partner Thomas Eggar.

Meanwhile, Wragge Lawrence Graham & Co tied-up with Canada's Gowlings in February this year to create Gowling WLG, but only the UK firm's results are included here.

Herbert Smith Freehills co-CEO Mark Rigotti says: "I think we will see more smaller firms merging to get the pace and scale they need to keep up with legislative change. As more firms merge, you will see more specialist firms sitting alongside them too."

For the first time, the required revenue figure to make the top 50 has risen above the £70m mark, with a clutch of firms in the £60m-£70m range sitting just outside of the group, including last year's 50th ranked firm, Browne Jacobson, and Scotland's top two firms, Brodies and Burness Paull.

Looking ahead, there is consensus that the post-Brexit deal market is likely to make it harder for law firms to achieve growth. Though firms are already securing advisory work and the weaker pound has started to drive some M&A activity, there is less certainty about transactional activity levels going forward.

As Macfarlanes senior partner Charles Martin says: "This is a challenging market, with increasing client demand for quality and value. We feel well positioned to deliver that and firms that do so should perform satisfactorily or better. But firms that are looking to both grow revenue and increase profitability will find current market conditions challenging. This feels like a year for listening carefully to your clients and in response, looking closely at efficiency and business mix. Few will perform very strongly in these market conditions."

Nabarro senior partner Ciaran Carvalho concludes: "Naturally, we have to be cautious at a time like this because no one knows how things will unfold. There will be a degree of caution rather than bravado, with people taking a bit longer over decision making."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Hogan Lovells and Burges Salmon Secure Lead Roles in Largest Ever UK Defence Ministry Contract

2 minute read

Latham, Cleary, Clifford Chance Help Middle East Sovereign Wealth Funds Monetise Assets

3 minute read

‘The US Market Is Critical’: KPMG’s Former Head of Global Legal Services On the Big Four Firm’s Legal Arm Entering the US

6 minute readTrending Stories

- 1Online Law School Comes Back to Haunt Attorney

- 2Deal Watch: Deals, IPOs Flow as Banking Regulation is Expected to Get Lighter

- 3University of Florida Drops Title IX Investigation Against Basketball Head Coach

- 4Jona Rechnitz Sentencing in Federal Court Is Postponed to June

- 5Big Tech is Cozying Up to President Trump. Here's Why Their Lawyers Are Cautiously Optimistic

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250