KWM's new European managing partner gives himself 12 months to turn the business around

Former Mallesons chief Tim Bednall sets out plans to rebuild KWM's prize European practices

October 24, 2016 at 06:51 AM

6 minute read

King & Wood Mallesons' (KWM) new European and Middle East managing partner Tim Bednall is giving himself a year to improve the immediate fortunes of the legacy SJ Berwin business.

Speaking exclusively to Legal Week, he is quietly confident that he can turn the business around. But after a bruising 18 months for the firm, how does he intend to do it?

"I will be looking at addressing critical issues internally and externally over 12 months and, at the same time, developing the strategy for the firm's onward trajectory. There are a whole range of internal issues to settle because we haven't had a managing partner in place for the last nine months and some things have tended to drift," he says.

He is not exaggerating. The firm has been hit by a number of high profile departures (some voluntary, but many at the request of the firm) and repeated delays to its profit distribution payments. Meanwhile, Barclays has tightened its lending agreements over the firm.

To combat such challenges and improve the bottom line, Bednall's plan is to rebuild and strengthen the international funds, private equity, real estate, litigation and regulatory practices – areas long associated with the legacy SJ Berwin business. Bednall also believes fostering better relationships across the firm's European offices will dramatically improve its outlook.

"It's really about unlocking some of the untapped potential of that network, as well as encouraging partners in various departments to engage in a greater degree of teamwork and collaboration," he says.

"We've already seen an improvement in cross-selling and collaboration in London since we implemented the new structure in May, but I am confident we can build on that."

The firm's once legendary private equity practice has fared particularly badly during the past 18 months – coincidentally, roughly as long as Bednall, the former head of legacy Australian firm Mallesons, has been in London.

Several heavyweight partners have left the firm during that time, including former co-head of private equity Richard Lever and Simon Fulbrook, who joined Goodwin in April and July 2015 respectively. Steve Davis quit for Proskauer in late 2014.

The situation took a turn for the worse this summer when a well-regarded six-partner private equity team jumped to Goodwin to launch the US firm's Paris office. KWM is now suing both Goodwin and Lever over the moves.

Bednall says that as a result of that team loss and departures including German funds head Sonya Pauls' move to Clifford Chance, France and Germany are key offices for the firm to rebuild and grow.

In August, it took a first small step towards rebuilding in Paris with the hire of senior associate Guilain Hippolyte from White & Case. He joined KWM as a partner, and Bednall says the firm is continuing to look for further partners in corporate, private equity and finance.

He praises the divisional structure review, which saw the firm's 17 London practice areas cut to three earlier this year, and says the European office network is currently aligning into this structure. He also has a particular focus on encouraging referrals of inbound China work to European offices.

"We have had a significant increase in inbound China work into Europe, particularly over the last 12 months. That's the result of a number of things – partners in China and Europe have developed a longer-term relationship in getting to know each other and having confidence in one another, and they've developed a great deal book since the merger. Germany has received a larger amount of work out of China than London has, and the Paris office is currently running three transactions for Chinese clients."

He adds that teamwork and collaboration are being identified and rewarded "by various means inbuilt into our practice management and financial systems, including origination, referrals and contribution on other team files".

A range of priority client lists are now in place, including global priority clients, EUME key clients, divisional and department priorities and individual partner priority clients. Speaking to Legal Week earlier this year, global managing partner Stuart Fuller named established KWM clients HSBC, Beijing-based insurance provider China Life and financial services company Macquarie Group as part of the global priority client group.

Bednall has provided partners with revenue growth targets for the European business, but declines to specify what they are.

As Legal Week revealed last week, KWM now has in place a plan to move on from the delays to profit distributions that have blighted the firm during the past year. It aims to pay off the remaining balance due from the 2014-15 financial year by next May – a move that will go some way to improving goodwill with partners.

Bednall also plans to rebuild trust within the firm by increasing communication with staff, including one-on-one partner consultations and frequent visits to offices in Europe, which he will fit around his ongoing corporate M&A work.

He describes his management style as "consultative and inclusive" and says he intends to "bring people along to a common view on how we should move forward".

While he agrees that his main rival for the managing partner role, Gareth Amdor, shared similar objectives in terms of the immediate and long-term future of the firm, he argues there was "a choice in terms of experience and style".

Bednall was former chairman of legacy Australian firm Mallesons Stephen Jaques before being parachuted into London, but he is quick to dismiss any concerns about how long he has been in the UK.

"People should not worry," he says. "I wasn't parachuted in yesterday and I was encouraged by partners in European offices to run."

He adds: "Although both candidates were clearly supportive of the broader global network, those who voted for me were clearly voting in someone devoted to our global network and what we can achieve from participation within that."

Bednall has been on the ground in London during one of the most difficult periods that the European arm of KWM has faced. He is committed to the firm's future and insists he wants to rebuild the European practice to its former glory. Perhaps under his quietly determined leadership KWM can lay its difficulties to rest, but he certainly has much to contend with.

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

EU Parliament Gives Blessing to New EU Competition Chief Ribera Rodríguez

2 minute read

Simpson Thacher Becomes Second Firm to Launch in Luxembourg in 2 Days With A&O Shearman Hires

3 minute read

HSF Hires Trio for Luxembourg Launch, Builds Private Capital Practice

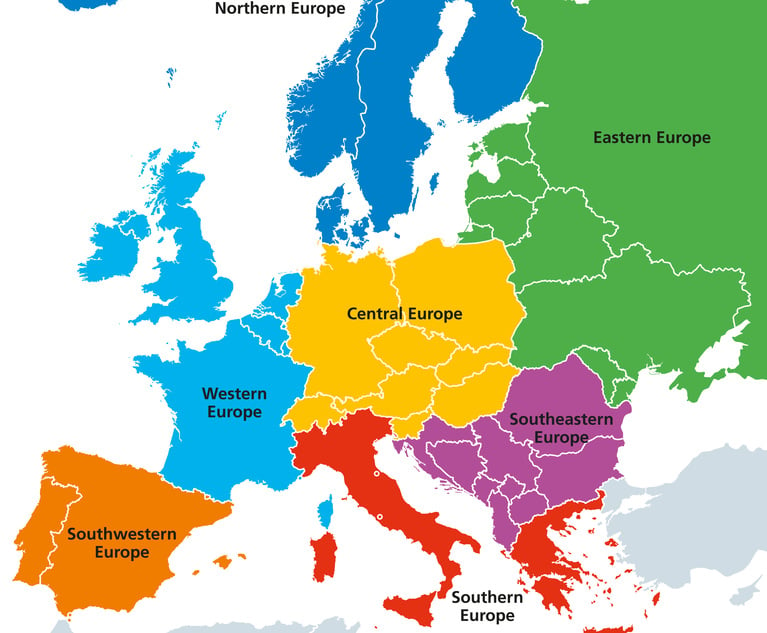

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of the Game'

7 minute readTrending Stories

- 1Friday Newspaper

- 2Judge Denies Sean Combs Third Bail Bid, Citing Community Safety

- 3Republican FTC Commissioner: 'The Time for Rulemaking by the Biden-Harris FTC Is Over'

- 4NY Appellate Panel Cites Student's Disciplinary History While Sending Negligence Claim Against School District to Trial

- 5A Meta DIG and Its Nvidia Implications

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250