Dentons in talks to take on KWM Europe as Greenberg and DLA circle City teams

Global giant Dentons circling troubled European arm of KWM as Greenberg and DLA Piper set sights on its London real estate partners

November 29, 2016 at 12:38 PM

3 minute read

Dentons has emerged as a potential merger partner for the beleaguered European arm of King & Wood Mallesons (KWM).

News of the discussions comes at a critical point for KWM's Europe and Middle East (EUME) partnership.

At the same time, it is understood that US firm Greenberg Traurig and DLA Piper are interested in some of KWM's Europe and Middle East (EUME) real estate partners.

However, Greenberg denied an earlier report today (30 November) that it was looking at acquiring KWM's entire EUME business. "We have no interest and have not had one conversation relating to the acquisition of KWM's EUME business, though we wish their lawyers and staff well," a press spokesperson said, adding: "Greenberg Traurig is an opportunistic firm, and we always look at situations where our objectives of excellence, cultural fit, value and financial discipline can be advanced."

KWM's European management has been forced to look at options including a merger after partners last week opted against a recapitalisation of the business, which would have secured a bailout from the Asia-Pacific arms of the verein.

Legal Week reported last week that only 21 of King & Wood Mallesons' European partners had agreed to commit in full to the troubled firm's failed recapitalisation plan.

That equates to just over 16% of the 130-strong European partnership – making it impossible to raise the nearly £14m required from European partners to secure the additional bailout from the Asia-Pacific arm of KWM, thought to be worth a similar value.

For the Asia bailout to go ahead, partners would also have had to commit to stay with KWM EUME for 12 months.

In response to questions about discussions with KWM, Dentons global chair Joe Andrew said: "While we would never comment on whether we are in combination conversations or not with any firm, we admire the many European/UK partners of KWM that our partners work with regularly and believe this is a very high quality group of impressive lawyers."

Sources familiar with the matter said that other firms are also talking to KWM's European management about a potential deal.

If the EUME management team is unable to secure a merger for the business, one potential alternative would be a pre-pack administration that could see one or several firms purchasing all or parts of the business.

It is also possible that partners within the Asia-Pacific arms of the verein could step in with another rescue offer.

KWM EUME has seen a number of partners leave the firm in recent weeks after the firm was plunged into crisis by the resignation of four high profile London partners, including UK investment funds head Michael Halford, who – it was announced last week – is heading to Goodwin Procter in London alongside four partners.

Yesterday, it emerged that KWM's global head of litigation Craig Pollack is in talks to join Covington & Burling in London.

Morgan Lewis has previously been tipped as a potential merger partner for KWM globally, however it was reported earlier this month that talks had been called off.

|This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

EU Parliament Gives Blessing to New EU Competition Chief Ribera Rodríguez

2 minute read

Simpson Thacher Becomes Second Firm to Launch in Luxembourg in 2 Days With A&O Shearman Hires

3 minute read

HSF Hires Trio for Luxembourg Launch, Builds Private Capital Practice

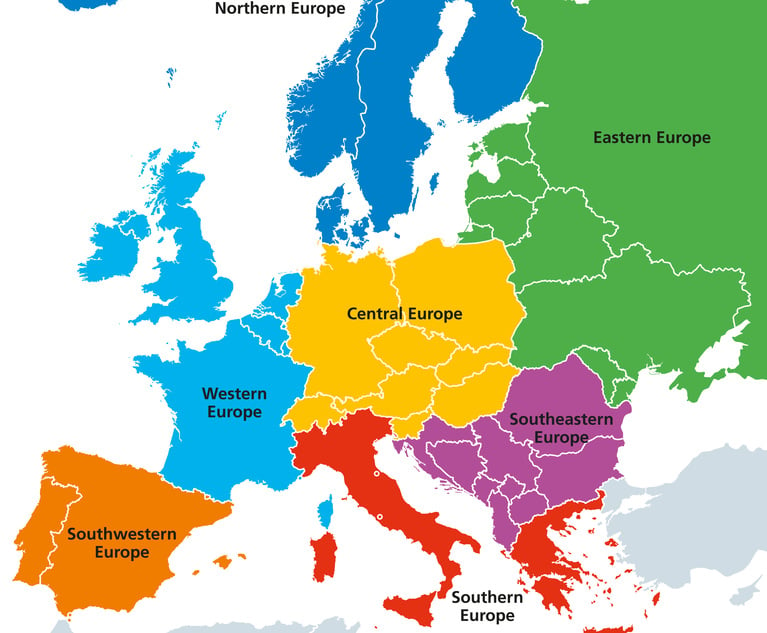

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of the Game'

7 minute readTrending Stories

- 1The Rise of AI-Generated Deepfakes: A New Cybersecurity Threat for Law Firms

- 2Litigation Leaders: Labaton’s Eric Belfi on Running Case Investigation, Analysis and Evaluation In-House

- 3Spoliation Sanctions

- 4At FDA, Flavored Vape Products Go Up In Smoke

- 5Arguing Class Actions: CAFA’s Local Controversy Exception

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250