Partners question 'unreasonable' Deutsche demands on junior lawyer pay

Survey of 200 partners finds more than half disagree with refusal to pay NQs and trainees

March 28, 2017 at 08:28 AM

6 minute read

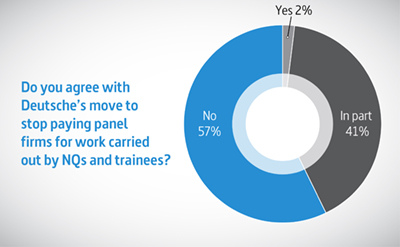

Almost 60% of partners think Deutsche Bank's plan to stop paying panel law firms for work carried out by junior lawyers is unreasonable, according to a new survey.

The finding comes as part of a Big Question survey of 200 partners, conducted after Legal Week revealed last week that firms appointed in Deutsche's current panel review will not be paid for work done by newly qualified (NQ) lawyers and trainees.

Fifty-seven percent of respondents to the survey said they disagree with such demands, with a further 41% saying they agreed 'in part'. Only 2% of respondents agreed with the move.

Fifty-seven percent of respondents to the survey said they disagree with such demands, with a further 41% saying they agreed 'in part'. Only 2% of respondents agreed with the move.

The vast majority of respondents said firms will find other ways to recover the costs, with almost all (96%) expecting Deutsche's move to impact practices at law firms. Thirty-three percent said firms will start staffing work with more senior lawyers and avoid using junior lawyers, while a further 55% said firms would try to increase rates elsewhere.

One respondent to the survey said: "This is shortsighted and foolish. It will encourage senior lawyers to waste their time on things that could be done more efficiently by juniors. If we all took this approach, where do banks expect the experienced senior lawyers of the future to come from?"

Others raised concerns about the likelihood of more work being delegated to paralegals. "Not being able to charge out junior lawyers will make corporate deals very difficult," said one respondent. "Even if the client thinks it is 'routine' work, it still requires a level of legal understanding which a paralegal or PA does not possess."

Longer term, the move could result in a skills gap, according to partners. One managing partner, who asked to remain anonymous, said: "An increasing trend for clients at panel pitches, particularly banks, is to say 'I don't see why I should be paying for junior resources to be learning their trade.' On the face of it you can understand why they might say that, but our response is: if you want to have a strong bench of experienced lawyers in 10 years' time, then you've got to be training those people today.

"The skills learned doing some of the more simple stuff are our building blocks. If you take what they're doing to an extreme, we wouldn't have any junior lawyers in London at all if nobody is willing to pay for them – or we have to suck up the cost of training those people ourselves."

However, others are more sympathetic towards Deutsche, admitting that in some cases, firms can over-staff their deals with junior lawyers.

One respondent says: "Junior solicitors make a valuable contribution where deployed appropriately. The real mischief is firms stacking teams of junior lawyers on cases where that is not appropriate."

Baker McKenzie chair Paul Rawlinson says: "I assume that Deutsche's objection is that they feel some firms are racking up hours for work that could be done by someone else for less.

Baker McKenzie chair Paul Rawlinson says: "I assume that Deutsche's objection is that they feel some firms are racking up hours for work that could be done by someone else for less.

"We've recognised for a while that we have to be able to deliver work at a more reasonable rate than a London NQ. Our Belfast office and artificial intelligence technology offer ways to provide that support in a cost-effective way.

"The other way of looking at this is that it's another attack on the hourly rate – if the work is done for an agreed fixed fee, it doesn't matter who's staffing it. It's all part of a continuing story about having to be more efficient."

Nabarro corporate partner Alasdair Steele adds: "Deutsche's decision reflects continuing pressure on the chargeable hours model. More and more on transactional work, we are moving to effectively fixed fees – whether expressed as such or as caps or estimates – as more clients prefer to know exactly what something will cost. It is much harder to design an advisory model away from chargeable hours as the work is more uncertain, and there are lessons which law firms will be able to learn from other professional advisory businesses, such as management consultants and, of course, the accountancy firms."

Deutsche's move is particularly notable in its approach to NQ lawyers. Almost half of respondents to the survey (49%) said it is unfair to put NQs in the same bracket as trainees, while a further 44% argued that is only fair 'in some cases'.

Deutsche's move is particularly notable in its approach to NQ lawyers. Almost half of respondents to the survey (49%) said it is unfair to put NQs in the same bracket as trainees, while a further 44% argued that is only fair 'in some cases'.

One partner commented: "Firms will have to come to the realisation that they cannot charge for trainees. NQs are a different matter – albeit there will be pressure to discount their hourly rates."

Although demands like Deutsche's are more prevalent in the US, they remain rare in the UK, with 71% of respondents saying they had never experienced clients refusing to pay for work by junior lawyers.

However, 17.5% of respondents said they had met such demands in the past, with a further 11.5% saying they had faced 'similar demands', including requests for free trainee secondees, free research, and work carried out by paralegals and trainees at no cost.

Overall, 25% of respondents said they thought such demands would now become more commonplace among banks and other major clients in the UK market, while 17% disagreed and said they would not. More than half (58%) were unsure whether Deutsche's move would prompt a market trend.

The majority of respondents said they would be likely to think twice about pitching for work from clients attempting to follow Deutsche's lead, with the obvious caveat that it would depend on the client in the question. More than half (58%) said they may think twice, depending on the client, while 13% said they would be "unlikely" to tender for such a client and 8% said they would "definitely" think twice.

One corporate partner at a top City firm argues that law firms must rise to the challenge: "Clients are increasingly challenging law firms to look at their service delivery model, in terms of team structure and location and use of technology, and expecting their firms to be innovative both in pricing and service delivery to ensure value is delivered. Firms have to respond to that challenge."

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

X-odus: Why Germany’s Federal Court of Justice and Others Are Leaving X

Mexican Lawyers On Speed-Dial as Trump Floats ‘Day One’ Tariffs

Threat of Trump Tariffs Is Sign Canada Needs to Wean Off Reliance on Trade with U.S., Trade Lawyers Say

5 minute read

Trending Stories

- 1US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 2Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 3African Law Firm Investigated Over ‘AI-Generated’ Case References

- 4Gen AI and Associate Legal Writing: Davis Wright Tremaine's New Training Model

- 5Departing Attorneys Sue Their Former Law Firm

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250