In-house lawyers raise doubts over Deutsche's panel stipulation on junior lawyer pay

Survey of almost 200 in-house counsel reveals mixed feelings over bank's pay demands

March 30, 2017 at 08:05 AM

6 minute read

The majority of in-house lawyers have reservations about Deutsche Bank's plan to stop paying panel law firms for work carried out by junior lawyers, but believe the move is likely to start a trend, according to a new Legal Week survey of corporate counsel.

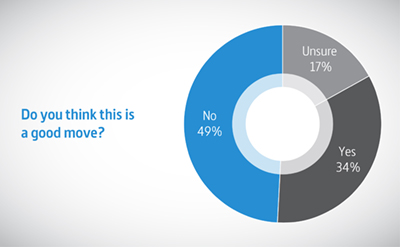

Just under half of almost 200 in-house lawyers who responded to the latest Big Question survey said they did not agree with Deutsche's stipulation that firms appointed in the bank's latest panel review will not be paid for work done by newly qualified (NQ) lawyers or trainees.

A further 17% said they were unsure about the decision, leaving only 34% arguing that it is a good move.

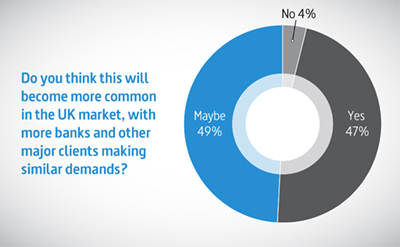

Despite these reservations, the vast majority of respondents (96%) believe the practice is likely to become more commonplace in future. Only 4% of those taking part said they felt it would not become more common, with 47% saying it will definitely become more commonplace and a further 49% believing it might.

Despite these reservations, the vast majority of respondents (96%) believe the practice is likely to become more commonplace in future. Only 4% of those taking part said they felt it would not become more common, with 47% saying it will definitely become more commonplace and a further 49% believing it might.

KPMG UK general counsel Jeremy Barton said: "I had heard this was a feature of the US market and it is something I am tempted to adopt. There is an interesting link to the automation/AI agenda, in terms of how much clients will wish to pay for activities that are seen more as foundational rather than value adding."

Vodafone Enterprise global general counsel Kerry Phillip has some empathy with Deutsche, but argues that the response needs to be more tailored.

She said: "We do not expect to be charged for training time, but not everything a trainee does is training time. Law firms should absorb the cost of training solicitors, but where there is genuine value added to the client – rather than pure learning through shadowing or watching – then it is fair to charge.

"That said, we generally agree a fixed price for a piece of work. I expect the law firm to put an appropriately experienced and qualified person on that work, but we are paying for an agreed result or output that the firm puts its name to."

However, one anonymous respondent to the survey was more damning, saying: "This is a poor move that will result in greater, not lower, cost for clients, and will also affect the development of talent in law firms and the pipeline for relationships between in-house and external lawyers."

Highlighting how unusual Deutsche's plan is, 76% of respondents said their companies had never asked firms to write off the cost of junior lawyers. In contrast, 2% said they already did not pay for junior lawyers as standard, while 12% said they sometimes did, and a further 10% stated they had occasionally done this in the past.

While such practices have not been publicised in the UK market to date, the results suggest that such demands have been made by some clients behind closed doors.

While such practices have not been publicised in the UK market to date, the results suggest that such demands have been made by some clients behind closed doors.

When asked how Deutsche's move could impact on law firms' billing practices, 69% of those surveyed said it would result in firms increasing their rates elsewhere. In addition, 21% said firms would start staffing deals with more senior lawyers and avoiding junior lawyers. Just 3% said it would have no impact.

One respondent to the survey said: "Law firms won't bid for low level/low value work and will then use more significant/complex work as a training ground for the trainees/NQs and absorb it as part of their fees."

Others felt that the changes would lead to firms taking on fewer trainees or cutting pay.

"I don't think it encourages firms to take on trainees," said one respondent. "It will possibly lower compensation for NQ lawyers," said another.

Phillip added: "I expect that the Deutsche Bank move will encourage law firms to look closely at how lawyers are effectively trained, how they can best learn, what they are paid and how the firm can work efficiently."

Chris Aujard, interim GC for consumer services at the Co-op, said: "I think this move is just part of more a general trend where in-house teams are saying to the industry: 'you have got to get real in terms of your charging structure'.

"The broad principle is that we have got to be shown value for money, and the big corporates are endeavouring to hold law firms to account."

Seventeen percent of respondents said it was fair for Deutsche to put NQ lawyers into the same category as trainees. A further 46% said it was fair in some circumstances, but more than one third (37%) said it was unfair to treat them the same.

While many may not agree with Deutsche's move, the survey found that almost two out of three in-house lawyers (65%) believe such demands would not be likely to affect relationships with outside counsel. Fifty-six percent said law firms would be unlikely to think twice about pitching for work from companies refusing to pay junior lawyers, with 9% of the belief that such demands would have no effect on the client's appeal.

The other one third of respondents thought it was 'likely' (26%) or 'very likely' (9%) that law firms would reconsider working with clients in the face of such demands.

Former Tyco and EY global general counsel Trevor Faure, author of The Smarter Legal Model, said: "The back-and-forth discussion around Deutsche Bank exemplifies the traditional 'zero-sum game' behaviour that both law firms and clients are responsible for: either side's gain is the other side's loss. But both sides would agree that ultimately they are aiming for the same thing – the right level of legal quality and price to match the stakes involved."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Workload and Getting It All Done Top Challenges for In-house Counsel: Survey

4 minute read

Amazon Corporate Counsel in Brussels Returns to US Firm in ‘Boomerang Hire’

2 minute read

Former Miral GC Brings Commercial Insight to BCLP’s Middle East Real Estate Practice

4 minute read

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Trending Stories

- 1US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 2Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 3African Law Firm Investigated Over ‘AI-Generated’ Case References

- 4Gen AI and Associate Legal Writing: Davis Wright Tremaine's New Training Model

- 5Departing Attorneys Sue Their Former Law Firm

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250