US firms dominate Q1 M&A rankings as deal volumes plummet to four-year low

Cravath and Kirkland come out top after least active quarter for deals since early 2013

April 06, 2017 at 05:09 AM

9 minute read

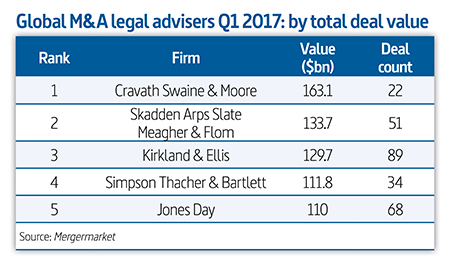

Cravath Swaine & Moore and Kirkland & Ellis have secured top spots in the M&A rankings by total deal value for the first quarter of 2017, a period that saw worldwide deal volume slump to a four-year low.

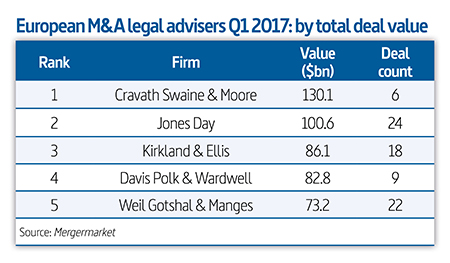

Figures from Mergermarket show Cravath topped the global and European deal value tables for Q1, after advising on 22 global deals worth a total of $163.1bn (£130.7bn) and six European deals worth $130.1bn (£104.3bn).

Figures from Mergermarket show Cravath topped the global and European deal value tables for Q1, after advising on 22 global deals worth a total of $163.1bn (£130.7bn) and six European deals worth $130.1bn (£104.3bn).

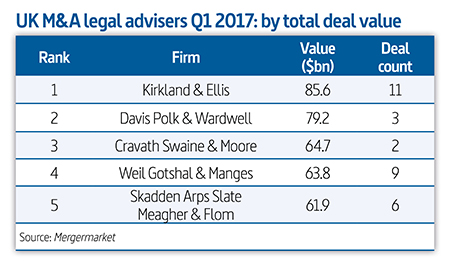

Meanwhile, Kirkland took first place in the UK rankings after acting on 11 deals worth a total of $85.6bn (£68.6bn). The US firm also placed top of the global rankings by volume after advising on 89 deals, 20 ahead of second-placed DLA Piper.

While total global deal values increased 9% year on year to $678.5bn (£543.9bn), global deal volume dropped almost 20% on Q1 last year to 3,554, the lowest quarter since Q2 2013.

Deal count in Europe fell 22% year on year to 1,346, the least active quarter since Q1 2013. Total deal value across the continent dropped to $170bn (£136.3bn), 2% down on last year's Q1 total of $173.2bn (£138.9bn).

These falls in total volume and value were also seen in the UK market, despite a positive end to 2016.

Total UK deal values for the first quarter of 2017 stood at $39bn (£31.3bn), 10% down on last year's Q1 total of $43.2bn (£34.6bn). There were 289 deals announced in the UK during the quarter, 15% fewer than in Q1 2016 and the lowest on record since Q2 2013.

In continental Europe people do resent Brexit and the fact that the British voted for it. Brexit is impairing the ability of UK firms to win business

The first quarter of 2017 was particularly notable for the prominence of US firms, with just three UK firms appearing in the top 10 European and UK advisers by value. In the European tables, Slaughter and May ranked 10th, while Herbert Smith Freehills (HSF) placed eighth. HSF was also eighth in the UK rankings, with Clifford Chance (CC) 10th.

HSF's strong showing comes after the firm won a mandate alongside Cravath on the largest global deal this quarter – British American Tobacco's proposed $60.7bn (£48.7bn) combination with US rival Reynolds American.

HSF's strong showing comes after the firm won a mandate alongside Cravath on the largest global deal this quarter – British American Tobacco's proposed $60.7bn (£48.7bn) combination with US rival Reynolds American.

Other US firms ranking highly for Q1 include Skadden Arps Slate Meagher & Flom, Jones Day and Davis Polk & Wardwell, which placed second in the global, European and UK rankings respectively.

Corporate partners attribute the dominance of US firms to an increase in big-ticket US takeovers in Europe, with Mergermarket data indicating that three of the top European deals were US acquisitions.

Cravath EMEA M&A head Richard Hall (pictured) said the market was driven by a "significant re-emergence of very big cross-border work".

He said: "Our topping of the rankings is driven largely by our focus on big-ticket transactions. The volume of cross-border activity is something the market hasn't seen in a very long time.

"There has been a cyclical swing away from UK-focused activity, and for continental European deals where a few years ago the UK firms might have picked up mandates, Brexit is impairing their ability to win business. I think in continental Europe people do resent Brexit and the fact that the British voted for it."

CC global M&A head Guy Norman commented: "It's clear that activity in the first quarter has been driven by US outbound M&A into Europe. Often, US corporates entering the UK market can be very loyal to their domestic US advisers, but we are now seeing growth in our US client base."

Baker McKenzie London corporate partner Tim Gee, the firm's former global M&A head, adds: "One of the biggest features of this quarter has been the rise in inbound M&A work into Europe. To the extent that there was any Brexit holdback, we've seen that ebbing away."

Indeed, the biggest deal in Europe by value was US pharmaceutical giant Johnson & Johnson's $29.6bn (£23.7bn) purchase of Swiss biotech company Actelion. Cravath took the lead role for Johnson & Johnson, opposite Swiss firm Niederer Kraft & Frey, Slaughter and May and elite US firm Wachtell Lipton Rosen & Katz.

However, Q1′s second largest European deal saw Italy's Luxottica – the owner of the Ray-Ban brand – secure a $25.4bn (£20.4bn) merger with French rival eyewear company Essilor. Cleary Gottlieb Steen & Hamilton and Jones Day are advising Essilor on the deal, while Luxottica has instructed Cravath, Italian firm BonelliErede and France's Bredin Prat.

Hall comments: "Major corporates are really looking for growth, and the uncertainty around the concept of Europe is encouraging international expansion."

But partners also noted the lack of deal activity following an upswing before year end.

But partners also noted the lack of deal activity following an upswing before year end.

"The surge of deal activity at the end of last year was unprecedented and, in comparison, there has been a slower start to the year in 2017," says Norman.

CC private equity head Jonny Myers adds: "With rising equity prices, it is increasingly challenging for private equity houses to find value across Europe. The ultra-low cost of debt is leading to intense competition for good assets."

Meanwhile, Slaughters M&A head Roland Turnill says deal activity during the course of 2017 could be "quite episodic". He explains: "Conditions for M&A are reasonable, but it depends on how people feel about various geopolitical factors, in particular Brexit and the environment in the US."

Another key characteristic of the market this quarter was a lack of Asian buyers in Europe. Partners say this became apparent after China added new restrictions in late 2016 on taking yuan out of the country in a bid to stabilise its financial system.

"Last year we saw outbound Chinese investment reach extraordinary levels, but the restrictions introduced towards the end of 2016 have resulted in the numbers dropping significantly," explains Allen & Overy global co-head of corporate Richard Browne (pictured).

"Last year we saw outbound Chinese investment reach extraordinary levels, but the restrictions introduced towards the end of 2016 have resulted in the numbers dropping significantly," explains Allen & Overy global co-head of corporate Richard Browne (pictured).

Gee adds: "We've seen Asia work slow down. The long-term Chinese policy to support outbound M&A work hasn't changed, but there has been a short change adjustment to protect currency reserves, which has dampened enthusiasm from external Chinese investment. I think that's unlikely to unwind until later this year."

Key Asian deals in 2016 include ChemChina's acquisition of Swiss pesticide and seed producer Syngenta for $43bn (£34.5bn). The deal, which if completed would be the biggest ever overseas acquisition by a Chinese company, handed key roles to Davis Polk, Simpson Thacher & Bartlett, and Linklaters.

Going forward, partners say a key question for the market is whether US buying appetite can make up for the Asian shortfall.

Norman concludes: "After a momentous year for China outbound in 2016 and a slower start for Asia over the last quarter, the year ahead in terms of global M&A levels will depend largely on whether US-led activity can fill the shoes of Chinese-led M&A and meet the values and volumes we saw last year. I am not certain that it will."

Views from the market:

HSF global head of M&A Stephen Wilkinson "I think we'll see a better year for M&A in 2017 than many think. The UK M&A market has been one of the strongest European markets for a long time, and while Brexit has had an impact and will present further challenges, it will not remove its importance. The Brexit effect also creates opportunities, particularly with the low value of sterling compared to acquirer currencies."

CC global private equity head Jonny Myers "We will see continuing periods of uncertainty. People are looking to be smarter about where they invest, and there is a constant search for better value deals.

CC global private equity head Jonny Myers "We will see continuing periods of uncertainty. People are looking to be smarter about where they invest, and there is a constant search for better value deals.

"There is an awful lot of capital looking for a home but a remarkably low volume of deals, as investments need to work harder to yield results that meet expectations."

Slaughters M&A head Roland Turnill "The percentage of bust deals is clearly higher now. There is increasing regulatory scrutiny. The regulators are more challenging and sceptical about transactions and more willing to say no.

Slaughters M&A head Roland Turnill "The percentage of bust deals is clearly higher now. There is increasing regulatory scrutiny. The regulators are more challenging and sceptical about transactions and more willing to say no.

"There is also more shareholder scepticism over deals. They are willing to put their hands up and express doubts or say they won't vote in favour of it. The stewardship agenda has a lot to do with this – there is considerable pressure on fund managers and institutional investors to be transparent and accountable in how they manage their investments."

CC global M&A head Guy Norman "Our clients are experiencing increasing regulatory challenges in takeovers. On large public transactions, competition authorities are intervening more frequently and our antitrust partners are being brought in to advise on deals at the infancy stages of transactions.

CC global M&A head Guy Norman "Our clients are experiencing increasing regulatory challenges in takeovers. On large public transactions, competition authorities are intervening more frequently and our antitrust partners are being brought in to advise on deals at the infancy stages of transactions.

"There are political influences too, which are increasingly impacting the complexity and certainty of deals, such as the Kraft-Heinz/Unilever situation where there was sensitivity around the UK losing one of its crown jewels. Protectionism continues to be a global issue as governments worry not only about foreign takeovers generally, but also about key technologies falling into overseas hands – something we saw on several deals in Germany last year as well as the US, Australia and elsewhere."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Lawyers React To India’s 2025 Budget, Welcome Investment And Tax Reform

Quartet Of Firms Secure Roles as LG Group’s IT Services Arm Lists for $823M

A&O Shearman, White & Case Advise on €1.2B Public Takeover of German Steel Giant Salzgitter

3 minute readTrending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250