CMS merger shakes up listed company adviser rankings as Slaughters holds on to top spots

CMS jumps to joint third place with HSF for total stock market client numbers

May 30, 2017 at 05:11 AM

3 minute read

CMS has seen its share of the listed company market more than double this quarter, catapulting the firm into joint third place with Herbert Smith Freehills (HSF), following its merger with Nabarro and Olswang.

CMS has seen its share of the listed company market more than double this quarter, catapulting the firm into joint third place with Herbert Smith Freehills (HSF), following its merger with Nabarro and Olswang.

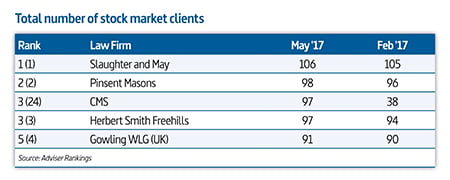

The rankings, compiled by Adviser Rankings in association with audit and advisory firm Crowe Clark Whitehill, also place Slaughter and May at the top of the tables for total number of stockmarket clients, FTSE 250 clients and FTSE 100 clients.

CMS, whose three-way merger went live on 1 May, now has 97 stockmarket clients, up from 38 in Q1 when it was ranked 24th.

CMS, whose three-way merger went live on 1 May, now has 97 stockmarket clients, up from 38 in Q1 when it was ranked 24th.

The firm also jumped up eight places in the FTSE 250 table during the period, moving from 14th place in Q1 to sixth place. During that time, the firm has increased its total FTSE 250 clients by 10. In the FTSE 100 ranking, it has risen to 10th place, up from 12th, by adding two clients: Land Securities from legacy Nabarro and ITV from legacy Olswang.

CMS corporate partner Alasdair Steele, formerly at Nabarro, said: "The merger has brought us more depth on the issuer side, from both CMS and Olswang, which is what we're seeing in the rankings and across the sectors. Historically, Nabarro was strong on the investment bank side.

"We are now all thinking about what we can take to existing and new clients and what we can go out to market with to get people's attention."

In addition, CMS has entered the Aim market ranking for the first time with 40 clients, the bulk of which belong to legacy Olswang and Nabarro. The combined firm's Aim clients include advertising company M&A Saatchi, internet-based market research company YouGov, real estate agency M Winkworth and oil and gas company Gulfsand Petroleum.

Meanwhile, Slaughters has retained the top spot with 106 stockmarket clients, gaining one new client, while Pinsent Masons remains in second place with 98 clients, up from 96.

Slaughters also topped the FTSE 250 and FTSE 100 rankings with 35 and 33 clients respectively.

The magic circle firm's M&A head Roland Turnill said: "In terms of our position in the rankings, it is of course encouraging to see validation of the time and effort we put into building relationships and giving our clients and potential clients what they need."

Commenting on market conditions, Turnill added: "Since news of the UK election, there's been a tailing off in activity. Everyone is waiting to see what happens. For M&A, there are two issues. First, assuming Theresa May wins, what's the size of her majority and what will she do with it – particularly in terms of industrial strategy and the mooted changes to the takeover regime? Secondly, how will the Brexit talks begin?"

Other magic circle firms with top spots in the FTSE 100 table include Allen & Overy in second place with a total of 27 clients, Linklaters in third (25) and Freshfields Bruckhaus Deringer in fourth (23).

In the FTSE 250 category, Linklaters is in second place with 32 clients, while HSF has placed third with 30 clients.

During the quarter, Linklaters gained three FTSE 250 clients – outsourcing company Capita, electronics retailer Dixons Carphone and online food delivery service Just Eat. It lost one: betting company CMC markets.

HSF also gained three: Capita, retail bank Aldermore Group and specialty chemicals business Elementis.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

X-odus: Why Germany’s Federal Court of Justice and Others Are Leaving X

Mexican Lawyers On Speed-Dial as Trump Floats ‘Day One’ Tariffs

Threat of Trump Tariffs Is Sign Canada Needs to Wean Off Reliance on Trade with U.S., Trade Lawyers Say

5 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250