'We want to be on a par with Freshfields' - Latham Germany chief sets out bold 2020 strategy

Latham's Oliver Felsenstein targets Germany growth as magic circle rivals scale back

June 07, 2017 at 04:17 AM

4 minute read

As its rivals downsize in Germany, Latham & Watkins is in hiring mode. The firm is targeting premium M&A work in a bid to catch up with key rivals by 2020, says country head Oliver Felsenstein, formerly global co-head of private equity at Clifford Chance (CC).

As its rivals downsize in Germany, Latham & Watkins is in hiring mode. The firm is targeting premium M&A work in a bid to catch up with key rivals by 2020, says country head Oliver Felsenstein, formerly global co-head of private equity at Clifford Chance (CC).

"In three years' time we want to be viewed at least on a par with Freshfields Bruckhaus Deringer and Hengeler Mueller. These firms have traditionally had strong reputations in strategic M&A, but we have invested and continue to win market share."

The new strategy encompasses four areas: Latham's reputation in the German market; recruiting and retaining the best talent; integration within the firm's four offices in Germany and around the firm's global network; and innovation and modernisation.

It was launched by Felsenstein in September to fulfil the firm's overall goal to become the number one law firm in the world.

He explains: "To be the world's leading global law firm you need market-leading expertise in the key financial and regulatory centres. In Germany, we are focused on building on our existing strengths to establish ourselves firmly at the top of the market.

"We are looking to continue to grow the M&A practice, but don't have set goals in terms of size. We are already market-leading in areas like private equity, capital markets and finance." He adds that the litigation practice is also earmarked for growth.

With Brexit we have seen a slight change in some clients' focus towards Frankfurt and Paris

Currently, the firm has 16 M&A partners in Germany, including nine private equity partners. In total, Latham has 170 lawyers in the country including 43 partners, across four offices in Frankfurt, Munich, Duesseldorf and Hamburg.

The focus in Germany on M&A laterals mirrors the approach taken in London. It was the hire of Allen & Overy (A&O) City M&A partner Ed Barnett in November that first signalled the firm's intent to ramp up in M&A, traditionally a magic circle stronghold.

However, the firm is yet to recruit a prominent M&A partner in Germany.

Recent M&A mandates include, in March, acting for German consumer products group Henkel, maker of household brands Persil and Pritt glue sticks, on a $1.05bn (£800m) deal to buy the can sealants and coatings unit of GCP Applied Technologies.

Felsenstein suggests the firm is also turning its attention more towards Germany in part due to uncertainty over how Brexit will impact the City. "London will remain a key strategic market for the firm, and we're not done there yet, but with Brexit we have seen a slight change in some clients' focus towards Frankfurt and Paris. The firm takes a long-term view and won't be making any snap decisions. We are well placed to pivot as required."

Felsenstein, who joined from CC along with fellow private equity partner Burc Hesse in 2015, was appointed country head in August 2016. Previously, the firm's Germany operations were led by three individual office managing partners.

His key clients include private equity firms CVC, Hg Capital, Permira, Terra Firma, 3i and Frankfurt's Quadriga Capital.

The firm is planning to grow in Germany while others opt for steep cuts in the region. Freshfields has reduced Germany partner numbers by 20% since late 2015, while CC has pushed forward with a similarly aggressive reduction in partner count in recent years.

So far, Latham's partner count has remained broadly stable at 43 during the past few years. The firm has no plans to close any offices or launch new ones.

Despite a sharp rise in exits in Germany, the firm has replaced these with lateral hires and promotions. In 2016, the firm brought in three magic circle partners – A&O Germany capital markets head Oliver Seiler in Frankfurt, Linklaters German head of private equity Rainer Traugott in Munich and Freshfields competition partner Michael Esser in Duesseldorf.

Prominent exits include Frankfurt white-collar defence partner Finn Zeidler, who last month quit for Gibson Dunn & Crutcher, where he was reunited with former Latham colleagues Dirk Oberbracht and Wilhelm Reinhardt, who left to launch the Frankfurt base last year.

Going forward, Felsenstein says Latham's ultimate position in the market by 2020 will depend on market perception.

"How will I know if we've achieved our goal? The test for me will be when I ask 10 people which law firm they regard as the best in Germany and the majority say Latham."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

EU Parliament Gives Blessing to New EU Competition Chief Ribera Rodríguez

2 minute read

Simpson Thacher Becomes Second Firm to Launch in Luxembourg in 2 Days With A&O Shearman Hires

3 minute read

HSF Hires Trio for Luxembourg Launch, Builds Private Capital Practice

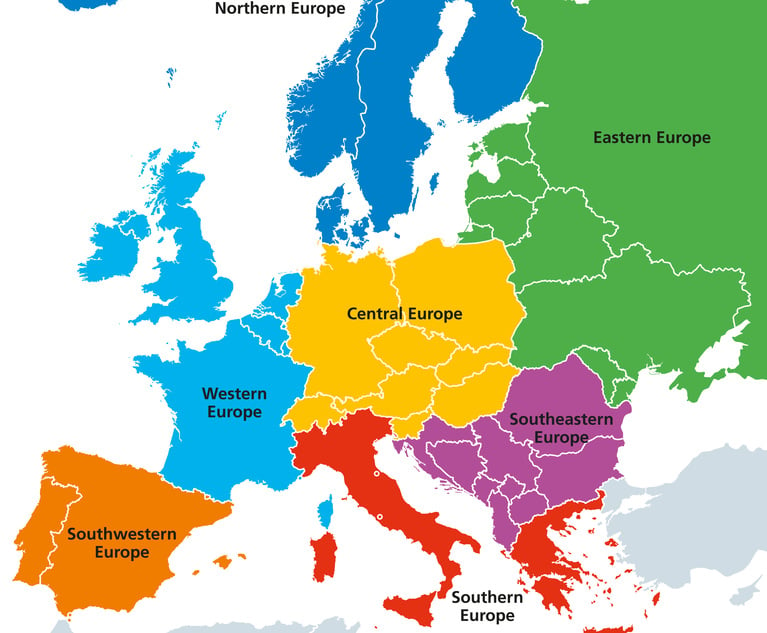

To Thrive in Central and Eastern Europe, Law Firms Need to 'Know the Rules of the Game'

7 minute readTrending Stories

- 1Friday Newspaper

- 2Judge Denies Sean Combs Third Bail Bid, Citing Community Safety

- 3Republican FTC Commissioner: 'The Time for Rulemaking by the Biden-Harris FTC Is Over'

- 4NY Appellate Panel Cites Student's Disciplinary History While Sending Negligence Claim Against School District to Trial

- 5A Meta DIG and Its Nvidia Implications

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250