Clifford Chance posts double-digit hikes in revenue and PEP to record highs

Revenue hits £1.5bn as PEP climbs to just under £1.4m

July 05, 2017 at 09:59 AM

4 minute read

Clifford Chance (CC) has posted double-digit increases in both revenue and average profit per equity partner (PEP), taking both metrics to new highs for the firm.

Turnover climbed 11% in 2016-17 to £1.54bn, with PEP soaring by 12% to an average of £1.38m against almost static equity partner count.

The firm said its financials were buoyed by strong performances in London and Asia-Pacific, as it confirmed that total partnership profit rose by 12% to £554m.

The strong results mean PEP has climbed by 23% in the past two years, with this year's figures coming on the back of a 2.7% rise in turnover to £1.39bn in 2015-16 and a 9.8% rise in PEP to £1.23m.

On a constant currency basis CC said revenue grew by 2%, with partnership profit outpacing this growth at 8.5%.

Managing partner Matthew Layton (pictured) said the firm's profit growth reflected both the increase in revenue as well as efficiencies in internal operations across the firm, with costs slightly down on a like-for-like basis.

He added: "We have seen a resilient performance in London. Clearly, there was a slowdown in activity levels around the referendum and a prolonged summer lull but activity came back strongly in the second half of the [financial] year."

By region, the strongest performers were the UK, which brought in £507m in turnover, up 4% to equate to 33% of total revenue, and Asia-Pacific, where revenue grew 7% in local currency and made up 18% of total sterling revenue.

Elsewhere, revenue either fell or remained static in local currency. US turnover of £202m was up 15% in sterling but in dollars was flat after a strong year in 2015-16. Continental Europe and the Middle East saw drops of 2% and 8% respectively in local currency, with Layton attributing this in part to the firm's restructuring of its now-smaller German practice and changes in Saudi Arabia.

He said: "As a consequence of restructuring [in Germany] we have seen some impact on revenues. However, we saw those businesses outperform [their targets] despite having fewer people. We anticipate seeing growth coming back into that region.

"In the Middle East, revenue was impacted by a restructuring of our Saudi operations. That stripped out Saudi revenue. But it is a really interesting market. There is also quite a bit of work in Iran and we have moved some project finance lawyers to Dubai to help drive Africa."

Overall, Layton said the financial growth was driven by the firm's latest client-focused strategy. "We launched our strategy two years ago and the momentum of that has developed into the second year.

"I think we have got the foundations of our strategy in place and we will continue that drive, making sure we are delivering on the most complex work, being efficient in the way we operate and continuing to invest in skills across project management, data and technology."

CC introduced its strategy in January 2015. Key to this plan is investment in technology and more flexible ways of working. However, Layton said the firm has no plans for a second legal services centre in a different location, an option it had previously considered. The firm has one support office in India.

Mandate highlights for CC during the past financial year include acting for FairSearch on the European Commission investigation that recently led to Google's €2.4bn (£2.1bn) fine for illegal search practices; acting for the banks on Postal Savings Bank of China's $7bn (£5.4bn) listing on the Hong Kong Stock Exchange; and advising the consortium of bidders for National Grid's sale of its gas pipe network, which is valued at £13.8bn.

Earlier this week, Legal Week reported that Freshfields had been outpaced by magic circle rival Linklaters in both revenue and profitability, after announcing stagnant turnover and shrinking net profit for 2016-17.

However, despite CC's rate of growth outpacing its magic circle rivals' to date, its PEP figure is still well below them. Linklaters partners now receive on average £1.568m (up 7.8%), with this figure standing at £1.547m (up 5%) at Freshfields.

Allen & Overy has yet to announce its results.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

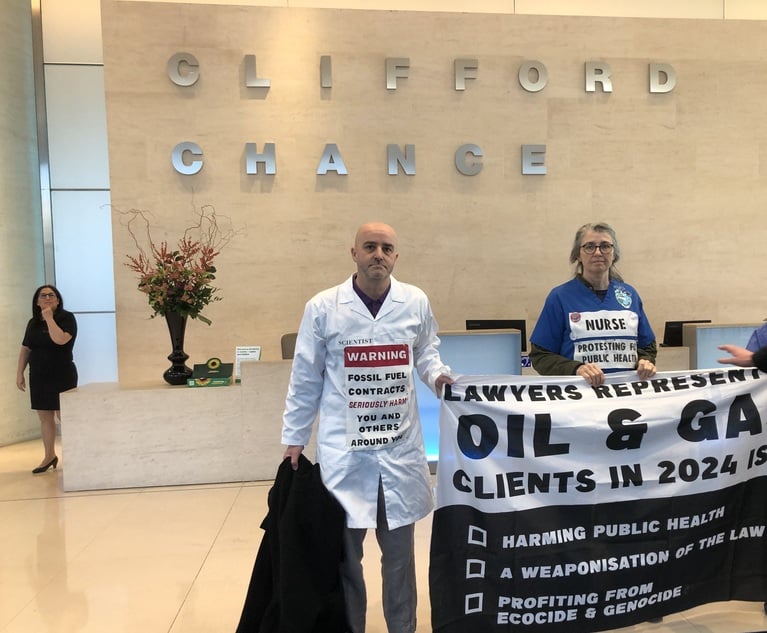

Doctors and Scientists Lead Climate Protests at Each Magic Circle Firm

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250