Kirkland tops half-year UK M&A rankings by value as deal volumes fall to four-year low

US firms dominate UK M&A rankings in higher value but thinner deal market

July 06, 2017 at 05:15 AM

5 minute read

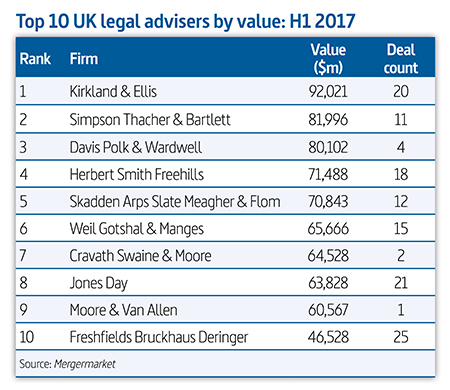

Kirkland & Ellis has topped the UK M&A deal rankings by value in the first half of 2017, in a market dominated by fewer, but higher value, deals.

Data from Mergermarket shows that the US firm advised on 20 deals worth $92bn (£71bn) to secure the top spot in the UK value table.

UK deal values nearly doubled in H1 compared to the equivalent period in 2016, rising from $48.6bn (£37.6bn) to $93.7bn (£72.6bn) this year, but deal volume fell by around 10% to 660 transactions – the lowest H1 total for the UK market since 2013.

DLA Piper topped the UK volume rankings, taking roles on 40 deals worth a total of $6.2bn (£4.8bn), just ahead of Latham & Watkins, which advised on 38 deals worth $18.2bn (£14.1bn).

Global deal value rose by 8% to $1,492bn (£1,156bn), while worldwide deal volumes slumped by 12% to 8,052 – also the lowest total for four years.

In Europe, total value jumped by 30% to $467bn (£361.9) against a 17% drop in volume.

Clifford Chance (CC) corporate head Guy Norman (pictured) said: "The first few months of the year were a bit slower in the UK. A few deals were put on hold following the election, particularly as some were hoping for a different result and a stronger mandate for the government in the context of Brexit.

Clifford Chance (CC) corporate head Guy Norman (pictured) said: "The first few months of the year were a bit slower in the UK. A few deals were put on hold following the election, particularly as some were hoping for a different result and a stronger mandate for the government in the context of Brexit.

"A lot of UK clients are worried about takeovers due to sterling's devaluation, and the fact that international companies are looking to bolster slow growth at home – that's a big driver of inbound activity."

Kirkland M&A partner Matthew Elliott added: "We are seeing a lot of US inbound investment in Europe – Germany in particular. Looking forward, we foresee an increased focus in the financial institutions sector due to increased regulatory oversight and the consequential desire to divest capital intensive assets associated with European banks."

Deals were put on hold following the election, particularly as some were hoping for a different result

Kirkland's haul of deals in the first half of 2017 included advising US baby milk formula company Mead Johnson on its $17.9bn (£14.4bn) sale to Reckitt Benckiser. Kirkland is also acting for private equity groups Bain and Cinven on their €5.3bn (£4.5bn) acquisition of German pharmaceutical company Stada.

In total, US firms took eight of the top 10 spots in the H1 rankings by value, with Herbert Smith Freehills coming in fourth, buoyed by its lead role for British American Tobacco (BAT) on its $49.4bn (£40bn) takeover of Reynolds American, and Freshfields Bruckhaus Deringer ranking 10th.

In total, US firms took eight of the top 10 spots in the H1 rankings by value, with Herbert Smith Freehills coming in fourth, buoyed by its lead role for British American Tobacco (BAT) on its $49.4bn (£40bn) takeover of Reynolds American, and Freshfields Bruckhaus Deringer ranking 10th.

This is in stark contrast to H1 last year, when Freshfields topped the ranking followed by Linklaters in second place and CC in sixth.

The biggest UK deal during the first half of the year was Blackstone's $13.8bn (£10.7bn) sale of its European warehouses and logistics business Logicor to China Investment Corporation (CIC), with CC acting for CIC and Simpson Thacher & Bartlett advising Blackstone.

Other major UK deals include the $4.6bn merger of Aberdeen Asset Management and Standard Life, which handed lead roles to Freshfields, Slaughter and May and Maclay Murray & Spens, and Tesco's $4.5bn acquisition of food wholesale operator Booker Group. CC is acting for Tesco and Freshfields is representing Booker.

Globally, H1′s biggest deal was BAT's Reynolds American takeover, followed by two European deals – German chemicals group Linde's $45.5bn merger with US rival Praxair and infrastructure company Atlantia's $33.2bn merger with Spanish rival Abertis.

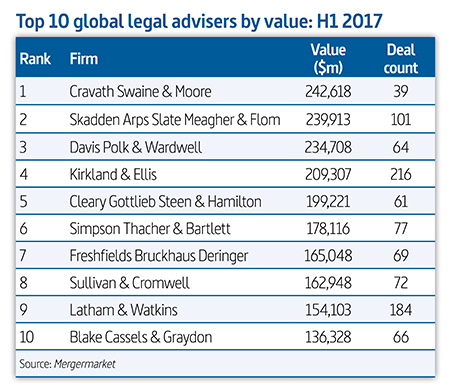

Cravath Swaine & Moore – which took roles on both the Reynolds-BAT and Linde-Praxair deals – topped the global deal table by value with roles on mandates worth a total of $242.6bn (£188bn), with Skadden Arps Meagher & Flom in second place on $240bn (£186bn). Freshfields was the top-ranked UK firm in the global value table, coming in at seventh.

Cravath Swaine & Moore – which took roles on both the Reynolds-BAT and Linde-Praxair deals – topped the global deal table by value with roles on mandates worth a total of $242.6bn (£188bn), with Skadden Arps Meagher & Flom in second place on $240bn (£186bn). Freshfields was the top-ranked UK firm in the global value table, coming in at seventh.

Commenting on market activity, Slaughters corporate head Roland Turnill said: "The UK market is relatively thin at the moment, and I would expect that to continue in the short term. Elsewhere, there are significant geographic variations. Europe is busier than it has been, the US is significantly quieter, and there have been some developments in China which tend to suggest it might be quieter for a while."

Norman added: "I think it will still be a reasonable year for global M&A despite geopolitical challenges. Although there will be some impact from reduced dealflows out of China and in the US, corporate and other investors are still looking for growth and deals that make strategic sense."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Lawyers React To India’s 2025 Budget, Welcome Investment And Tax Reform

Quartet Of Firms Secure Roles as LG Group’s IT Services Arm Lists for $823M

A&O Shearman, White & Case Advise on €1.2B Public Takeover of German Steel Giant Salzgitter

3 minute readTrending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250