Stop hiring, stop opening and stop playing where you can't win: the Big Law survival guide

Big law firms are doing little to mitigate key threats to their prosperity - and much to exacerbate them

August 03, 2017 at 05:18 AM

12 minute read

The challenges besetting big law firms are of their own making. The industry has overshot the needs of clients and overlooked the effect of growth on the intensity of competition. The really frightening part? Recent surveys show firms are doing nothing to mitigate the threats to their prosperity – and much to exacerbate them.

During the past two to three decades, law firms have developed and offered sophisticated, bespoke – and increasingly expensive – services to clients; many of who simply do not need such sophisticated services and who do not get good value at the prevailing price point.

As one eminent corporate practitioner told me: "We're not just protecting clients against a 100-year flood; we're protecting them against a one-in-10,000-year event."

Overshooting client need

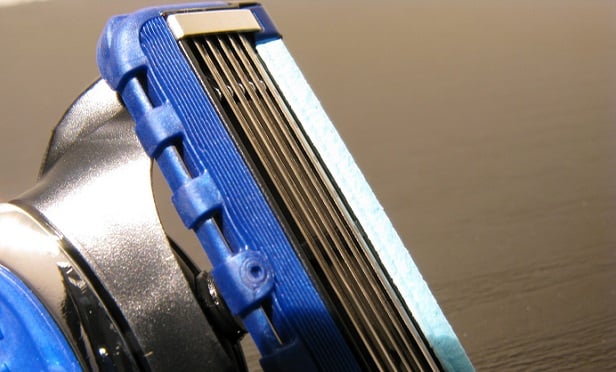

The men's shaving market provides a foreboding analogy. Starting in the 1970s, Gillette followed a simple and lucrative strategy: add new features and raise the price. The world's first two-blade razor was introduced in 1971. Then came: two blades plus lubricating strips; three blades; three blades plus micro-fins; five blades on a pivoting head with before-and-after soothing strips and a trimmer… somewhere along the line, shavers grew frustrated and a sense of being gouged on price took hold.

While Gillette was charging more than $6 for its latest cartridge, new rivals offered a twin-blade razor at a dollar. Gillette's market share has dropped 16% – the equivalent of a magnitude 9.0 earthquake in an established consumer goods category. Gillette has responded by cutting prices across the board, promoting its lower-priced product lines more, and introducing its own online service.

The clear and present danger is in clients turning their back on Big Law and taking work in-house

The parallel in Big Law is that in response to firms overshooting the market's needs, clients have grown frustrated and have slowly, steadily and irreparably taken legal services in-house.

Recent surveys make this point emphatically: 82% of firms report they're losing business to in-house legal departments; in-house counsel report that they meet 73% of total demand internally because of cost. There is a segment of client demand that values Big Law's sophisticated, high-price offering. However, this segment is considerably smaller than the available supply – i.e. the volume of such work that the industry has sized itself to deliver.

Big Law didn't just sleepwalk itself into this situation. It had help. Consultants and headhunters have overpromoted the virtues of growth – expansion is much easier to sell to firm leaders than is one that makes the case for retrenchment.

Similarly, while the threats posed by the emergence of artificial intelligence and alternative legal service providers are real, the industry pundits have not identified clearly that these are not imminent. The clear and present danger is in clients turning their back on Big Law and taking work in-house.

In-house lawyers will adopt new technology more rapidly than their outside counterparts

Technology will accelerate the trend for clients to take work in-house. This follows from the different incentives of in-house and Big Law lawyers. While law firms' sluggishness in new technology adoption has been ascribed to traditional conservatism and low technological literacy, the true root cause is more basic – lawyers are measured on their billed hours; technology reduces billed hours, so it is not in a partner's interest to sacrifice billed hours today for the firm's enhanced competitiveness tomorrow.

In-house lawyers have the obverse incentives. They are pressured relentlessly to do more with less. Technology helps them do so. Thus, in-house lawyers will adopt new technology more rapidly than their outside counterparts.

Economics tells us that substitution of one service (in-house) for another (outside counsel) increases as the price of the former declines relative to that of the latter: lowered in-house service costs combined with rising outside counsel prices will accelerate the pace of substitution of in-house for outside counsel work. The market pundits are absolutely right that technology will have a major impact on Big Law; what they miss is that law firms will experience it primarily as an acceleration in the industry-wide contraction of client demand.

Reduced friction will also accelerate the pace of in-house substitution. Just like push-starting a car, where it takes a lot more effort to get the clunker going than to keep it moving, the forces to overcome at the early stages of the in-house migration of work are much greater than those as it builds momentum.

The initial frictions include things like: reticence for in-house lawyers to damage personal relationships with outside counsel; challenges of attracting really high-quality lawyers to in-house positions; senior in-house lawyers needing to learn how to manage other in-house lawyers without reliance on up-or-out systems and an annual fresh supply of talent; and the tendency on the part of some client executives to place greater trust in outside counsel. All these frictions lessen with time, thereby accelerating further the pace of substitution.

Overlooking the effect of growth on competition

The 1990s and 2000s were good decades for Big Law. True, there was the dotcom bubble bursting, but the market recovered quickly and got back on its upward trajectory. Billing rates kept going up – it took nerve just to raise rates as high as you knew other firms were doing, but there was no point in being the one missing out.

No one wanted to be the one firm among its peers that didn't have an office in New York or London or Hong Kong. No one wanted to be the one firm that didn't have the prestige practice of the time, be it strategic M&A or middle-market private equity or white-collar defence.

With demand falling and competition intensifying, the erosion of prices will accelerate and profits will tank

Clients weren't going to dissuade firms from moving into new markets – it is unambiguously in their interests to have an expanding set of viable service providers. Likewise, it was a boom for partners in the sought-after markets who were open to moving laterally. Second-tier lawyers in top-tier markets suddenly become highly sought after; compensation above economic value naturally ensued, funded by partners in the growing firms' legacy markets.

It is hard to understand the rationale for this collective action. The madness of crowds?

Whatever it was, it wasn't sound strategy. After all, the goal of strategy is to build businesses with sustainable above-normal profitability, and strategy's most basic principle is that profitability declines as the number of competitors increases. Moving en masse into new markets with ill-distinguished offerings simply increases the number of players in the market and thereby intensifies competition; it is the perfect antithesis of sound strategy.

Big Law's response

The migration of work in-house has removed a very significant chunk of demand from the market. Yet firms have not reduced their numbers of lawyers. Industry-wide overcapacity ensues – more than three quarters of firms report overcapacity is diluting profitability. While GDP and financial markets are well above their pre-recession highs, 74% of firms report demand is below 2007 levels, indicating that this overcapacity is the result of structural change (i.e. companies taking work in-house) and not of the vagaries of the business cycle. We should be clear about the consequence of the demand shift being structural: there is no forthcoming relief from a cyclical upswing.

Not only has aggregate demand shrunk but, with law firms in each other's markets as never before, more firms are fighting for the shrunken pie. Underutilised lawyers and price competition inevitably ensue: 70% and 80% of firms report their equity and non-equity partners, respectively, are not sufficiently busy; more than 95% of firms believe more price competition is a permanent trend. Law firms have this last one right: clients will inexorably and increasingly leverage the glut of supply to their advantage in pricing.

The industry's plans in the face of overcapacity and intensified competition are stunning in their perversity: for 2017, fully 100% of firms plan to grow capacity organically; 99% plan to add laterals; 87% plan to pursue groups of laterals; and 42% will pursue new office openings.

This sets the industry on a course for which the prognosis is clear and certain: with demand falling, capacity growing and competition intensifying, the erosion of prices will accelerate and profits will tank. You don't see this response in other industries – sometimes industries can be slow to pare back on capacity; there can be exit costs, transactional friction. But I can't think of an industry that continued to add capacity in the face of a major structural contraction of demand.

Why are law firms accelerating the incipient destruction of their industry's profitability? What are firm leaders thinking? Here again, the Altman Weil survey sheds some light. There appear to be three different segments:

The unaware: 34% of firms do not believe that erosion in demand for law firms is a permanent trend. This denies the overshot-the-market logic for, and evidence of, clients taking work in-house.

The unthinking: 19% of firms see price and demand erosion as permanent and, like the rest of the industry, are adding capacity, yet they don't foresee even a slowdown in growth of profit per partner (PEP). This defies reason.

The unmoved: 47% of firms see a slowdown in growth in PEP as permanent but, like the industry as a whole, continue to add capacity, hire laterals, etc.

The beliefs of the first two segments are addressable through data and logic. The 'unmoved' segment is more perplexing. Something deeper – and darker – may be at play: firm leaders face an effort-reward imbalance. Turning around a partnership is difficult and emotionally-taxing work. It is especially so when, as here, it requires leaders to acknowledge (at least tacitly) they've made mistakes – it can be a struggle to acknowledge such to oneself, let alone to one's partners. Leaders will have to pull the plug on pet initiatives – this is a challenge to the most mature and self-aware of leaders. As my father, an avid gardener, likes to say: no man can prune his own roses. And while current leaders would bear the pain of the turnaround effort, the resulting gain would accrue primarily to future generations of partners because today's leaders will likely maintain strong compensation through to their relatively near-in retirements.

All that said, pinpointing the drivers of the industry's stunning perversity isn't necessary. What matters is to identify the course changes needed and to make them happen.

The change of course

The actions firm leaders need to take are straightforward.

- Stop adding capacity.

- Stop adding new offices.

- Stop playing where you can't win. Former GE CEO Jack Welch used to say you should be number one or two in your market or you should exit. Because of client conflicts, the legal world is less concentrated, but law firm leaders should look at their firm's positions in each market segment in which it participates and identify where they truly have sustainable leadership positions; in others, they should exit.

- Stop measuring partners on billed hours. Partners should be assessed on three things: the volume of work they bring in; the volume of service delivery they oversee; and the efficiency with which each is executed.

- Change what partners think of as excellence. Superior legal knowledge is not a significant competitive advantage – what the vast bulk of the market wants isn't exceptional legal work; it's excellent legal work, done exceptionally well.

- Lead. All leaders think of changing their organisations; few think of changing themselves. For incumbent leaders, this fits Einstein's definition of insanity (repetition with the expectation of a different outcome).

To enhance the prospects for success, leaders should change the composition of their leadership teams to include many more young partners. You need to have people with skin in the game to tackle appropriately a firm's long-term challenges.

These changes will ask more of many incumbent leaders than they are emotionally equipped to deliver – it is entirely reasonable for some leaders not to have the appetite to retool and restructure for the task ahead. In such cases, they should simply step aside and let others take the helm.

There's a saying in engineering that it takes three mistakes for a catastrophe to occur. Big Law is at this limit. First, it overshot the market with its offer. Then it ignored the most fundamental aspect of strategy. And now it's on the brink of its third mistake: carrying on as if nothing has happened.

The consequence of such inaction can be captured in two words: industry suicide. The avoidance action required of firm leaders is just one word: lead.

Hugh Simons is a strategist and veteran professional services firm leader. He is a former senior partner, executive committee member and chief financial officer at The Boston Consulting Group and the former chief operating officer at Ropes & Gray.

Picture credit: Jemimus

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Will a Market Dominated by Small- to Mid-Cap Deals Give Rise to This Dark Horse US Firm in China?

Big Law Sidelined as Asian IPOs in New York Dominated by Small Cap Listings

X-odus: Why Germany’s Federal Court of Justice and Others Are Leaving X

Trending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250