UK top 50 push total revenues past £20bn as currency gains mask market uncertainty

One third of UK top 50 post double-digit revenue rises as group's total turnover jumps 10%

August 31, 2017 at 08:23 AM

8 minute read

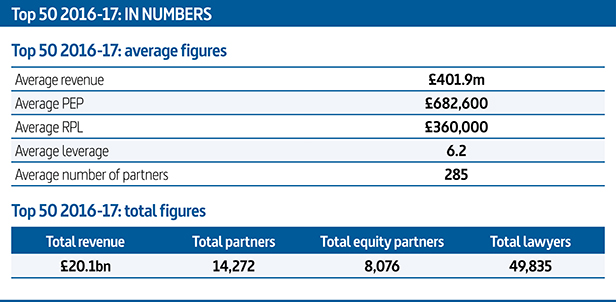

The UK's 50 largest law firms saw combined revenue break the £20bn barrier for the first time in 2016-17, with the weak pound helping drive up total fee income across the group by 10%.

Legal Week's ranking of the UK's 50 largest commercial law firms shows turnover across the group hit £20.1bn last year, up from £18.3bn in 2015-16, equating to an average revenue growth of 7.7% across the group.

Only eight top 50 firms posted falling revenues, with just two seeing their top line fall by more than 2%. Conversely, one third of the group – 16 firms – posted double-digit turnover increases.

With currency uplift from overseas revenue helping many firms to mask stagnating activity levels prompted by the much-cited Brexit and Trump factors, the results represent a significant improvement on 2015-16, when average revenue growth stood at just 2.4%.

However, while the overall figures for the top 50 appear positive, on closer inspection they hide significant disparities in individual performance.

With the exception of a handful of firms – such as Freshfields Bruckhaus Deringer, which experienced a challenging 2016-17 after a run of positive growth – the weak pound significantly skewed the rankings in favour of those with large international presences.

Highlighting the impact of currency fluctuations, verein firms DLA Piper and Hogan Lovells both saw significant hikes in revenue and profits when their 2016 calendar year revenue figures were converted into sterling from the dollar figures provided for the Am Law 100 rankings compiled by Legal Week's US sister title The American Lawyer.

For Hogan Lovells, a 17.6% revenue hike based on dollar conversions would only have equated to a 7.9% rise at constant currency, with the uplift helping the transatlantic firm jump ahead of Freshfields in the rankings for the first time ever.

Similarly, firms that have traditionally reported in euros in recent years, such as Bird & Bird and Osborne Clarke, also saw growth soar in our rankings, with the former posting a rise in revenue of nearly 21% and the latter of 17.5%.

At the top end of the UK market, perhaps keen to demonstrate why apparently booming results should not translate into significant pay hikes for lawyers, several magic circle firms confirmed the extent to which their figures were inflated by the fall in sterling against the dollar and the euro.

Allen & Overy (A&O) posted a 16% increase in revenue and a 23% hike in PEP, but on a constant currency basis the increases would be effectively halved, translating to 6% for revenue and 14% for PEP.

Despite strong performances from Clifford Chance and Linklaters, A&O was the standout performer within the magic circle after a couple of lacklustre years. Its results mean it also leapfrogged Freshfields by revenue, moving it into third place.

Even allowing for disappointing results from Freshfields, where revenue nudged up only 0.2%, this uplift from currency changes helped drive revenue growth of 9% across the magic circle and 10% across the 10 largest – and most international – firms, compared with growth of just 3% at UK-only firms.

By and large, as a result of the currency uplift, revenue growth slowed lower down the rankings with average turnover growth for firms 31-50 standing at 3.8% compared with the average 10.4% rise across the top 30.

A&O managing partner Andrew Ballheimer argues that the firm's strong performance this year is down to the investment it has made in its overseas network and core practices, and that any currency gains are cancelled out by costs in these more expensive markets.

Ballheimer (pictured) told Legal Week: "Looking at global firms, they have a presence all over the world, so each benefits or is hurt by currency fluctuations. For example, if you are a dollar-based US firm with a big presence in London, all of a sudden London-based partners paid in US dollars are getting paid a disproportionate amount, while their income has dropped by 18%-20% because they generally bill in sterling, so actually it is not helpful for US firms.

Ballheimer (pictured) told Legal Week: "Looking at global firms, they have a presence all over the world, so each benefits or is hurt by currency fluctuations. For example, if you are a dollar-based US firm with a big presence in London, all of a sudden London-based partners paid in US dollars are getting paid a disproportionate amount, while their income has dropped by 18%-20% because they generally bill in sterling, so actually it is not helpful for US firms.

"I don't think the currency is hurting or helping anyone – it nets out – if you are a US firm investing over here, all your expenses are in dollars, which has increased in value, while your income is in sterling, which has decreased."

At Macfarlanes, which has no significant international presence, senior partner Charles Martin says he was particularly pleased by the firm's 4.1% revenue rise and 7.7% increase in PEP given the absence of the uplift from currency gains.

He said: "It's a tough market. It's not surprising you're seeing divergent law firm results. Our results are strong, but not outstanding – any revenue increase is hard fought for in this environment, and if you match it with a corresponding increase in profitability you're doing well.

"We saw no gain from currency – our practice proved to be far more resilient post the Brexit vote than we anticipated. Levels of activity in corporate that we thought would be significantly challenged held up pretty well."

Once again, average profit growth lagged behind revenue rises, even though 18 firms posted double-digit profit per equity partner (PEP) hikes for 2016-17, helping to grow PEP by an average of 5.4% across the top 50.

It's a tough environment, and getting tougher, so gains are hard won

Fourteen firms saw PEP decline during the year, and while this is a reduction on the 15 last year, there are some significant declines across the group, topped by Addleshaw Goddard's 25% drop.

The disparity between revenue and profit changes hint at the struggle that Martin describes.

Herbert Smith Freehills (HSF), for example, saw PEP fall by 2.4% against a 10.6% increase in revenue on the back of a programme of international expansion, with various other firms experiencing the same disparity.

The gap between profit and revenue growth, which was also seen last year, comes after many UK firms opted for significant pay increases for associates in May 2016.

HSF chief executive Mark Rigotti (pictured) comments: "We had a lot of uplift from currency changes, but we also had lots of investment in our overseas offices [which impacted profit]. I think all firms were caught out last year by the associate salary increases at a time when expected revenue maybe wasn't there because of the political uncertainty. I expect our investment will consolidate in the next year – the business is going pretty well and we're still investing – it's a question of balancing profit today with profit tomorrow."

HSF chief executive Mark Rigotti (pictured) comments: "We had a lot of uplift from currency changes, but we also had lots of investment in our overseas offices [which impacted profit]. I think all firms were caught out last year by the associate salary increases at a time when expected revenue maybe wasn't there because of the political uncertainty. I expect our investment will consolidate in the next year – the business is going pretty well and we're still investing – it's a question of balancing profit today with profit tomorrow."

Against this backdrop and amid increasing political instability in Asia, some believe firms are likely to start tightening the reins on spending as well as their grip on the equity.

The 2016-17 results already show some firms controlling their equity in a bid to boost profit. And, while overall lawyer numbers across the top 50 grew by 3.4%, this was driven in large part by consolidation rather than organic growth, with Gowling WLG a notable example, given this year's figures include its Canadian merger partner for the first time.

Even allowing for such consolidation, partner growth did not keep pace with lawyer count increases, rising by 2.2% across the top 50. Among the magic circle and the UK top 10, total partner numbers fell marginally, with equity partner numbers falling by more than 2.5% across the UK as a whole, as firms bid to keep a handle on profits.

Martin (pictured) comments: "It's a tough environment, and getting tougher, so gains are hard won. Firms are taking a much more hard-nosed and business-like approach to the cost base and a much more open and flexible approach to the way that they approach fees. They are listening to and engaging with clients about what they want on a given job. All of the changes that are going on in the legal market are creating firms that are less samey, more strategically clear. There's a level of focus on efficiency that we haven't seen to this extent before."

Martin (pictured) comments: "It's a tough environment, and getting tougher, so gains are hard won. Firms are taking a much more hard-nosed and business-like approach to the cost base and a much more open and flexible approach to the way that they approach fees. They are listening to and engaging with clients about what they want on a given job. All of the changes that are going on in the legal market are creating firms that are less samey, more strategically clear. There's a level of focus on efficiency that we haven't seen to this extent before."

Looking to the current year, Ballheimer concludes: "There is market volatility out there, uncertainty over Brexit and currency fluctuations with an increasingly strong euro against sterling and the dollar, and these factors will have some impact. There are also geopolitical issues in Asia with North Korea continuing to raise the stakes, plus uncertainty over the deliverability of the Trump administration's agenda. For the medium term, it is likely to be a period of continuing uncertainty."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG Moves to Provide Legal Services in the US—Now All Eyes Are on Its Big Four Peers

International Arbitration: Key Developments of 2024 and Emerging Trends for 2025

4 minute read

The Quiet Revolution: Private Equity’s Calculated Push Into Law Firms

5 minute read

'Almost Impossible'?: Squire Challenge to Sanctions Spotlights Difficulty of Getting Off Administration's List

4 minute readTrending Stories

- 1Public Notices/Calendars

- 2Monday Newspaper

- 3Judicial Ethics Opinion 24-98

- 4'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 511th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250