Herbert Smith Freehills pips Slaughters to first place in listed company adviser rankings

HSF in first place by total stockmarket clients after Adviser Rankings admits listed specialist funds to its client roster for the first time

September 04, 2017 at 04:23 AM

4 minute read

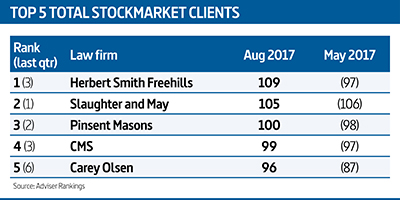

Herbert Smith Freehills (HSF) has topped the latest ranking of firms by their share of the UK listed company market, pushing Slaughter and May into second place for the first time in eight years.

The rankings, published by Adviser Rankings in association with audit and advisory firm Crowe Clark Whitehill, place HSF at the top of the overall table, after the firm added 12 listed clients to take its total to 109.

The additions for HSF and the change at the top of the table come after Adviser Rankings changed its ranking criteria to include companies listed on the Specialist Fund segment of the London Stock Exchange for the first time.

The additions for HSF and the change at the top of the table come after Adviser Rankings changed its ranking criteria to include companies listed on the Specialist Fund segment of the London Stock Exchange for the first time.

This decision added 35 companies to its adviser rankings, 10 of which name HSF as adviser. The additions for HSF include UK healthcare bond fund BioPharma Credit, Sherborne Investors – the vehicle of New York-based activist investor Edward Bramson – and aircraft leasing and acquisition investment company Amedeo Air Four Plus.

The firm came third in the FTSE 250 rankings and fifth in the FTSE 100 table (see below for these tables).

HSF London corporate head Ben Ward said: "Obviously this league table has been around for a while. We're always highly ranked and we've always had a strong relationship with listed companies. Investment funds have recently been admitted. They are listed companies which require advice, and it is often complex. They are important clients and they play a major part in the London listed market."

The shift in criteria knocked Slaughters into second place with 105 clients, loosening its grip on the top slot for the first time since 2009. The last firm to pip the elite magic circle firm to the top spot by total listed clients was legacy Eversheds in February that year, when it had 110 stockmarket clients compared with Slaughters and legacy Norton Rose on 109 each.

Other firms to score well in the new ranking include Pinsent Masons in third place with 100 clients, followed by CMS with 99.

Pinsents corporate finance head Rosalie Chadwick commented: "Our ambition is to do more work with these clients and really kick on from that position [in the total stock market ranking]."

She said the firm's latest London capital markets hires of Gareth Jones and Julian Stanier, who joined the firm from Berwin Leighton Paisner last week, fit in with this plan.

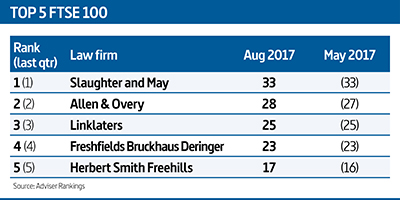

Slaughters has retained its position at the top of both the FTSE 100 and FTSE 250 rankings, despite seeing its FTSE 250 client list drop by 1 to 34.

The top of the FTSE 100 table did not change on Q2, with Allen & Overy (A&O) in second place with 28 clients, Linklaters in third (25) and Freshfields Bruckhaus Deringer in fourth (23).

However, in the FTSE 250 ranking, A&O climbed into fourth place with 27 clients, knocking Freshfields into fifth, with 26 clients.

During the quarter, A&O gained one FTSE 100 client (BT Group) and one FTSE 250 client, UK fertilizer development company Sirius minerals.

Slaughters saw its FTSE 250 client list shrink by one following the takeover of UK engineering company Atkins by SNC-Lavalin.

Looking ahead, Ward said he expects a rise in listed company takeovers. "Obviously the story has been about sterling being devalued, making UK assets attractive financially – I don't think that's the only reason for more takeovers by foreign investors. A lot of transactions we'll see will be based more on fulfilling medium-term strategy."

Top 5 firms by total number of FTSE 100 and 250 clients:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

X Ordered to Release Data by German Court Amid Election Interference Concerns

Compliance With the EU's AI Act Lags Behind as First Provisions Take Effect

Quinn Emanuel's Hamburg Managing Partner and Four-Lawyer Team Jump to Willkie Farr

Trump ICC Sanctions Condemned as ‘Brazen Attack’ on International Law

Trending Stories

- 1ACC CLO Survey Waves Warning Flags for Boards

- 2States Accuse Trump of Thwarting Court's Funding Restoration Order

- 3Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 4Coral Gables Attorney Busted for Stalking Lawyer

- 5Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250