UK Top 50 2016-17: the winners and losers over the last five years

Magic circle lags top 50 competitors for five-year revenue growth as mergers reshape market

September 08, 2017 at 08:27 AM

6 minute read

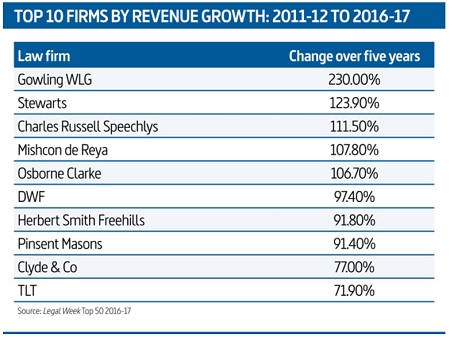

Gowling WLG, Stewarts Law and Charles Russell Speechlys have emerged as the fastest-growing UK top 50 firms during the past five years, according to data compiled by Legal Week that shows the extent to which firms' revenue growth has been driven by mergers and the challenges larger firms have faced to increase their top line organically.

Revenue data compiled for Legal Week's UK top 50 rankings highlights how the majority of the top 10 performers since 2011-12 have primarily achieved growth via mergers, with only two of the 10 – Stewarts and Mishcon de Reya – not having carried out a tie-up in the past five years.

Revenue data compiled for Legal Week's UK top 50 rankings highlights how the majority of the top 10 performers since 2011-12 have primarily achieved growth via mergers, with only two of the 10 – Stewarts and Mishcon de Reya – not having carried out a tie-up in the past five years.

Legacy Wragge & Co – now Gowling WLG – tops the ranking of the fastest-growing firms since 2011-12, with a 230% increase in turnover from £118.2m to £390.1m, following its combination with £52m legacy Lawrence Graham in 2014 and Canada's Gowlings last year.

Its 2016-17 results cover the first full financial year since the Gowlings combination, and highlight the comparable size of the UK and Canadian arms of the firm, with the Canadian business generating £200m compared with the UK partnership's £190.1m.

Charles Russell Speechlys, meanwhile, secured its top three position on the back of its 2014 union with £57m firm Speechly Bircham. The union is the main driver for the 111.5% increase in revenue over the period.

Of the rest of the top 10, Herbert Smith tied up with Australia's Freehills in October 2012, not long after Osborne Clarke merged with its Spanish and Italian allies, and Pinsent Masons and TLT took over Scots firms McGrigors and Andersen Fyfe respectively. Clydes merged with Simpson & Marwick in 2015, while DWF's growth has been driven by a series of acquisitions including the 2013 takeover of Cobbetts.

Stewarts is the only firm ranked in the top three for five-year revenue growth to buck the merger trend, achieving transformational growth without the aid of a tie-up.

The litigation specialist is one of only a small number of firms to have achieved significant revenue growth organically in the past five years, seeing turnover leap 123% from £34.9m in 2011-12 to £78.1m last year. The increase has propelled the firm into the UK Top 50 rankings for the first time.

While the firm's talks with fellow disputes player Enyo Law earlier this year about a possible tie-up suggest it is open to a strategy shift, managing partner John Cahill stresses than any deal would have to fit with its focus.

"We've always had an open mind in relation to merger; however, Stewarts is a litigation business and we have no intention of changing that very important strategic position. If we contemplate a merger, it has to be with another litigation business that can meet the various filters that we apply to our own business. Opportunities are limited."

He attributes much of Stewarts' growth during the period to innovative costing strategies that have encouraged clients to use the firm, including hourly rate retainers, and "in the right case, conditional fee arrangements, partial conditional fee arrangements, damage-based agreements, contingency agreements and, in some cases, fixed pricing".

Cahill also highlights the firm's work advising shareholder groups embroiled in the controversial RBS £12bn rights issue as a revenue generator during the past five years.

Just behind Stewarts, and also without a merger, is fellow disputes specialist Mishcons, which has seen revenue more than double since 2011-12, growing by 107% from £73m to £151m. The firm set out – and fulfilled – a bold strategy during the period, reaching its target of £100m a year early in 2014-15.

The research highlights the difficulties larger firms have faced achieving consistent growth in a challenging market, with huge competition on pricing and for top talent.

Notably, three magic circle firms sit within the bottom 10 by revenue growth in the past five years, with Freshfields Bruckhaus Deringer, Linklaters and Clifford Chance (CC) all seeing turnover climb by less than 20% during the period, despite strong years for both Linklaters and CC in 2016-17.

Notably, three magic circle firms sit within the bottom 10 by revenue growth in the past five years, with Freshfields Bruckhaus Deringer, Linklaters and Clifford Chance (CC) all seeing turnover climb by less than 20% during the period, despite strong years for both Linklaters and CC in 2016-17.

They sit within 12 firms to post revenue growth of 20% of less since 2011-12; however, three of this group will have rectified this by next year through the merger of CMS, Nabarro and Olswang on the first day of the 2017-18 financial year.

With a 10.4% drop in revenue over five years, Olswang is the worst performer in the group after a challenging few years. The firm rounds out a bottom trio – including insurance-focused firms Hill Dickinson and Ince & Co – which all saw revenue decline during the period.

Ince's revenue has fallen 3.4% on 2011-12′s figure of £91.6m, while Hill Dickinson has seen revenue fall by 7.6% from £110m to £101m this year, and is set to to shrink further with the imminent sale of its £23m general insurance business.

The firm is in talks to transfer the business, which comprises 16 partners and more than 400 other staff, to Keoghs – a deal which, if confirmed, could potentially result in the firm dropping out of the UK top 50 entirely.

Hill Dickinson chief executive Peter Jackson says: "In 2011-12, our insurance business was turning over around £40m – it's budgeted to do £25m this year. There's been a massive shrinkage in the size of that business, which is down to a number of factors.

"We also took the view two years ago that defendant firms were not going to need to supply claimant services to insurers, so we disposed of that part of the business. Other parts of our business have grown significantly – our business services practice has grown by 25% over the past three years – but haven't kept up."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG Moves to Provide Legal Services in the US—Now All Eyes Are on Its Big Four Peers

International Arbitration: Key Developments of 2024 and Emerging Trends for 2025

4 minute read

The Quiet Revolution: Private Equity’s Calculated Push Into Law Firms

5 minute read

'Almost Impossible'?: Squire Challenge to Sanctions Spotlights Difficulty of Getting Off Administration's List

4 minute readTrending Stories

- 1Public Notices/Calendars

- 2Monday Newspaper

- 3Judicial Ethics Opinion 24-98

- 4'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 511th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250