UK Top 50 2016-17: A&O managing partner Andrew Ballheimer on why clients are 'crying out' for truly global firms

A&O's managing partner discusses transatlantic mega-mergers, the Brexit 'phoney war' and the factors behind the firm's record-setting year

September 19, 2017 at 04:21 AM

5 minute read

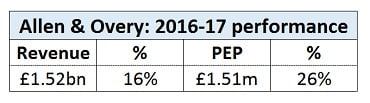

For this year's UK top 50, Legal Week has spoken to law firm leaders across the market for their take on the key trends from 2016-17, as well as their plans for the year ahead. In this Q&A, Allen & Overy (A&O) managing partner Andrew Ballheimer discusses the factors behind the firm's record year, the Brexit 'phoney war' and the prospects for UK-US mergers

What contributed to A&O's strong results in 2016-17? "If you look at our network and offering, it is broader in terms of the number of offices than our peer group. We have 44 offices across the world, so the extent of our network in terms of geographic coverage has helped us.

What contributed to A&O's strong results in 2016-17? "If you look at our network and offering, it is broader in terms of the number of offices than our peer group. We have 44 offices across the world, so the extent of our network in terms of geographic coverage has helped us.

"Each of our core practices – capital markets, litigation, banking and corporate – are at the top of their markets, so it is a well-hedged business in terms of geography and products. Most of our peers major on one or two of those areas, but not all four, so the result for us is a broadly built international platform with mature, top-tier offerings in each of the core areas.

"We have made a series of long-term investments in our offering, our network and our product mix, where perhaps others have not invested to the same extent.

"Our business also has a natural hedge because our income base is a mix of sterling, dollars and euros, so if you aggregate all three, that is 95% of our income. There is no single currency that predominates, so our business has this natural hedge."

Why have we seen such divergent results across the market this year? "If there is a concentration of your business in a jurisdiction, then that is a factor. If you are only in the UK, there hasn't been a lot of growth; while in the US it has been a little bit better – 4%-5% if you have done really well.

"Growth is in the cross-border and international space, so firms that have done the best are those that have built out compelling offerings around the world in a broad range of product areas. If you look at those US firms which operate almost exclusively in the US, it's flat growth on the whole. Latham & Watkins has done 5% or so, and a lot of that growth is outside the US, but most of the rest are flat or 1%-2%. If you look at the magic circle firms, those firms that are more international seem to have performed better."

How do you see the prospects for the year ahead? "There is uncertainty; the pipeline is relatively good at the moment but in the longer term it is harder to predict. If you look at the global market there is a concentration of a few firms that are moving away – A&O, a couple of others from the UK and a couple of the US firms."

What impact do you think Brexit will have? "There is not a great amount of clarity as to how it will play out – we are in the phoney war period at present. I think that in financial services, there will be a move away from London, but English law will still have a major role as the law of choice for financial transactions.

"I think there will be a greater presence on the continent for firms like us, but in terms of locations of expertise, I think the London market will continue to have a major role."

And Donald Trump? "I think his agenda has stalled at the moment. I don't see the possibility of him having a major economic change in policy or regulation anytime soon."

Do you expect to see more law firm mergers during the next financial year? "I can see an increase in domestic mergers of law firms in the US and the UK to help in terms of costs synergy, but a domestic merger would not make any sense for us.

"In terms of transatlantic mergers, I think clients are crying out for a handful of global law firms that are equally at home in the US as they are around the world, and there are no firms in the world at this point in time who fit that mould.

"There are firms like us that are well on the way, but are we fully built out around the world? No, but no one else is closer. Clients, if they had their choice, would opt for that – they have that offering in every other area of professional services. Law firms are the only sector where they haven't got that."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

How to Build an Arbitration Practice: An Interview with 37-Year HSF Veteran Paula Hodges

Scratching the Entrepreneurial Itch: Linklaters' AI Head On Becoming a Partner and GenAI Hallucinations

'Relationships are Everything': Clifford Chance's Melissa Fogarty Talks Getting on Big Deals and Rising to the Top

7 minute read

The 'Returnity' Crisis: Is the Legal Profession Failing Women Lawyers Returning From Maternity Leave?

8 minute readTrending Stories

- 1Public Notices/Calendars

- 2Monday Newspaper

- 3Judicial Ethics Opinion 24-98

- 4'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 511th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250