UK Top 50 2016-17: the firms battling to make their mark at the edge of the rankings

Whether by merger or organic growth, the firms just outside the top 50 face intense competition for a place in the top tier of the UK market

October 12, 2017 at 03:59 AM

5 minute read

For the firms at the bottom of the UK top 50 table, the competition is intense. Revenues are tightly grouped, and in any given year a firm can leapfrog the competition to make its way into the rankings – the most common method being a merger.

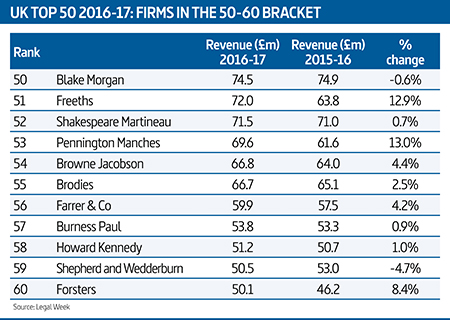

Blake Morgan, itself the product of the 2014 combination of Blake Lapthorn and Morgan Cole, this year sits in 50th place with revenue of £74.5m. Just £5m covers the next three firms – Freeths (£72m), Shakespeare Martineau (£71.5m) and Pennington Manches (£69.6m) – highlighting an opportunity for all of them to push into the top 50 next year.

The 2015 merger of Shakespeares and SGH Martineau propelled Shakespeare Martineau into the rankings last year, but a relatively flat 2016-17, during which revenue crept up by less than 1% from £71m to £71.5m, put paid to the firm's place in the top 50.

The 2015 merger of Shakespeares and SGH Martineau propelled Shakespeare Martineau into the rankings last year, but a relatively flat 2016-17, during which revenue crept up by less than 1% from £71m to £71.5m, put paid to the firm's place in the top 50.

CEO Andy Raynor (pictured above) says: "I view us as a top 50 firm in quality, and the desire is to grow the business. One of the reasons we have grown so rapidly in recent years is through mergers. We feel that they have been very successful, but I think we need to keep our feet on the ground locally – there is a real demand from to clients to know they have local advisers who understand the local climate and take them wherever they need to go, nationally and further.

"Yes, we would like to grow to be a larger national business, and we would continue on the merger trail, but it must not be to the detriment of what we want to do organically."

Another firm that has flitted around the edges of the UK top 50 in recent years is Browne Jacobson, which placed 50th in 2014-15. The firm had been set for a return to the rankings this year amid merger talks with construction and insurance practice Beale & Company, which would have created a combined £82m firm. However, the discussions came to an end this summer, and while Browne Jacobson still boosted revenues by 4% to £66.8m, it too narrowly missed out on this year's top 50.

Managing partner Iain Blatherwick (pictured) said: "We are still open minded to merging, but we would only be interested if it was a strong strategic fit and complemented our sector focus areas.

Managing partner Iain Blatherwick (pictured) said: "We are still open minded to merging, but we would only be interested if it was a strong strategic fit and complemented our sector focus areas.

"As an ambitious firm we would like to consistently be in the UK top 50. However, over time the relative strength of the competition and increasing consolidation means the boundaries have been shifting. The option to merge will remain a part of our strategy, but it won't be because we simply want to be bigger – it has to be a good fit."

In contrast, Scotland's Burness Paull – now among the largest firms north of the border following a run of takeovers of the country's major players – is focusing on organic growth. The firm, which posted 2016-17 revenue of £53.8m, is one of three Scots firms in the 51-60 bracket, alongside Brodies (£66.7m) and Shepherd and Wedderburn (£50.5m).

The top end of the Scottish market has been transformed during the past 10 years, with former UK top 50 stalwarts Dundas & Wilson and McGrigors acquired by CMS and Pinsent Masons respectively, and Maclay Murray & Spens this year sealing a merger with Dentons, but Burness Paull chairman Philip Rodney is resolute about the benefits of independence.

Rodney (pictured right) says: "We want to remain independent. That model works for our clients and us. It works for our clients because the talent we have is focused on serving our client base in Scotland, and it works for us because we like dealing with the complex end of the transactions. In the case of a merger you inevitably become the branch office, with the sexy stuff done in London.

"One observation you might make is that the independent firms have all done very well. Look to Brodies or Shepherd and Wedderburn, and the same is true in Europe with the independent firms such as Garrigues and Noerr doing well."

"One observation you might make is that the independent firms have all done very well. Look to Brodies or Shepherd and Wedderburn, and the same is true in Europe with the independent firms such as Garrigues and Noerr doing well."

The case for organic growth has been made plainly by this year's only new top 50 entrant - Stewarts Law. The litigation specialist firm shot into the rankings for the first time this year, despite the failure of merger talks with Enyo Law. The firm, which concluded a number of long-running cases last year, has more than doubled in size from a £35m firm five years ago to £78m this year, proving that merger is by no means the only route into the top 50 rankings.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Some Elite Law Firms Are Growing Equity Partner Ranks Faster Than Others

4 minute read

KPMG's Bid To Practice Law in US On Hold As Arizona Court Exercises Caution

Trending Stories

- 1Public Notices/Calendars

- 2Wednesday Newspaper

- 3Decision of the Day: Qui Tam Relators Do Not Plausibly Claim Firm Avoided Tax Obligations Through Visa Applications, Circuit Finds

- 4Judicial Ethics Opinion 24-116

- 5Big Law Firms Sheppard Mullin, Morgan Lewis and Baker Botts Add Partners in Houston

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250