PEP growth at US top 10 outpaces UK rivals by 50% over five years as earnings gap widens

The US top 10 have increased PEP by an average of 24.7% over the last five years, compared with just 15.7% at their UK counterparts

November 06, 2017 at 05:25 AM

4 minute read

New research from Legal Week highlights the mountain that UK firms need to climb in order to compete for talent in a global marketplace, with partner profits at the top 10 US firms growing by roughly 50% more than their equivalent UK rivals over the last five years.

New research from Legal Week highlights the mountain that UK firms need to climb in order to compete for talent in a global marketplace, with partner profits at the top 10 US firms growing by roughly 50% more than their equivalent UK rivals over the last five years.

Data from Legal Week's UK Top 50 and The American Lawyer's Global 100 rankings shows that the 10 largest UK firms by revenue have increased profit per equity partner (PEP) by an average of 15.7% during the last five years, compared with 24.7% across the 10 largest US firms.

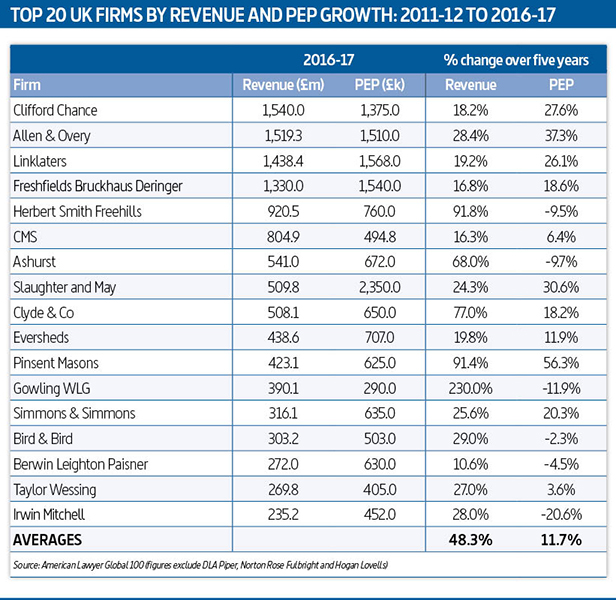

The disparity is even more stark when considering a larger group of firms from each market, with the US top 20 growing PEP by more than twice as much as their 20 UK counterparts in the same period.

Across this group of 20 US firms, PEP increased by an average of 25.2% between 2011-12 and 2016-17, compared with less than 12% at the equivalent largest UK firms.

(The research disregards transatlantic players DLA Piper, Norton Rose Fulbright and Hogan Lovells, which are classed as UK firms by Legal Week and US firms by The American Lawyer.)

Nine top 20 US firms have seen PEP climb by more than 30% over the past five years – Paul Weiss Rifkind Wharton & Garrison, White & Case, Latham & Watkins, Kirkland & Ellis, Sidley Austin, Gibson Dunn & Crutcher, Simpson Thacher & Bartlett, Ropes & Gray and Skadden Arps Slate Meagher & Flom.

In contrast, just three of the UK top 20 have achieved five-year PEP growth of at least 30% – Allen & Overy, Pinsent Masons and Slaughter and May (with the added proviso that Slaughters does not disclose PEP and therefore its performance is estimated).

Given that the already higher base figures at the biggest US firms mean even a relatively small percentage increase pushes PEP further out of the reach of UK firms, the difference in growth rate is doubly important.

For example, A&O's 37% five-year increase boosted PEP by £400,000 ($523,000) from £1.1m to £1.5m, but Latham & Watkins' 34.8% hike took PEP from $2.27m in 2011 to $3.06m last year – a difference of $790,000 (£600,000).

Commenting on the findings, White & Case London head Oliver Brettle (pictured) said: "I would have expected that the US-based firms would be ahead, but not this significantly.

Commenting on the findings, White & Case London head Oliver Brettle (pictured) said: "I would have expected that the US-based firms would be ahead, but not this significantly.

"My expectation is that the US firms' growth is linked to the very strong performance of the US economy and the strong performance of US-headquartered corporates and financial institutions, enabling US firms to follow them as they expand and invest globally. Where are the UK equivalents of Google, Apple and Facebook?"

While many have long argued that PEP is not the best measure of law firm profitability or success, it remains the most widely used comparator within the market.

Many leading UK firms, including most of the magic circle, have overhauled their lockstep systems in recent years to create more flexibility at the top end in order to better recruit and retain star performers in the face of US advances.

However, as highlighted by these figures, the higher underlying growth in profitability at US firms means the UK elite will have to step up this fight in order to remain competitive.

Brettle added: "If commentators are correct that 48% of global legal spend is in the US and 12% is in the UK, then it stands to reason that if you do not have a strong US practice, you will find it more difficult. The findings put UK firms at a further disadvantage when it comes to hiring and retaining talent, given this is before converting these figures to dollars and making the difference look even more stark. A lot of this is about talent – investing and keeping people because you can afford to do so."

Within the UK top 10, average growth was brought down by Herbert Smith Freehills and Ashurst, both of which have completed Australian mergers during the last five years and both of which have lower PEP now than their legacy UK side did five years ago.

Within the UK top 10, average growth was brought down by Herbert Smith Freehills and Ashurst, both of which have completed Australian mergers during the last five years and both of which have lower PEP now than their legacy UK side did five years ago.

In contrast, Morgan Lewis & Bockius is the only top 10 US firm to report lower PEP for the 2016 calendar year than in 2011 – a decrease that has come alongside a significant hike in equity partner numbers following the firm's acquisition of sizeable teams from now-defunct firms Dewey & LeBoeuf and Bingham McCutchen.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

DeepSeek and the AI Revolution: Why One Legal Tech Expert Is Hitting Pause

4 minute read

What Happens When a Lateral Partner's Guaranteed Compensation Ends?

Lawyers React To India’s 2025 Budget, Welcome Investment And Tax Reform

Russia’s Legal Sector Is Changing as Western Sanctions Take Their Toll

5 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250