Magic circle firms secure top spots in 2017 M&A rankings as European deal values hit nine-year high

Magic circle trio secure spots in European top five for 2017 as Kirkland leads UK ranking

January 04, 2018 at 08:27 AM

5 minute read

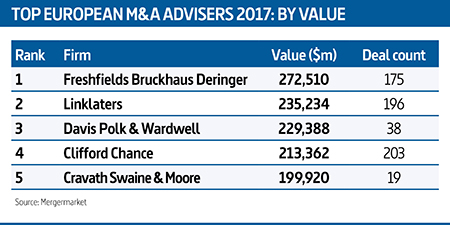

Freshfields Bruckhaus Deringer, Linklaters and Clifford Chance (CC) have secured three of the top five places in the European M&A rankings for 2017, in a year that saw total deal value on the continent surge to a nine-year high.

Figures from Mergermarket show Freshfields retained first place in the European ranking by value, advising on 175 deals with a total value of $272.5bn (£201bn), after also topping the table last year.

Linklaters came in second after advising on 196 deals worth a total of $235.2bn (£173.7bn). CC placed 4th after a busy year featuring roles on 203 deals, with Davis Polk & Wardwell and Cravath Swaine & Moore rounding out the top five.

Linklaters came in second after advising on 196 deals worth a total of $235.2bn (£173.7bn). CC placed 4th after a busy year featuring roles on 203 deals, with Davis Polk & Wardwell and Cravath Swaine & Moore rounding out the top five.

Total European M&A deal value for the year increased 14% to $929.3bn (£685.3bn), the highest level since 2008, when more than one trillion dollars of deals were announced. However, deal count dipped slightly on last year, falling 2% to 7,235.

Freshfields City M&A partner Bruce Embley (pictured) commented: "The team has been very busy and 2018 still has some very interesting deals. Europe has got the wind in its sails again. It is experiencing genuine growth after a period of austerity and the doom and gloom in the aftermath of the crisis. 2017 was a busier year for Europe in terms of larger deals than we have seen in a while."

Deal highlights for Freshfields include acting on German construction company Hochtief's $38.9bn (£28.7bn) counterbid for Spanish toll operator Abertis. The firm also advised Aberdeen Asset Management alongside Maclays on its $4.5bn (£3.3bn) merger with Standard Life.

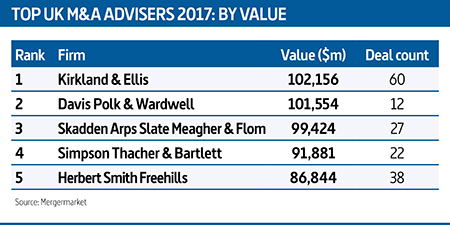

Despite the magic circle's strong showing in Europe, US firms dominated the UK and global deal tables by value. Kirkland & Ellis took first place in the UK value rankings, climbing from 17th position after acting on 60 deals worth a total of $102.2bn (£75.4bn), ahead of Davis Polk and Skadden Arps Slate Meagher & Flom.

Despite the magic circle's strong showing in Europe, US firms dominated the UK and global deal tables by value. Kirkland & Ellis took first place in the UK value rankings, climbing from 17th position after acting on 60 deals worth a total of $102.2bn (£75.4bn), ahead of Davis Polk and Skadden Arps Slate Meagher & Flom.

Kirkland London corporate partner Matthew Elliott said: "We have had an incredibly busy 2017 both in terms of numbers and value of private equity deals on which we have advised. There is still plenty of dry powder in the hands of private equity sponsors. The effect of Brexit may also provide unique investment opportunities for holders of private capital across M&A, real estate and distressed investing."

UK deal highlights for Kirkland include acting for Blackstone Group on the $4.2bn (£3.1bn) acquisition of insurance broker Aon's employee benefits outsourcing business.

Total UK deal values rose 14% on last year to reach $202.6bn (£149.4bn), while deal volumes increased by 3% to 1,530. However, global deal values fell 15% to $1.3trn (£1trn) as volume remained broadly stable at 5,326.

The largest deal in Europe last year was German chemicals group Linde's $45.5bn (£33.6bn) merger with US rival Praxair, which handed roles to firms including Cravath, Linklaters and Sullivan & Cromwell.

In the UK, the highest value deal was Blackstone's $13.8bn (£10.2bn) sale of its European warehouses and logistics business Logicor to China Investment Corporation (CIC). CC advised CIC while Blackstone turned to Simpson Thacher & Bartlett.

People would not have predicted that 2017 would be as good as it was

Linklaters corporate partner David Avery-Gee said that there was a degree of surprise at the buoyancy of the European and UK M&A markets in light of uncertainty around Brexit.

"M&A has been really resilient in the face of what you would imagine would not be a strong M&A market because of all the political uncertainty. Activity has been pretty strong and there have been some huge deals across a lot of sectors. Going into the new year there is quite a lot of optimism."

Davis Polk City corporate partner Will Pearce added: "We had a consistently busy 2017 in London, perhaps slightly more going on in the second half of the year than in the first couple of months, and no real discernible impact of Brexit. We saw continued interest in European assets from strategic US buyers, competitive auctions held up for private M&A deals in the £250m-£500m range, but were far softer for deals over £1bn."

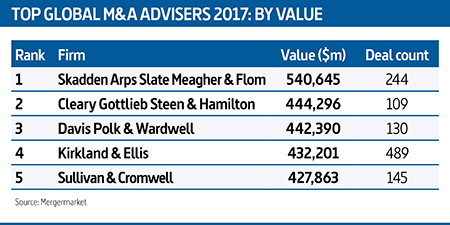

Meanwhile, US firms continued to dominate the global M&A ranking by value, with Freshfields the only UK firm in the top 10. Skadden Arps Slate Meagher & Flom topped the ranking after acting on 244 deals worth a total of $540.6bn (£398.7bn).

Meanwhile, US firms continued to dominate the global M&A ranking by value, with Freshfields the only UK firm in the top 10. Skadden Arps Slate Meagher & Flom topped the ranking after acting on 244 deals worth a total of $540.6bn (£398.7bn).

By volume, DLA Piper retained first place across the global, European and UK rankings, ahead of CMS in the UK and Europe and Kirkland in the global volume table.

King & Wood Mallesons led the way in Asia both by deal value and volume, after advising on 111 deals valued at $80.9bn (£59.7bn) during 2017.

Going forward, partners are positive about the upcoming year despite the ongoing uncertainty caused by Brexit.

Herbert Smith Freehills corporate partner Gavin Davies said: "We are positive on the outlook for M&A in 2018 – continuing political headwinds, but the demands of rationalisation, the search for growth and the need to get ahead of tech disruption driving M&A across all sectors."

Avery-Gee also sounded a positive note about the upcoming year, but with a degree of caution.

"We go into 2018 with a great pipeline of good M&A deals and clients wanting to do deals, particularly on a cross-border basis. Obviously we are cautious, but people would not have predicted that 2017 would be as good as it was."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KMPG Moves to Provide Legal Services in the US—Now All Eyes Are on Its Big Four Peers

International Arbitration: Key Developments of 2024 and Emerging Trends for 2025

4 minute read

The Quiet Revolution: Private Equity’s Calculated Push Into Law Firms

5 minute read

'Almost Impossible'?: Squire Challenge to Sanctions Spotlights Difficulty of Getting Off Administration's List

4 minute readTrending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250