Partners predict rising revenues and more UK mergers amid buoyant business confidence

Law firm leaders at Clifford Chance, White & Case, CMS and Hogan Lovells weigh in on prospects for consolidation

January 23, 2018 at 08:02 AM

6 minute read

Two thirds of partners think 2018 will be a better year for UK law firms than 2017, according to a new survey which also reveals partners are expecting an increase in mergers in the UK market.

Legal Week's latest Big Question survey found nearly half of respondents (49%) think the financial outlook for 2018 is better than for 2017, with an additional 17% stating that it is "a lot better". Only 13% believe 2018 looks set to be a worse year for law firms than last year.

Despite the continued uncertainty surrounding Brexit, most partners are expecting to see healthy revenue increases at their firms this year.

Overall, 94% are confident about their firm's prospects for the year, with only 4% stating that they are not confident and 2% admitting to being concerned.

A quarter of respondents are predicting double-digit revenue growth for 2017-18, with a further 49% expecting growth of 5%-10%. Only 4% of those taking part predicted that revenue at their firm will fall this year.

A quarter of respondents are predicting double-digit revenue growth for 2017-18, with a further 49% expecting growth of 5%-10%. Only 4% of those taking part predicted that revenue at their firm will fall this year.

Partners predict that corporate/M&A, banking and finance and dispute resolution will be the busiest practice areas, with intellectual property, capital markets and restructuring highlighted as quieter areas, despite the recent collapse of Carillion and a string of high-profile retail failures.

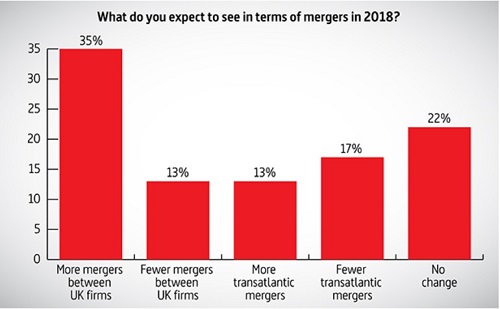

The survey also found that more than a third of partners think there will be an increase in mergers between UK firms in 2018. Partners were more divided on the prospect of more transatlantic mergers, with just 13% saying there will be more deals between UK and US firms, and 17% predicting that there will be fewer.

The survey also found that more than a third of partners think there will be an increase in mergers between UK firms in 2018. Partners were more divided on the prospect of more transatlantic mergers, with just 13% saying there will be more deals between UK and US firms, and 17% predicting that there will be fewer.

Last year, the transformational three-way union of CMS UK, Nabarro and Olswang was the standout example of consolidation in the UK legal market. Other deals involved US firms, such as Eversheds' tie-up with Atlanta's Sutherland Asbill & Brennan, and Norton Rose Fulbright's takeover of New York firm Chadbourne & Parke, which went live in June.

Berwin Leighton Paisner is also currently in merger talks with US firm Bryan Cave, although progress has been held up as the pair wrangle with tax issues relating to their desire for full financial integration.

CMS senior partner Penelope Warne (pictured above) says, in the current market, smaller UK firms should consider a merger to distinguish themselves. "In a challenging market and with Brexit coming up, even though business confidence is high, smaller firms need to think about what direction they are going in and make a transformative move. Mergers are neither good nor bad but they need proper execution. They are not a fairytale solution."

She adds: "A merger is never easy. On paper, Nabarro, Olswang and CMS looked like a strategically good combination, but it was critically important to have a well-aligned leadership team driving it through to realise success. We were an unusual tripartite merger and therefore needed to be a team – the trouble with two-way mergers is that it is very much 'them and us'."

White & Case London managing partner Oliver Brettle (pictured) argues that mid-market law firms in the UK are under "an enormous amount of pressure". He comments: "We have got a large number of law firms in London and the market is not big enough to sustain them, even though actually I agree with the general business sentiment that things are looking pretty good for this year.

White & Case London managing partner Oliver Brettle (pictured) argues that mid-market law firms in the UK are under "an enormous amount of pressure". He comments: "We have got a large number of law firms in London and the market is not big enough to sustain them, even though actually I agree with the general business sentiment that things are looking pretty good for this year.

"I think the mid-tier market will continue to be challenging in terms of pricing and the expectations of general counsel, and that will probably mean there will be more mergers in the UK legal market."

Hogan Lovells London and Africa managing partner Susan Bright also expects an increase in mergers. "My expectation is that we will continue to see consolidation in the market for some mid-tier and smaller firms. This is partly because businesses need to have sufficient resources to invest in technology, and that's a driver."

The survey also asked respondents about recruitment trends, with respondents predicting further aggressive expansion in London by US firms. Thirty-one percent of partners expect to see more lateral hiring activity by US firms this year than last, compared with just 4% predicting activity will fall.

The positive market conditions mean partners also expect to see an increase in hiring by UK firms, with 30% expecting to see more lateral recruitment in 2018.

Key hires in 2017 included Freshfields Bruckhaus Deringer private equity star David Higgins resigning to join Kirkland & Ellis as London co-head, White & Case global private equity co-head Richard Youle's move to Skadden Arps Slate Meagher & Flom, and DLA Piper international senior partner and global co-chair Juan Picon's departure for Latham & Watkins.

Other trends highlighted by the survey include the impact of the UK's ongoing Brexit negotiations on business activity. Nearly half of those responding believe Brexit will negatively impact activity levels, with 18% arguing it will have a 'much more negative impact than last year'.

Bright (pictured) adds: "People are confident in terms of prospects for this coming year, although Brexit is still a big uncertainty. In terms of our clients and business overall, particularly in regulated areas, the top priority is getting certainty about a transitional arrangement in the early part of the year."

Bright (pictured) adds: "People are confident in terms of prospects for this coming year, although Brexit is still a big uncertainty. In terms of our clients and business overall, particularly in regulated areas, the top priority is getting certainty about a transitional arrangement in the early part of the year."

Clifford Chance managing partner Matthew Layton concludes that the global market is "more important than Europe and Brexit". He says: "We are having a good year. For us, the global context is most important. There's an overall strength and confidence in the global macroeconomic outlook, even though there are clearly potential issues around security and the extent of the bubble created by liquidity and quantitative easing policies, and how that withdrawal will impact on global markets. "

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid To Practice Law in US On Hold As Arizona Court Exercises Caution

Law Firms 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Trending Stories

- 1Gunderson Dettmer Opens Atlanta Office With 3 Partners From Morris Manning

- 2Decision of the Day: Court Holds Accident with Post Driver Was 'Bizarre Occurrence,' Dismisses Action Brought Under Labor Law §240

- 3Judge Recommends Disbarment for Attorney Who Plotted to Hack Judge's Email, Phone

- 4Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 5Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250