White & Case City revenue soars 13% as global turnover reaches record high of $1.8bn

London revenue climbs 13% to $328m as global turnover hits $1.8bn

February 12, 2018 at 07:00 AM

5 minute read

The original version of this story was published on The American Lawyer

White & Case's London revenue climbed 13% in the 2017 calendar year to a new high of $328m (£236.7m at today's exchange rate).

The London results – up from $290m last year – would put the firm at the edge of the UK top 20 based on 2016-17 results and outpace a strong firmwide performance.

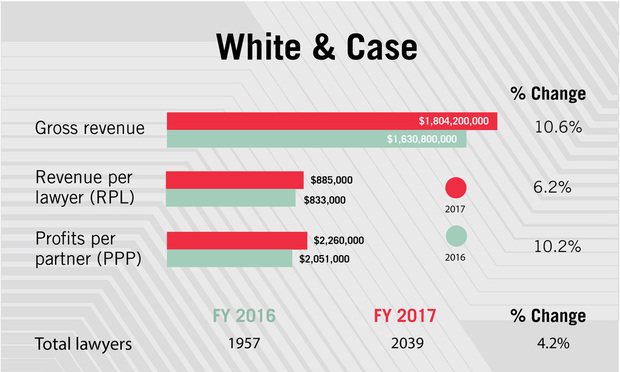

Globally, White & Case's gross revenue grew 10.6% to $1.8bn in 2017, a new record for the firm, and up from $1.63bn the year prior. Revenue per lawyer increased 6.2%, to $885,000, while profits per partner jumped 10.2%, to $2.26m.

Halfway through a five-year strategic plan, it's clearly onward and upward for White & Case.

"It's a very growth-focused strategy, particularly in the US and the UK, and the numbers reflect the impact of that growth," said chairman Hugh Verrier, who has led the firm since 2007.

London managing partner Oliver Brettle added: "I think we are very well positioned to continue to benefit from the track record of investment in London. We see opportunities in expanding our disputes practices in London and we are committed to continue to build the City practice as set out in the firm's 2020 strategy."

By office, the firm's London base made the second largest contribution to total revenue after New York. By practice, Brettle highlighted capital markets, disputes and project finance as particularly strong areas in 2017.

The 2,039-lawyer firm saw its overall head count grow 4.2% across all of its 41 offices around the world. White & Case also saw its number of equity partners rise 6.7% , to 319, while its nonequity partnership tier increased 11.9%, to 179.

The 2,039-lawyer firm saw its overall head count grow 4.2% across all of its 41 offices around the world. White & Case also saw its number of equity partners rise 6.7% , to 319, while its nonequity partnership tier increased 11.9%, to 179.

In London, the firm has 370 lawyers currently, including 105 partners.

In late 2015, the global legal giant set out to grow its London and New York offices to about 500 lawyers apiece by expanding its capital markets, disputes, M&A and private equity expertise. Verrier said those regions and practice groups proved to be the foundation for White & Case's strong financial performance in 2017.

"We're hitting all our targets, and it's full steam ahead," Verrier said.

Fuelled by strong M&A activity in the US, the firm grabbed roles on several high-profile deals. White & Case advised Houston-based Calpine Corp. in $5.6bn sale to an investor group led by Energy Capital Partners. The firm also represented San Diego-based electric and gas utility company Sempra Energy on its $9.45 bn acquisition of Dallas-based Energy Future Holdings Corp. and its stake in Oncor Electric Delivery Co.

Globally, the firm took the lead for United Arab Shipping Co and its major shareholders the Qatar Investment Authority and the Public Investment Fund of Saudi Arabia in a combination with German shipping giant Hapag-Lloyd AG that created the world's fifth-largest liner shipping company. The Saudi Arabian Oil Co, a longtime White & Case client that the firm has been advising on its efforts to pursue a potential initial public offering, also turned to the firm to handle a $7 bn investment in its Malaysian state-owned counterpart Petronas.

White & Case, founded in New York in 1901, also unveiled a new office in the McGraw-Hill Building in midtown Manhattan focused on creating a communal working space for its lawyers and staff, including napping pods. The firm opened another disputes-focused office in Uzbekistan and is also reportedly poised to open an outpost in Houston after hiring lawyers from Andrews Kurth Kenyon and Vinson & Elkins.

Hugh Verrier

Hugh VerrierOn the lateral market front, White & Case saw two top private equity partners leave its London office last year, as Richard Youle and Katja Butler joined Skadden, Arps, Slate, Meagher & Flom.

However it has made a number of partner additions in London as part of its strategic growth plans. These include City structured finance partner Chris McGarry from Ropes & Gray, Clifford Chance banking co-head Patrick Sarch and Macfarlanes competition head Marc Israel, as well as last month adding Weil, Gotshal & Manges co-head of international dispute resolution Hannah Field-Lowes in London.

Elsewhere the firm has hired Clifford Chance global banking partner Mattias von Buttlar in Frankfurt and picked up Skadden counsel Andre Zhu as a corporate partner in Beijing, having seen regional restructuring and insolvency head Damien Whitehead decamp in December for Ashurst.

In New York, White & Case welcomed Norton Rose Fulbright M&A and private equity partner Marwan Azzi and added Allen & Overy project finance partner Dolly Mirchandani.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Hengeler Advises On €7B Baltica 2 Wind Farm Deal Between Ørsted and PGE

2 minute read

Israeli Firm Pearl Cohen Combines with San Francisco IP Boutique

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250