Greenberg's KWM hires help drive 75% London growth as more strong US financial results roll in

Debevoise and Dechert among other US firms posting record financial results for 2017

February 25, 2018 at 09:30 PM

8 minute read

Greenberg Traurig boosted London cash revenues by more than 75% last year on the back of a major increase in its City headcount, as top US law firms continue to post impressive financial results for 2017.

The US firm has estimated that its London office took in $35m (£25m) during the year, with lawyer headcount rising 63%, driven in large part by the hire of a six-partner team from King & Wood Mallesons (KWM).

That team included real estate funds duo Steven Cowins and Marc Snell, real estate partner Matthew Priday, corporate finance duo Michael Goldberg and David Fitzgerald and tax partner Clive Jones, who were followed to Greenberg by around 25 other lawyers as KWM's European arm collapsed into administration.

Greenberg executive chairman Richard Rosenbaum said that firm's core areas of focus in Europe – which include M&A, real estate, private equity, funds, capital markets, finance, and tax - were paying "tangible dividends".

"We are pleased with our London performance, where cash revenues improved by more than 75% over 2016 and demand nearly doubled," he said. "We have seen increased performance across all practice groups and industries and throughout all of our offices, particularly in Europe, where we made the strategic decision to invest in key markets, including London, Warsaw, Berlin and Amsterdam.

"We continue our path of strategic growth, without resorting to mergers or vereins, and the results speak for themselves."

The US firm saw global revenue jump 7.2% during 2017 to $1.477bn, while profits per equity partner (PEP) at the Miami-based firm, which celebrated its 50th anniversary last year, also grew 5.6% to reach $1.634m.

CEO Brian Duffy credited a strong, successful year for the firm's clients as spurring its financial success in 2017. "It was a broad-based and deep, strong year for Greenberg Traurig," said Duffy, who was elevated to the CEO role in 2015.

He noted that the firm saw increased performances across all practice groups and industries and throughout all of its offices, particularly in Europe.

Greenberg saw global headcount hit 1,944 in 2017, up 3.2% from the year prior. However, the firm did see a slight dip in its number of equity partners, which dipped 3.2% last year, to 298, down from 308 in 2016.

Looking abroad, Greenberg Traurig bolstered its Warsaw office last year with the addition of an 11-lawyer real estate team from Hogan Lovells that included the latter's former local practice head Jolanta Nowakowska-Zimoch. The move came a little more than a year after Greenberg Traurig backed away from a potential merger with Berwin Leighton Paisner.

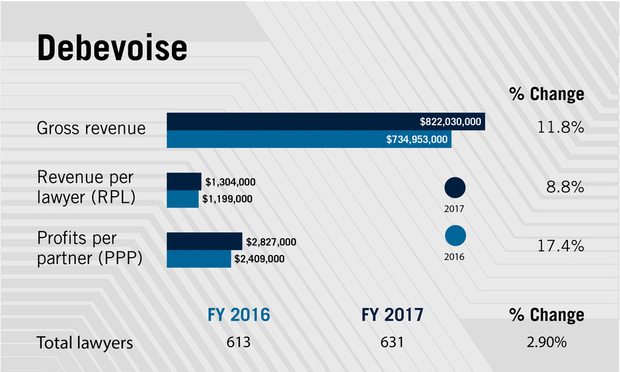

Elsewhere, Debevoise & Plimpton rebounded in 2017 after a dip in profits in 2016, by posting new, all-time financial highs.

Elsewhere, Debevoise & Plimpton rebounded in 2017 after a dip in profits in 2016, by posting new, all-time financial highs.

The Am Law 100 firm's gross revenue grew 11.8% last year to $822m, a record high. PEP also hit a record high, jumping 17.4% to $2.827m, while revenue per lawyer (RPL) grew 8.8% to $1.3m.

In London, revenues rose 5% to $112.8m, up from $107m last year. Highlights for the office included advising Rolls-Royce on its £671m deferred prosecution agreement with the Serious Fraud Office, while a London and Moscow team also advised long-term client Norilsk Nickel on its $1bn Eurobond offering.

Debevoise presiding partner Michael Blair, who assumed leadership of the New York-based firm in 2011, said the significant financial growth of the firm was directly attributable to strong growth in client demand.

"It wasn't just one, two or three really big projects," Blair said. "It was, to a remarkable degree, just an across the board increase in client demand that in the aggregate was the largest that we've seen in more than a decade."

Blair described 2017 as a "successful year" for the firm's London office. "We have been steadily growing our London presence over a number of years," he added. "This latest set of financials shows our strategy is paying off."

All of the firm's priority industry groups - banking, healthcare, insurance, private equity and technology, media and telecoms – experienced an increase in client demand in 2017, as did Debevoise's offices across Asia, Europe and the US, Blair said.

Debevoise landed roles on some of 2017's most high-profile deals. The firm advised Tribune Media on its $3.9bn sale to Sinclair Broadcast Group. It also advised Discovery Communications on its acquisition of Scripps Networks Interactive, a transaction valued at $14.6bn. The firm closed out 2017 by advising Time Inc. on its $2.8bn sale to magazine publishing rival Meredith.

Headcount at the firm also increased 2.9% last year to 631, while the number of equity partners also grew 3% to 138. In 2017, Debevoise welcomed back a number of former lawyers following notable stints in public service.

Former litigation partners Andrew Ceresney and Mary Jo White both returned to the firm from the US Securities and Exchange Commission (SEC). White led the SEC for four years under the Obama administration before heading back to Debevoise as senior chair and head of the firm's new strategic crisis response and solutions group.

Elsewhere on the lateral market front, the firm picked up Clifford Chance insurance partner Clare Swirski in London.

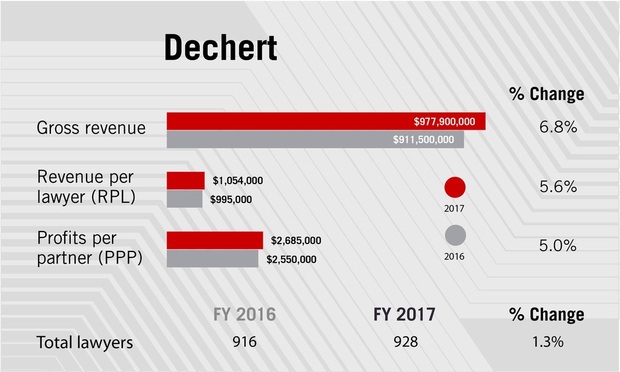

Dechert was another US firm to reach new highs in 2017, posting record PEP and RPL after what firm chair Andrew Levander described as an "excellent" year for the firm

Dechert was another US firm to reach new highs in 2017, posting record PEP and RPL after what firm chair Andrew Levander described as an "excellent" year for the firm

Gross revenue reached $977.9m, an increase of 6.8% on 2016. RPL was $1.054m, up 5.6% and PEP grew 5% to $2.7m.

The firm beat its budget expectations "across the board," Levander said.

"Corporate, financial services and international arbitration had the biggest growth," Levander said. He cited strong performance by the litigation practice in the Europe, Middle East and Africa region and said the corporate practice was particularly active in Asia. International arbitration was active in Latin America and elsewhere, he added.

Among other significant matters, the firm is advising CVS on its combination with Aetna; advised SK hynix Inc. on its $18bn acquisition of Toshiba's flash memory and solid-state drive business; worked with Airbus on its internal fraud investigation; and advised Egypt on a $4bn multi-tranche sovereign bond issuance.

While he said litigation was strong, Levander acknowledged that Dechert also coped with two major matters winding down: the firm's work on behalf of Takata related to allegedly defective airbags, and its work for Elliott Management in a protracted fight with Argentina over payment for defaulted bonds.

The firm's "interesting business" has helped its recruitment efforts, Levander said.

Firmwide headcount grew by 1.3% in 2017 to 928 lawyers. That included 2.5% growth in the equity partner tier, with 161 equity partners last year. The non-equity partnership shrank by 2.3% to 132.

It was a good year for partner recruitment, Levander said, pointing to seven lateral hires in Asia, five in London and seven in New York.

Those hires included Linklaters' former US banking head, Jeff Norton, who joined in New York, and Ropes & Gray London financial services regulation partner Monica Gogna.

"We expect to see even more this year, and I think that steady growth, that level of excitement and interesting matters helps attract laterals," he said.

Dechert's profit margin stayed steady at 44%, with net income of $432.5m in 2017, showing growth of 7.4%.

Levander said the firm has always been conservatively run, and it did not take any new cost-cutting measures last year. But the firm has found opportunities over the years to make staffing cuts due to improved technology. While Levander would not give specific numbers, he said Dechert prepaid costs more in 2017 than it did the year before.

For 2018, Levander said the firm is looking to hire laterals in various practice groups. "We may have a lot to say over the next six months," he said, particularly in London, New York, Chicago and on the West Coast.

The firm is also looking to increase its diversity, he said.

"For the first time, we have three women on our policy committee and two other diverse people on that committee, and it's something we are working hard at," Levander said.

As for mergers or other combinations, Levander said he gets occasional calls. There hasn't been cause to move forward on those possibilities, he said, but "I always listen and I always learn."

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

German Court Orders X to Release Data Amid Election Interference Concerns

Big Law Sidelined as Asian IPOs in New York Dominated by Small Cap Listings

Trending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250