Weil sets new records as PEP rises 18% and London revenues shoot up 33%

Global revenues grow nearly 10% to reach new high after record year for US firm

February 26, 2018 at 12:21 PM

4 minute read

Weil Gotshal & Manges enjoyed a record year in 2017, with revenue reaching new heights, profits per equity partner (PEP) seeing double-digit growth and London turnover surging by 33%.

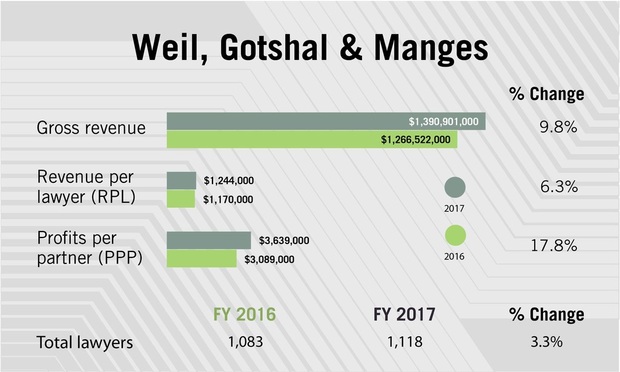

Firmwide revenues rose 9.8% to $1.39bn, while PEP grew 17.8% to $3.64m. Even as the firm's lawyer headcount and equity partner ranks swelled, revenue per lawyer grew 6.3% to $1.24m.

In London, the US firm generated about $165.4m (£118.5m) in revenue last year – a near 33% increase. A slowdown related to Brexit uncertainty "cleared itself up in 2017", but the main driver for the revenue growth was "obtaining more market share", according to executive partner Barry Wolf.

"These clearly are records for Weil", said Wolf. "We are very pleased with our performance in London, which was driven mainly by our obtaining more market share in this highly competitive space."

Combined with its 2016 results, Weil's profits per partner have increased about 44% in the last two years, Wolf noted.

The past two years stand in contrast to a period of sluggish revenue growth for Weil from 2010 to 2015. In 2013, the firm announced a series of cost-cutting measures, including layoffs and pay cuts for some partners.

But more than four years later, Wolf credits a long-term vision for the firm's sharp comeback. He said its 2017 growth can be attributed to the successful implementation of a 2011 strategy that entailed gaining strength and market share in core practices – including bankruptcy, corporate and litigation – in the US and overseas.

"Our strategy is to keep that balance going, It's not to have one practice dominate the other," Wolf said, adding: "I don't see major investments in new offices or practice areas."

"Our strategy is to keep that balance going, It's not to have one practice dominate the other," Wolf said, adding: "I don't see major investments in new offices or practice areas."

Weil saw demand increase in 2017 across all three of its core practices, Wolf said, as well as increased demand outside the US. Billing rate increases were a factor in the revenue rise, Wolf acknowledged, as they have been for many New York firms. But the firm's revenue growth was principally driven by hikes in demand, Wolf said, noting that the number of hours billed by lawyers rose 3%.

The firm's expenses last year also rose, but revenue grew faster, helping the firm achieve a 21% increase in net income.

Wolf said any savings from the firm closing its Dubai office were minimal, as that office had just three lawyers, while the firm's decision to pull out of Budapest only took effect this month. When asked if the firm will see any more office closings, Wolf answered cautiously: "We constantly look at whether offices make sense or not."

"Clearly with respect to Dubai and Budapest," he said, "it didn't make any strategic sense."

Meanwhile, the firm increased total headcount about 3% to 1,118 lawyers, and added five more equity partners to its ranks. Associate headcount rose to nearly 778, but still stands far below the roughly 850 associates the firm employed in 2012, before its staff reduction.

Wolf said the firm does not aspire to any specific headcount but follows demand. "We will grow as far as the demand is there," he said.

Weil's work on some of the largest deals and bankruptcies last year helped drive its numbers to their record levels. The firm said it advised on more than 80 transactions valued at more than $1bn apiece, including advising a transaction committee of Reynolds American on its $49bn merger with British American Tobacco and advising Scripps Networks in a $14.6bn merger with Discovery Communications.

Other deals included advising Goldman Sachs and Bank of America Merrill Lynch in providing $13.7bn committed bridge financing to Amazon for its acquisition of Whole Foods Market. The firm also advised Barclays, Goldman Sachs and Bank of America Merrill Lynch in providing $49bn of financing commitments to CVS Health to finance its acquisition of Aetna.

Weil's well-known restructuring practice was involved in some of the largest bankruptcy cases in the last year, including Takata, Westinghouse Electric on its $9.8bn Chapter 11 case, and Tidewater in its $2bn case.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Hengeler Advises On €7B Baltica 2 Wind Farm Deal Between Ørsted and PGE

2 minute read

A&O Shearman To Lose Another Five Lawyers, Including Madrid Practice Head, to EY

3 minute read

Rosenblatt Breaks Away From RBG, Becomes 40-Strong Standalone Firm

Trending Stories

- 1The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 2Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 3Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 4Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

- 5Zoom Faces Intellectual Property Suit Over AI-Based Augmented Video Conferencing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250