Orrick, Fried Frank and Winston all post revenue and PEP hikes as record US results continue

Orrick sees London revenues rise 16% as City top line passes $50m mark

March 12, 2018 at 04:06 PM

9 minute read

The original version of this story was published on The Recorder

![]()

Orrick Herrington & Sutcliffe, Fried Frank Harris Shriver & Jacobson and Winston & Strawn have become the latest US law firms to post impressive financial results for 2017, with all three seeing revenue and partner profits head upwards.

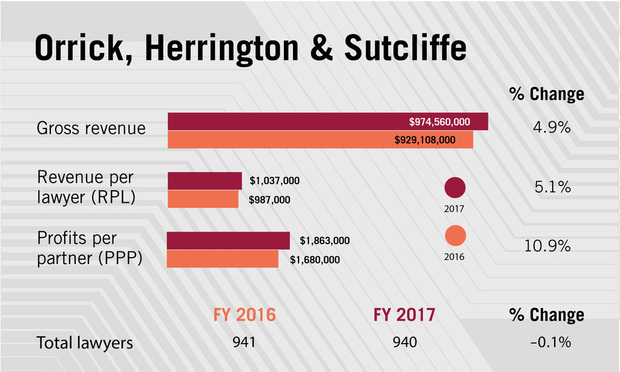

Fuelled by the lateral hiring spree it invested in the previous year, Orrick saw revenue grow 4.9% in 2017 to $974.6m, while net income jumped 11.5% to $219.6m.

The Silicon Valley-based firm also saw revenue per lawyer (RPL) rise 5.1% to $1.04m, with profit per equity partner (PEP) increasing by 10.9% to $1.86m.

Orrick's London office took in $54.6m (£39m) in 2017, a 16% increase on 2016′s figure of $46.9m. The firm, which recently told Legal Week that European revenues had grown 24% during 2017, now has about 100 lawyers in the City, and is looking ramp up its corporate practice on the back of the hire of M&A partner Paul Doris from Watson Farley & Williams.

"We increased the amount of technology, energy [infrastructure] and finance work we did overall," said Orrick global chairman and CEO Mitchell Zuklie, noting that the firm has sought to strategically focus its growth on those three industry sectors, rather than any specific geographic region or practice area.

As part of Orrick's plan to bolster its expertise in those sectors, Zuklie said the firm opened an office in Houston in 2016 that predominantly focuses on energy and infrastructure work.

"2016 was a year of really profound growth," Zuklie said. "We got good news in 2017, we saw that uptick and it paid off for us economically."

"2016 was a year of really profound growth," Zuklie said. "We got good news in 2017, we saw that uptick and it paid off for us economically."

In 2017, Orrick did see its headcount remain mostly flat, at 940 lawyers. The size of its equity partnership rose by one partner, to 118. Compared with 2016, the firm was less active on the lateral hiring front, bringing on 13 new partners for its offices in California, Europe, Hong Kong, Texas and Washington DC.

Among some of Orrick's new additions in Europe were former Reed Smith non-contentious financial services regulatory head Jacqui Hatfield in London, four lawyers from Clifford Chance in Paris, led by former local competition head Patrick Hubert, and another team of lawyers in Munich from King & Wood Mallesons, led by the latter's ex-German corporate head Christoph Brenner.

Zuklie, who assumed leadership of Orrick five years ago from current congressional candidate Ralph Baxter, added that the firm's momentum has continued into 2018. Orrick opened another Texas office this month in Austin, in a move that added more than 20 public finance lawyers from Andrews Kurth Kenyon. Earlier this year, Orrick absorbed 15 lawyers from litigation boutique Morvillo, bolstering its offices in New York and Washington DC.

"In general, we are bullish on the New York market, we found some great talents there," Zuklie said. "So we are going to continue to grow in both New York and northern California."

As regulatory issues affecting large technology companies become more prevalent among its clients, Zuklie noted that Orrick is also looking into investing more in Washington DC. The firm's US Supreme Court and appellate practice is representing Microsoft in its landmark privacy case involving a challenge to the US Department of Justice's attempt to seize customer data stored in a foreign country.

"Data privacy and security – five years ago that wasn't on the top of our clients' minds," Zuklie said. "I think every general counsel in the world is dealing with that now in a really profound way, so we are going to add to our team, no matter where we find those talented lawyers."

After posting its best-ever financial year in 2016, Fried Frank enjoyed another record-breaking performance last year.

After posting its best-ever financial year in 2016, Fried Frank enjoyed another record-breaking performance last year.

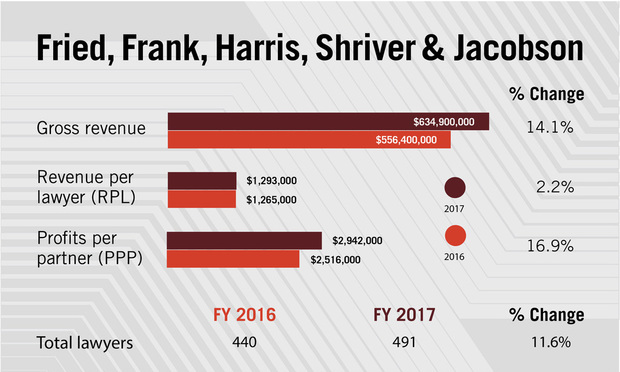

In its third consecutive year of growth in several key financial metrics, the firm saw revenue rise 14.1% to $634.9m, up from $556m the year before. RPL rose 2.2% to $1.29m, while PEP jumped nearly 17% to $2.94m.

This financial success is a direct result of a strategic plan implemented by the New York-based firm in 2014 that focuses on advising clients on their most complex, sophisticated work and growing its six core transactional practices – asset management, capital markets, finance, M&A, private equity and real estate – in the US and Europe, said Fried Frank's global chairman David Greenwald.

"The efforts of everyone at the firm in executing our strategy have been central to the success we've achieved," added Greenwald, a former deputy general counsel at Goldman Sachs who returned to the firm in 2013 and took over as leader the following year amid the departure of Valerie Ford Jacob to Freshfields Bruckhaus Deringer.

Overall headcount also increased 11.6% last year, to 491 lawyers, up from from 440 in 2016. The number of equity partners at the firm ticked up 3.8% to 109, up from 105 the year before.

Fried Frank, whose financial year ended on 28 February, saw strong performances across all of its practices globally, Greenwald said. The firm's gross revenue growth was driven primarily by its asset management, capital markets, litigation and real estate.

Thanks to an active transactional market in the US, Greenwald said Fried Frank was able to expand its client base and gain market share in 2017. In addition, the firm's London office, which brought on Ashurst real estate duo Darren Rogers and Patrick Williams, has "paid dividends" and continues to grow along with Fried Frank's business in Europe, Greenwald said.

Fried Frank London managing partner Mark Mifsud said: "Our London office plays a very important role in our growth strategy. In particular, our asset management, leveraged finance and litigation practices were key drivers of revenue growth and the recent addition of Darren Rogers and Patrick Williams formally established our London corporate real estate practice. Looking ahead, we will continue to further align our activities in Europe with our core practices in the US, and recruit talented individuals to meet our clients' growing needs."

"We continue to focus on executing our strategy and meeting the growing demands of our clients," said Greenwald, a process that he noted includes being active in the lateral market.

Fried Frank also advised on several high-profile deals in 2017, including serving as outside counsel to Coach on its $2.4bn acquisition of fashion rival Kate Spade & Co. As for 2018, Greenwald said the firm is focused on continuing to perform, but declined to discuss whether Fried Frank would entertain potential tie-up talks with other firms.

"We've had three great years in a row [and] that puts some pressure on us to continue performing," Greenwald said. "I'm bullish on 2018."

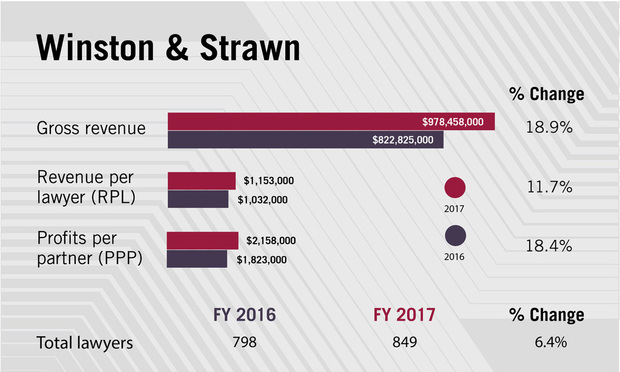

Elsewhere, Winston & Strawn saw revenues rise nearly 19% last year to reach $978.5m, as PEP topped $2m for the first time, growing 18.4% to $2.16m. RPL jumped 11.7% to $1.15m.

Elsewhere, Winston & Strawn saw revenues rise nearly 19% last year to reach $978.5m, as PEP topped $2m for the first time, growing 18.4% to $2.16m. RPL jumped 11.7% to $1.15m.

Firm chairman Thomas Fitzgerald predicted late last year that 2017 would be the "best year the firm has ever had". He was right.

From a recruiting perspective, Winston has added 90 lateral partners in the past 14 months up to February, while headcount grew 6.4% last year to 849 lawyers.

The firm was also aided by a one-off contingency fee payment it received following a settlement with Walt Disney over a case filed in 2011. The firm represented Beef Products in a defamation claim following a report by Disney-owned ABC News calling the company's product "pink slime".

While the size of that settlement remains confidential, Disney has disclosed that it paid $177m over its insurance limits to conclude the matter.

"We hit our bogey and our partners did great. We had a great year," said Fitzgerald. "I owe it all to our partners. They did great."

The firm began its year with the announcement of a new Dallas office, which opened in February 2017 with 23 partners from eight different firms. The office now stands at 57 lawyers, according to the firm's website.

Winston's non-equity ranks surged last year by 16.4% to 224 partners, with compensation for that group growing by nearly 36% to about $162m. Despite the increase in recruiting, the firm's equity partnership actually shrunk 2.4% down to 140.

Fitzgerald said that was the result of Winston's hiring of large groups of lawyers, many of whom were leveraged with non-equity partners. In April, the firm will begin a process to move closer to a one-tier partnership, with non-equity partners paying in capital over a three-year period.

As for its recruiting streak, Fitzgerald said Winston & Strawn will try to keep it up. But without a pink slime-sized settlement on the horizon, he said the growth rates the firm notched last year may be tough to match in 2018.

"I can't tell you we'll be able to match last year. We want to. We'll see," Fitzgerald said. "Our efforts will be just as substantial. Last year was so unusual that I'd never want to say we'd match it because that would be setting myself up."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KWM Adds Three New Partners in Singapore and Australia

Whistleblowing in 2025: What's on the Horizon for GCs?

Quartet Of Firms Secure Roles as LG Group’s IT Services Arm Lists for $823M

Trending Stories

- 1Attorney Says Seeking Justice for Inmate's Death Requires Systemic Change as Well as Compensation

- 2Justice 'Weaponization Working Group' Will Examine Officials Who Investigated Trump, US AG Bondi Says

- 3Judge Accuses Trump of Constitutional End Run, Blocks Citizenship Order

- 4Brooklyn Prosecutor Returns to Private Practice to Co-Found Wrongful Conviction Boutique

- 5Hasbro Faces Shareholder Ire Over 'Excessive' Toy, Game Inventory

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250