Q1 M&A rankings see resurgence of UK firms as Freshfields rises up global tables

Freshfields tops Europe M&A rankings despite least active quarter for deals for five years

April 05, 2018 at 07:34 AM

5 minute read

UK firms have returned to dominance in the Q1 M&A tables after playing second fiddle to the US elite last year, with Freshfields Bruckhaus Deringer rising up the rankings following a busy quarter for the firm.

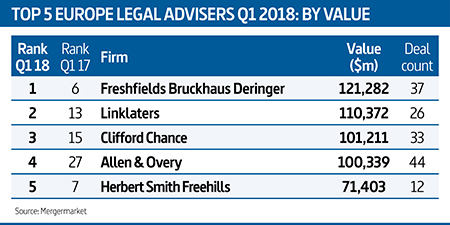

Figures from Mergermarket show Freshfields topped the European deal value ranking for the first quarter of the year, after acting on 37 deals worth a total of $121bn (£86bn).

While last year the Q1 European M&A rankings were dominated by US firms, this year the top five spots were taken by four magic circle firms and Herbert Smith Freehills (HSF).

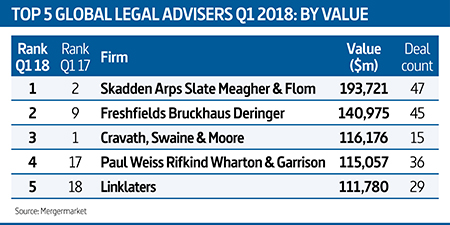

Freshfields' strong showing also saw the firm rise to second in the global M&A rankings, up from ninth last year, after acting on 45 global deals worth a total of $141bn (£100bn).

Freshfields' strong showing also saw the firm rise to second in the global M&A rankings, up from ninth last year, after acting on 45 global deals worth a total of $141bn (£100bn).

Skadden topped the global and US deal value tables for Q1, after advising on 47 global deals worth a total of $194bn (£137bn) and 39 US deals worth $170bn (£121bn).

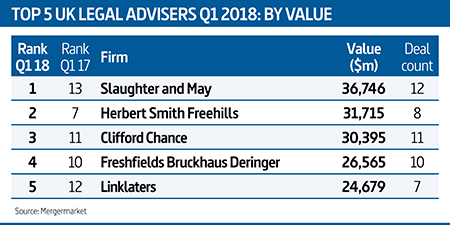

Slaughter and May came top for UK M&A by value, having acted on 12 deals worth a total of $37bn (£26bn), with Herbert Smith Freehills (HSF) second and Clifford Chance (CC) third.

Meanwhile, DLA Piper took the top spot for European deal volumes, acting on 50 deals worth a total of $52bn (£37bn). Kirkland & Ellis took first place for global deal count, acting on 112 deals worth $67bn (£47.5bn) during the quarter, with CMS top for UK volumes with roles on 21 deals.

Total global deal value increased by 18% on Q1 last year to $891bn (£632bn), although global deal volume dropped 19% to 3,774, the lowest quarterly figure since Q3 2013.

Total global deal value increased by 18% on Q1 last year to $891bn (£632bn), although global deal volume dropped 19% to 3,774, the lowest quarterly figure since Q3 2013.

Deal count in Europe also fell by 22% year on year to 1,409, the least active quarter since Q1 2013. Despite the fall in deal numbers, total deal value across the continent rose to $256bn (£182bn), a 22% increase on last year's Q1 total of $211bn (£148bn).

The same trend was seen in the UK, with a fall in the total number of deals coming against an increase in deal value. UK deal numbers for Q1 fell 31% year on year from 386 to 266, alongside a 41% increase in total deal value across the same period to $59bn (£42bn), up from $42bn (£20bn).

HSF M&A partner Caroline Rae said: "Several of the issues we faced in Q1 2017, including Brexit, remain unresolved, but many UK corporates now have the confidence to plough on and execute their M&A strategies despite the ongoing uncertainty.

HSF M&A partner Caroline Rae said: "Several of the issues we faced in Q1 2017, including Brexit, remain unresolved, but many UK corporates now have the confidence to plough on and execute their M&A strategies despite the ongoing uncertainty.

"One of the key trends in 2018 will be technology as an important factor for M&A strategy. Technology is having an impact across sectors and we are seeing a lot of clients who are looking at how they are going to keep up with their competitors. They are looking to M&A as a way to acquire technology."

Allen & Overy (A&O) global co-head of corporate Richard Browne added: "The market is strong across a broad base, and we are not seeing any sign of it slowing up. Quite a lot of significant deals have been announced in the quarter, including a lot of good-sized private M&A deals. There are a lot of political macro events out there that can affect the market, but the fundamental dealmaking environment is still strong."

The rankings are notable for the resurgence of UK firms in the top 10 European advisers by value, with six making the top 10.

Freshfields, Linklaters, CC, A&O and HSF ranked first to fifth respectively, with DLA Piper in eighth. For 2017, the Q1 rankings saw just three UK firms make the top 10 European and UK advisers by value.

The largest UK deal of the quarter was GlaxoSmithKline's $13bn (£9bn) purchase of a 36.5% stake in its consumer health joint venture with pharma giant Novartis. Freshfields advised Novartis while Slaughters represented GSK.

Slaughters also won a role on the second largest UK deal, representing FTSE 100 engineering business GKN on its bitterly contested takeover by Melrose. Its initial £7bn bid was rejected, but Melrose won support of more than half of GKN's investors and its subsequent $12.1bn (£8.6bn) bid was accepted last week (29 March).

Slaughters also won a role on the second largest UK deal, representing FTSE 100 engineering business GKN on its bitterly contested takeover by Melrose. Its initial £7bn bid was rejected, but Melrose won support of more than half of GKN's investors and its subsequent $12.1bn (£8.6bn) bid was accepted last week (29 March).

Meanwhile, the biggest European deal this quarter was E.ON's €46.6bn (£33bn) deal to acquire a controlling stake in renewable energy business Innogy from German rival RWE. That deal handed key roles to Freshfields for RWE, Linklaters for E.ON and Hengler Mueller for Innogy.

Going forward, partners believe activity levels will continue to hold up, despite Brexit looming on the horizon.

Skadden M&A partner Scott Simpson says: "Everyone saw a slowdown of M&A activity during the time of the Brexit vote and thereafter, but M&A activity has returned. It doesn't mean the uncertainty is behind us, but people are getting on with their plans and probably concluding Brexit is not going to disturb their long-term investment plan for Europe."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Hengeler, Noerr, Freshfields Steer Multi-Million Euro Deals for XXXLutz, Huf Group & More

3 minute read

Goodwin Enlisted for $1.15 Billion GSK Acquisition of US Biopharma Business

Freshfields Leads European M&A Rankings Again in 2024, as U.S. Firms Gain Market Share

5 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250