Freshfields tops European deal value rankings as activity levels plummet to five-year low

UK firms put in a strong show as deal values soar but volume levels dip globally

July 05, 2018 at 07:21 AM

6 minute read

European M&A deal volume fell to its lowest level since 2013 during the first half of 2018, despite a surge in high-value transactions, according to new data from Mergermarket.

The latest figures from the data provider show that the total number of European deals fell to 3,199 during H1 2018, down from 3,856 in the same period last year – a fall of 17%. Deal volumes in Q2 this year stood at just 1,478 – a fall of 14% on the first quarter of the year and representing the slowest activity levels since Q3 2013.

At the same time, total deal values in the first half of the year rose to their highest level for more than 10 years. Mergermarket tracked $600.9bn (£453.6bn) of European deals during the period, representing a 21% increase on the previous year and the largest six-month deal tally since just before the financial crash in 2007.

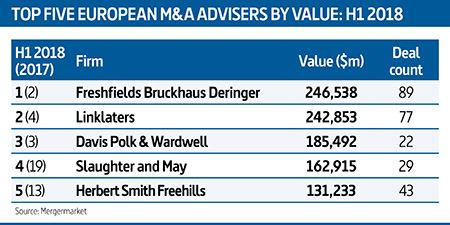

Freshfields Bruckhaus Deringer topped the European value rankings, advising on 89 deals worth $246.5bn (£186.1bn), just ahead of Linklaters, which advised on 77 deals worth $242.8bn (£183.2bn).

Freshfields Bruckhaus Deringer topped the European value rankings, advising on 89 deals worth $246.5bn (£186.1bn), just ahead of Linklaters, which advised on 77 deals worth $242.8bn (£183.2bn).

Freshfields' mandates in the six-month period include advising Comcast on its £40.7bn purchase of Sky, alongside Davis Polk & Wardwell, in what was the largest UK deal of H1 and the third-largest deal in Europe.

Linklaters, meanwhile, played a role on the largest deal in Europe and – Japan's Takeda's $79.7bn (£60.1bn) bid for Irish drug company Shire, a deal that also generated roles for firms including Davis Polk & Wardwell, Latham & Watkins and Slaughter and May.

Freshfields co-head of the global M&A client group, Bruce Embley, said: "The M&A market is at a very interesting stage and is absolutely buoyant – debt markets are as liquid as you could imagine and, driven by disruptive new technologies, we've seen companies engaging in ambitious cross-sector deals – such as AT&T's acquisition of Time Warner, and Amazon and Wholefoods.

"There are a few things you need for big-ticket M&A deals. A relatively conducive regulatory and political market and ready access to debt and equity capital. But also investor confidence."

Andy Ryde, who heads fourth-placed Slaughter and May's corporate practice, said: "It's been a very busy M&A market in which we've seen a resurgence of large deals. A lot of deals are in the £5bn to £20bn range, a sign of a hot M&A market… Since last September, it has been really busy."

Looking at the volume rankings, DLA Piper advised on the largest number of European deals, with roles on 143 transactions worth $58.7bn, significantly above second- and third-placed CMS and Allen & Overy, which advised on 103 and 101 deals respectively.

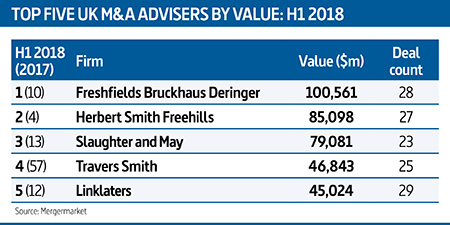

The drop in deal activity was slightly larger in the UK than Europe, with total deal numbers falling from 791 in H1 2017 to 629 in the same period this year – a drop of 20%. Total value meanwhile increased from $93.4bn (£70bn) to $147.4bn (£111bn) year on year – a 58% jump.

UK firms reclaimed the top spots in the UK value rankings from their US rivals in H1 2018. Freshfields ($100.5bn), Herbert Smith Freehills ($85.1bn) and Slaughters ($79bn) took the top three places, compared with Kirkland & Ellis, Simpson Thacher & Bartlett and Davis Polk & Wardwell this time last year.

UK firms reclaimed the top spots in the UK value rankings from their US rivals in H1 2018. Freshfields ($100.5bn), Herbert Smith Freehills ($85.1bn) and Slaughters ($79bn) took the top three places, compared with Kirkland & Ellis, Simpson Thacher & Bartlett and Davis Polk & Wardwell this time last year.

CMS topped the UK value rankings with roles on 50 deals worth $28.9bn, with DLA Piper and Eversheds Sutherland rounding out the top three.

Charles Currier, co-head of the CMS UK corporate practice, said: "We're not seeing a slowdown in the M&A market. While there may be fewer deals, we've not seen less work, which might echo fewer but bigger deals."

Travers Smith corporate partner Richard Spedding backed this up, adding: "Ever-increasing competition is driving larger corporate players to consolidate their respective industries – and also to seek complementary bolt-ons to broaden their offering."

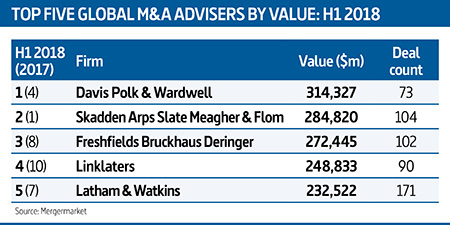

Looking at the global rankings, Davis Polk & Wardwell topped the value rankings, with roles on 73 deals worth $314bn. Freshfields and Linklaters both feature in the top five globally, with Freshfields in third place and Linklaters in fourth. In total, six UK firms made it into the top 20 by global value. Kirkland topped the global volume rankings, ahead of DLA Piper and Jones Day.

Looking at the global rankings, Davis Polk & Wardwell topped the value rankings, with roles on 73 deals worth $314bn. Freshfields and Linklaters both feature in the top five globally, with Freshfields in third place and Linklaters in fourth. In total, six UK firms made it into the top 20 by global value. Kirkland topped the global volume rankings, ahead of DLA Piper and Jones Day.

Global deal volumes fell by 11%, against a 28% increase in value.

Looking forward, many expect the M&A market to remain robust but there are concerns about the impact of Brexit further down the line.

DLA Piper M&A co-chair Jon Kenworthy said: "The longer we go without clarity on what the next step is, I think you'll see increased nervousness from business and this may lead to reined-in M&A activity from firms."

Latham co-chair of global M&A Ed Barnett said: "There is a question over the change in global interest rates and how that might impact the cost of doing M&A. We could also see Brexit uncertainty start to cool the market towards the end of the year."

However, he added: "I think the market appreciates that uncertainty is the new norm. There are plenty of opportunities out there for acquisitive companies eyeing up expansion or consolidation and there remains a great deal of PE money to be deployed."

Freshfields partner Bruce Embley: "M&A has already factored Brexit into its pricing. When you look at geopolitical shocks, there are far bigger issues for the market [than Brexit], such as the trade wars."

Travers partner Richard Spedding: "Brexit continues to loom but the timelines and implications remain hard to unpick. I think that corporates and PE funds are therefore deciding that there is no point waiting to see what pans out, given the opportunities they may miss in the meantime. It's not been lost on people that we are nearing the Q1 2007 high watermark for M&A, but at the moment there seems to be 'safety in numbers' among the buy-side community."

Slaughter and May M&A head Roland Turnill: "With the outline of the Brexit transition deal apparently settled, clients saw a window of opportunity to get things done. But it may become less stable – things might slow down."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Hengeler Advises On €7B Baltica 2 Wind Farm Deal Between Ørsted and PGE

2 minute read

Slaughter and May and A&O Shearman Advise as Latest UK Company Goes American

3 minute read

Linklaters Continues Renewable Energy Hot Streak With Latest Offshore Wind Farm Project

2 minute readTrending Stories

- 1'Lookback Window' Law for Child Abuse Cases Constitutional, State High Court Finds

- 2Troutman Pepper Says Ex-Associate Who Alleged Racial Discrimination Lost Job Because of Failure to Improve

- 3Texas Bankruptcy Judge Withdraws Ethics Complaint Against Jackson Walker

- 4Apply Now: Superior Court Judge Sought for Mountain Judicial Circuit Bench

- 5Harrisburg Jury Hands Up $1.5M Verdict to Teen Struck by Underinsured Driver

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250