Quinn Emanuel forms shareholder group to sue Glencore after bribery and corruption allegations

US firm leads claim backed by litigation funder as mining giant turns to Linklaters

July 12, 2018 at 06:21 AM

2 minute read

Quinn Emanuel Urquhart & Sullivan is investigating potential action against trading and mining company Glencore, after it was revealed that it is involved in bribery and corruption probes in the UK and US.

Last week (3 July), Glencore announced that its US subsidiary, Glencore Group, had received a subpoena from the US Department of Justice to produce documents relating to its businesses in Nigeria, the Democratic Republic of Congo (DRC) and Venezuela from 2007 to the present day.

The subpoena follows reports in May that the Serious Fraud Office (SFO) was considering seeking approval to open an investigation into the FTSE 100 company's dealings in the DRC.

The US firm has formed a shareholder group, which intends to lodge a claim based on a sharp fall in the company's share price in the wake of the allegations, resulting in a fall of almost £7bn in Glencore's market capitalisation

The claim is being backed by Jersey-based litigation funder Innsworth, which, according to its website, finances commercial litigation and arbitration claims in excess of $100m (£75m).

Quinn Emanuel London co-managing partner Richard East and Switzerland managing partner Thomas Werlen are leading on the potential action, which the firm expects to file in the Financial List of the High Court.

East said: "Glencore has a well-known appetite for risk and operates in many of the world's most endemically corrupt countries, of which the DRC is a notable example.

"We are of the view that Glencore shareholders may be entitled to bring claims in England under the terms of the Financial Services and Markets Act 2000, in order to seek compensation for losses caused by Glencore's alleged untrue or misleading statements and/or failures to disclose relevant information to the market."

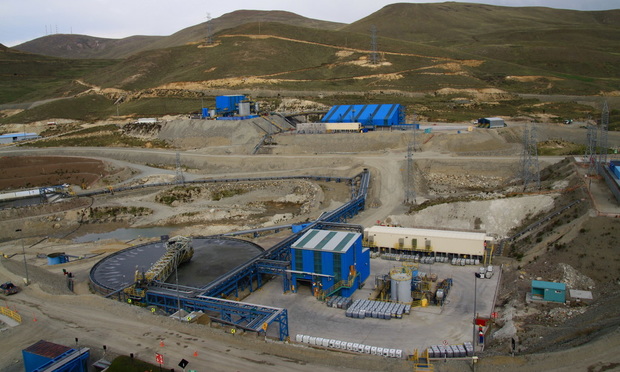

Linklaters is understood to be acting for Glencore. The magic circle firm is a longstanding legal adviser to the commodities giant, and has taken roles on numerous deals including 2016′s $2.5bn sale of its agribusiness to Canada Pension Plan Investment Board, as well as its merger with miner Xstrata and its $5bn disposal of the Las Bambas copper mine in 2013.

Photo credit: Golda Fuentes

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

US-Based Smith, Gambrell & Russell Expands to Italy With Cross-Border Transactional Attorneys

3 minute read

Freshfields Name Change Becomes Official as Company with Similar Name Dissolves

2 minute read

Leaders at Top French Firms Anticipate Strong M&A Market in 2025 Despite Uncertainty

6 minute readTrending Stories

- 1Pa. Superior Court: Sorority's Interview Notes Not Shielded From Discovery in Lawsuit Over Student's Death

- 2Kraken’s Chief Legal Officer Exits, Eyes Role in Trump Administration

- 3DOT Nominee Duffy Pledges Safety, Faster Infrastructure Spending in Confirmation Hearing

- 4'Younger and Invigorated Bench': Biden's Legacy in New Jersey Federal Court

- 5'Every Single Judge on Board': First-Impression Case Revived

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250