'It's not about egos' – CC's private equity practice looks to shape up after recent exits

CC's private equity practice has seen a number of losses in recent years, but the firm is looking to build around its bench of up-and-coming talent

September 27, 2018 at 06:07 AM

4 minute read

"People at Clifford Chance (CC) deliver for the firm and not the individual; it's not about egos," says the magic circle firm's global private equity head Jonny Myers (pictured).

Of course, in the wake of a number of partner exits from the practice in recent years, it would be surprising if Myers – who has on occasion been the subject of departure rumours himself – was putting forward a line about anything other than the importance of team spirit.

Underlining the damage US firms have carried out to the firm's practice, Latham & Watkins returned during the summer to pick up infrastructure M&A head Brendan Moylan. While not sitting within the private equity practice, Moylan specialised in PE-related deals, with a particular focus on infrastructure clients such as Global Infrastructure Partners.

Following multiple exits to Latham in the five years since former private equity head David Walker's departure in spring 2013, Moylan's move has once again raised questions about CC's status in the private equity sphere.

While the practice, which is made up 21 partners and roughly 60 associates in London, has been stable in more recent years, some still argue that it lacks enough star performers in the wake of the exits that followed Walker to Latham in 2014 – CVC favourite Tom Evans, Africa specialist Kem Ihenacho and German duo Oliver Felsenstein and Burc Hesse. Market sources suggest that relationships with key clients like CVC and Carlyle Group have been affected.

While they have been clients of CC for some time, Permira and CVC have both recently handed mandates to Freshfields, while Carlyle turned to Linklaters last year on its acquisition of defence company Praesidiad from CVC, which was advised by Freshfields. And US firms have also made steady inroads, with Simpson Thacher & Bartlett tightening its grip on KKR in recent years, advising on deals such as its €7bn purchase of Unilever's spreads division earlier this year. "Compared to where they were in the market," says one partner at another firm, "CC is not so far ahead anymore."

But Myers is undaunted. He says the practice's revenues are up by about 35% since the exits five years ago, and that within the last five months the team has worked on deals for a raft of regular clients including Actis, Blackstone, Carlyle, Cinven, CD&R, CVC, EQT, KKR and Permira.

In June, he led a team advising on a €2bn (£1.8bn) double deal for Partners Group on the acquisition of both Megadyne Group and Ammeraal Beltech, contracts for which were signed within two hours of one another, and newer clients for the PE practice in London include Elliott Advisors – the owner of bookstore Waterstones, which is in the process of purchasing Foyles – and Aberdeen Standard.

Myers highlights that even after recent departures the firm still has a strong bench, made up of the likes of Spencer Baylin, Simon Tinkler and Amy Mahon, while the exits have also opened up opportunities for talented junior lawyers to prove their worth.

In the past three years, three associates have been made up to partner in the London private equity team: Alexandra Davidson, Christopher Sullivan and Andrew Husdan. Sullivan, though new to the partnership, has already earned a good reputation among industry competitors who highlight his work for Cinven, while he worked alongside Baylin on the Waterstones deal.

Baylin and Mahon also recently led a team advising EQT on Apax Partners' $2bn sale of chemicals distribution company Azelis.

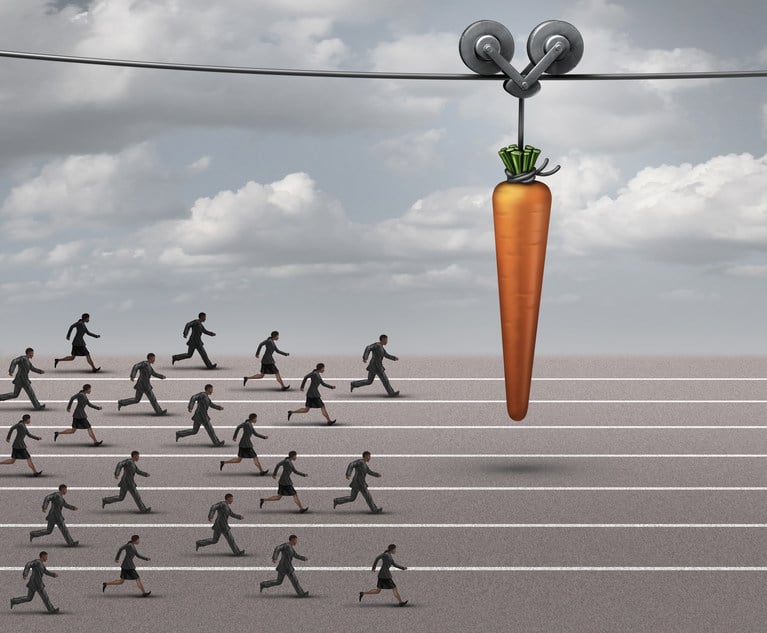

So how does Myers plan to stop further partners from leaving? Simply put, by appealing to their sense of team spirit and the calibre of the firm's clients.

"It is a free world," Myers says of the US offensive on the magic circle. "Some of the US firms have been here for over 30 years. Understandably the US firms are looking to become key players in the European market. We continue to ensure that our growth is done as a team.

"It's the people that are fundamental to this place," he adds. "What drives the people here is the quality of the clients, the work and the associates – and we have many outstanding associates."

One rival PE partner says of the firm's team: "CC still has a very good name in the market," with a "recognised brand, footprint and client roster".

Another partner adds: "If you asked me a couple of years ago, I'd have said that they went downhill a little, but in the last year or so they've come back up. I think you see them in more deals now and they've got some of their clients back."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid To Practice Law in US On Hold As Arizona Court Exercises Caution

Law Firms 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Trending Stories

- 1Litigators of the Week: A $630M Antitrust Settlement for Automotive Software Vendors—$140M More Than Alleged Overcharges

- 2Litigator of the Week Runners-Up and Shout-Outs

- 3Linklaters Hires Four Partners From Patterson Belknap

- 4Law Firms Expand Scope of Immigration Expertise, Amid Blitz of Trump Orders

- 5Latest Boutique Combination in Florida Continues Am Law 200 Merger Activity

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250