Baker McKenzie Nears $3BN Revenue, Buoyed by Global Deals

The mega-firm said cross-border transactions and litigation fueled solid growth.

March 13, 2019 at 12:00 PM

5 minute read

The original version of this story was published on The American Lawyer

Baker McKenzie offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Baker McKenzie offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Baker McKenzie posted solid increases in revenues and profitability in its 2018 fiscal year, with gains driven by an uptick in cross-border dealmaking.

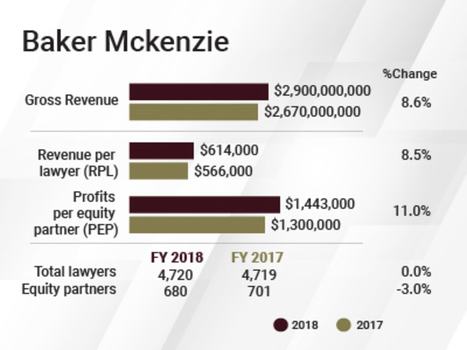

For the fiscal year ending at the end of June 2018, the firm increased revenue by 8.6 percent to $2.9 billion. Profits per equity partner, meanwhile, grew 11 percent, from $1.3 million to $1.44 million.

Net income jumped 7.7 percent to more than $981 million, while revenue per lawyer climbed 8.5 percent to $614,000.

"We had more cross-border transactions than ever before and, critically, transactions where we were serving as lead counsel," said Baker McKenzie North America CEO Colin Murray.

The firm acted as lead legal counsel to major German building materials company Gebr Knauf KG in connection with its $7 billion acquisition of Chicago-based USG Corp, and also to Servier, a France-based independent international pharmaceutical company, on its agreement to acquire Shire's oncology business for $2.4 billion.

Murray also highlighted significant demand for the firm's tax services, pointing to the effects of tax reform measures in the U.S. and other jurisdictions, and a growing number of companies using a transactional strategy as part of their tax-planning efforts.

Murray also highlighted significant demand for the firm's tax services, pointing to the effects of tax reform measures in the U.S. and other jurisdictions, and a growing number of companies using a transactional strategy as part of their tax-planning efforts.

Litigation, too, has been robust. "We saw more trials in a strong economy," Murray said.

Murray and his colleague North America chair Duane Webber did acknowledge ebbs and flows in government enforcement efforts, both in the U.S. and elsewhere. The recent U.S. government shutdown offers one example, but diminished resources for bringing cases – both by regulators and prosecutors – is a wider issue.

"That is something we're hearing in all of our markets," Murray said.

While the firm's overall headcount stayed stable in 2018, with 4,720 lawyers last year, the size of the equity partnership dipped slightly, from 701 to 680 partners. Webber attributed the 3 percent drop to recent retirements. And while he expects the retirement trend to continue, he also anticipates the number of equity partners remaining stable or growing slightly.

"Both in our promotions and in our lateral hires, we're pursuing strong equity partners who will continue to help us drive quality service to our clients," he said.

At the end of the 2018 fiscal year, the firm converted to a black box system for equity partner compensation.

Baker McKenzie brought on more than 50 lateral partners in 2018. Among the most significant additions were five California hires from Hogan Lovells, three of whom became the founding partners at the firm's new Los Angeles office, which opened last spring. The firm had been targeting Los Angeles for some time.

"LA is a hotbed for disputes, perhaps more than any other place in the U.S.," Murray said. "The team hit the ground running, and they tried a significant case a couple of months ago."

Thus far in 2019, the firm has been growing in New York, adding former Milbank M&A lawyer Mark Mandel along with the former co-chairman of Morgan, Lewis & Bockius's life sciences practice, Randall Sunberg, and partner Denis Segota, who will operate out of the life sciences corridor in Princeton, New Jersey.

Baker McKenzie is also looking to expand its footprint in London and China, according to Webber. And in September, global chairman Paul Rawlinson told Legal Week that it was actively looking for a merger partner in the U.S. Rawlinson remains on leave after temporarily stepping down due to exhaustion in October.

Webber, however, would not commit as forcefully to the prospect.

"We're always with our eyes open on opportunities to provide further and broader service to our clients, through any type of acquisition or merger activity that may be identified," he said. "We don't talk about it, but we certainly consider ourselves to be part of that ongoing dialogue."

Globally, the firm shuttered an office in Baku, Azerbaijan, in 2018. The firm is largely satisfied with its global footprint, according to Webber.

"There's probably only one other major market we'd like to be in, but we're constrained now, like everyone else: that's India," he said. The Indian Government and the Bar Council of India currently block foreign law firms from setting up shop in the world's second-largest country.

The firm also announced it would be opening a legal services centre in Tampa to complement existing back-office operations in Northern Ireland and the Philippines, which will open in 2020. That's alongside personnel investments in client services, highlighted by the June hire of global director of legal operations David Cambria, and January's addition of director of legal project management Casey Flaherty and director of pricing strategy Jae Um.

"We're doubling down on the integrated approach to delivery of our services," Webber said.

And the firm is bullish about its prospects for 2019 and beyond, even in a global climate where Brexit and escalating trade tensions are immediate examples of rising unpredictability.

"It's more of an uncertain time than it had been before, but that really goes to the core of what our value proposition is," Murray said.

Read More

After Baker McKenzie Chair Takes Leave for 'Exhaustion,' Other Leaders Share Pressures

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Malaysia’s Shearn Delamore Set To Expand Local Footprint With New Office Launch

CMA Uses New Competition Powers to Investigate Google Over Search Advertising

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Trending Stories

- 1Lessons From Five Popular Change Management Concepts: A Guide for Law Firm Leaders in 2025

- 2People in the News—Jan. 15, 2025—Ballard Spahr, Brahin Law

- 3How I Made Office Managing Partner: 'Stay Focused on Building Strong Relationships,' Says Joseph Yaffe of Skadden

- 4Snapshot Judgement: The Case Against Illustrated Indictments

- 5Texas Supreme Court Grapples Over Fifth Circuit Question on State Usury Law

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250