Weil Gotshal London Revenue Jumps 14% As Firm Hits New Highs

The firm had major roles in six of the top 10 Chapter 11 filings of 2018.

March 21, 2019 at 05:02 AM

6 minute read

The original version of this story was published on New York Law Journal

Barry Wolf, executive partner with Weil, Gotshal & Manges. (Courtesy photo)

Barry Wolf, executive partner with Weil, Gotshal & Manges. (Courtesy photo)

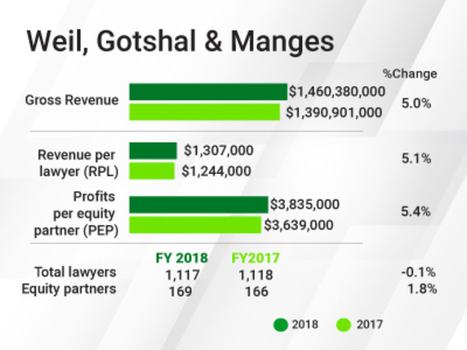

Boosted in part by a string of large bankruptcies, Weil, Gotshal & Manges recorded its highest-ever revenue and profits in 2018.

The firm's gross revenue rose 5 percent to $1.46 billion. Average profits per equity partner increased 5.4 percent to $3.8 million.

While its headcount stayed flat at about 1,117 lawyers, the firm's revenue per lawyer also rose about 5 percent, to $1.3 million.

Barry Wolf, Weil's executive partner and management committee chairman, said its litigation, corporate and restructuring departments all saw significant growth. "It was an overall strong, balanced year," Wolf said.

After a series of cost-cutting measures in 2013, including layoffs and pay cuts for some partners, Weil has been on a steady growth trajectory in the past five years. Its profits per equity partner have increased by about 85 percent from 2013.

In a typically strong economy, a restructuring practice would not be very busy, Wolf noted. "But it's quite the opposite at Weil Gotshal. Our restructuring practice was booming in 2018," he said.

In a typically strong economy, a restructuring practice would not be very busy, Wolf noted. "But it's quite the opposite at Weil Gotshal. Our restructuring practice was booming in 2018," he said.

Weil had major advisory roles in six of the top 10 Chapter 11 filings of 2018, including advising the debtor in the Sears and Claire's Stores cases. Weil also remained busy with Westinghouse, which filed in 2017, and is advising California utility Pacific Gas & Electric, which filed for bankruptcy this year.

"We have extraordinary market share of large debtor cases," Wolf said.

Weil's fees for such cases have continued to attract press scrutiny. From Sears' October 15 Chapter 11 filing in New York bankruptcy court through to the end of 2018, Weil has billed more than $22 million. The firm recently caught press attention over a single paralegal's busy month: 431 hours, billed at $405 per hour – more than 14 hours for every day of the month.

Wolf, in an interview, defended the firm's fees and said there was no premium being charged. "These are extremely complicated cases, and they come to the Weil Gotshal bankruptcy platform because they're extremely complicated," he said.

Wolf added that the Chapter 11 process allows jobs to be saved and businesses to continue. "I'm very proud of the work our lawyers do," he said. "People come to Weil Gotshal when there's a very complicated matter."

International offices

Weil's London office generated $188.1 million last year, up by about 14 percent from 2017. London business was driven by private equity, restructuring, and banking and finance, said Wolf, adding that he was "extremely pleased" with the office's growth.

The firm saw some departures in London, including tax partner David Irvine, who exited for Kirkland & Ellis, and London banking head Mark Donald, whose plan to join White & Case fell through this year.

Wolf noted that three of Weil's 11 newly promoted partners in 2019 are in London, while Weil hired Sidley Austin private equity partner Mark Thompson this year. Wolf said the firm expects to make more lateral additions in London.

Last year, Weil closed offices in Budapest, Hungary, and then in Prague, Czech Republic, marking the third office closure for the firm in 18 months. Wolf said the offices didn't fit from a financial or strategic perspective.

As he did last year in an ALM interview, Wolf declined to say whether the firm will close any more offices. ALM reported in December that the firm's Poland office was facing an uncertain future. "We are always, from a management perspective, evaluating the strategic importance and strategic fit of our offices," he said.

Weil made several lateral additions in the last year, including Joseph Pari, now co-chairman of its global tax department, who arrived from KPMG; and Matthew Stewart, formerly of King & Spalding, who joined the firm's private equity team in Silicon Valley. Earlier this year, Weil lured Evan Levy, head of the real estate capital markets practice at Skadden, Arps, Slate, Meagher & Flom, to its New York office; and this week, the firm announced the addition of former Goldman Sachs vice-president Brian Parness as a New York private equity partner.

While the firm's equity partner ranks increased by three, Weil's non-equity partner tier in 2018 dropped by 14 to 95 attorneys. Wolf attributed the drop to natural attrition, including some retirements, and said there was no plan to decrease the ranks of the non-equity partnership.

Weil last year announced that the firm was shortening the path to partnership, in a move designed to increase retention of top associates, and said it would allow mid-level and more senior associates in the U.S. to work from home one day a week.

Wolf said the reaction from associates has been positive, but it's too early to tell the results of the shortened partnership track. The new track will be implemented firmwide at the end of 2019.

Amid all the changes, Weil continued in 2018 to transition its departments to a new generation of leaders, Wolf said. "These are people who continue to want to bring the firm forward," he said.

Besides bankruptcy, Weil was retained on several significant matters last year. In October 2018, it obtained a defence verdict on behalf of Johnson & Johnson in a bellwether talc mass tort case. The firm also secured victories in investigations and litigation on behalf of AIG, Discovery Communications, Morgan Stanley, Pandora Media, Sanofi and Walgreens.

Meanwhile, Weil's corporate department advised Eli Lilly and Co on its $8 billion acquisition of Loxo Oncology; Campbell Soup Co on its $6.1 billion acquisition of Snyder's-Lance; and Belmond, an owner and operator of luxury hotels and tourist trains, on its $3.2 billion sale to LVMH Moet Hennessy Louis Vuitton SE.

Read More

Global Firms Back Away from Eastern Europe

Weil Gotshal Shortens Path to Partnership in Bid to Retain Associates

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Malaysia’s Shearn Delamore Set To Expand Local Footprint With New Office Launch

CMA Uses New Competition Powers to Investigate Google Over Search Advertising

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Trending Stories

- 1Snapshot Judgement: The Case Against Illustrated Indictments

- 2Texas Supreme Court Grapples Over Fifth Circuit Question on State Usury Law

- 3Exploring the Opportunities and Risks for Generative AI and Corporate Databases: An Introduction

- 4Farella Elevates First Female Firmwide Managing Partners

- 5Family Court 2024 Roundup: Part I

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250