Fried Frank Keeps Up Growth, Doubling Partner Profits Over Five-Year Span

Chairman David Greenwald said 2019 is shaping up to be another strong year.

March 22, 2019 at 04:48 AM

4 minute read

The original version of this story was published on The American Lawyer

Fried Frank chairman David Greenwald

Fried Frank chairman David Greenwald

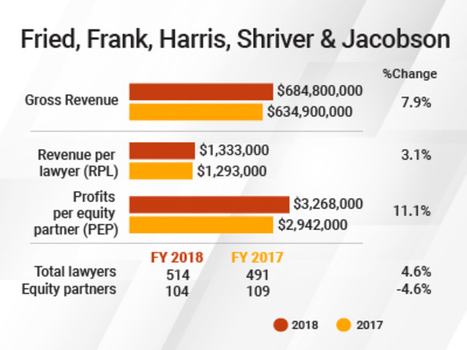

Fried, Frank, Harris, Shriver & Jacobson is continuing to grow its top and bottom lines, boosting revenue and surpassing the $3 million mark in profit per equity partner (PEP) for the first time in the Wall Street firm's 129-year history.

PEP rose 11.1 percent in 2018 to $3.268 million. During the past five years, PEP has grown by 100 percent, noted Fried Frank chairman David Greenwald.

Fried Frank's gross revenue grew 7.9 percent in 2018 to $684 million, and revenue per lawyer rose 3.1 percent to $1.333 million, a milestone for the firm.

Greenwald credited the growth to strategic focus on being go-to counsel on clients' most complex matters, especially in the firm's asset management, capital markets, finance, M&A, litigation, private equity, real estate and restructuring practices, Greenwald said.

"As a result, we've continued to have excellent results and last year was a very strong year," Greenwald said.

Fried Frank's asset management, real estate, private equity and M&A practices had a particularly strong year, said Greenwald, a former deputy general counsel at The Goldman Sachs Group Inc, who returned to the firm in 2013 and took over as its leader the following year.

Among standout matters in 2018, the firm advised Brookfield Asset Management in connection with the formation of Brookfield Strategic Real Estate Partners III, which closed with $15 billion in aggregate commitments and is Brookfield's largest property fund to date.

Among standout matters in 2018, the firm advised Brookfield Asset Management in connection with the formation of Brookfield Strategic Real Estate Partners III, which closed with $15 billion in aggregate commitments and is Brookfield's largest property fund to date.

The firm advised Dallas-based technical professional services firm U.S. Jacobs Engineering Group Inc on the $3.3 billion sale of its energy, chemicals and resources segment to Australian engineering services firm WorleyParsons Ltd. It also worked with U.S. aluminum producer Aleris Corp on its $2.6 billion acquisition by Novelis Inc.

Fried Frank also advised Google in its $2.4 billion acquisition of Chelsea Market in New York City – the second-highest price ever paid for a single building in the U.S. The firm advised RXR Realty in connection to JetBlue's proposed $2 billion to $3 billion terminal expansion at John F Kennedy Airport, a part of the Port Authority's planned $10 billion redevelopment of the New York airport.

Notable lateral additions last year included Stroock & Stroock & Lavan litigation and securities enforcement and regulation partner Michael Keats, and Paul, Weiss, Rifkind, Wharton & Garrison's Colin Kelly, both in New York. The firm also added real estate investment trusts partners Stuart Barr and Cameron Cosby from Hogan Lovells in Washington, D.C.

There were also key additions in London, including Freshfields Bruckhaus Deringer corporate and capital markets partner Ashar Qureshi, Norton Rose Fulbright corporate partner Ian Lopez, and Milbank Tweed Hadley & McCloy City finance partner Neil Caddy.

"We still are hunting for more people to join us in practice areas where we can better support our clients and grow our strategically important practices," Greenwald said.

Overall headcount at the firm increased 4.6 percent in 2018 to 514 attorneys. The equity partner tier dropped from 109 partners to 104 partners, while the non-equity tier grew 52.2 percent to 35 partners, from 23 the year prior.

"Our strategy continues to pay off and looking ahead, we think we're well positioned to help our clients navigate their most complex and important matters," Greenwald said.

"I'm optimistic about 2019. I think it's going to be another good year," he added.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Malaysia’s Shearn Delamore Set To Expand Local Footprint With New Office Launch

CMA Uses New Competition Powers to Investigate Google Over Search Advertising

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Trending Stories

- 1Snapshot Judgement: The Case Against Illustrated Indictments

- 2Texas Supreme Court Grapples Over Fifth Circuit Question on State Usury Law

- 3Exploring the Opportunities and Risks for Generative AI and Corporate Databases: An Introduction

- 4Farella Elevates First Female Firmwide Managing Partners

- 5Family Court 2024 Roundup: Part I

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250