Top 50 Firms Have £5.6BN Of Unpaid Client Invoices

Research shows that the legal sector is operating on a thinly-capitalised model that leaves it vulnerable to market shocks.

June 20, 2019 at 06:21 AM

6 minute read

Law firms have increasingly large amounts of unpaid bills sitting on their balance sheets, which is hurting their cash position, according to an analysis of their limited liability partnership (LLP) accounts.

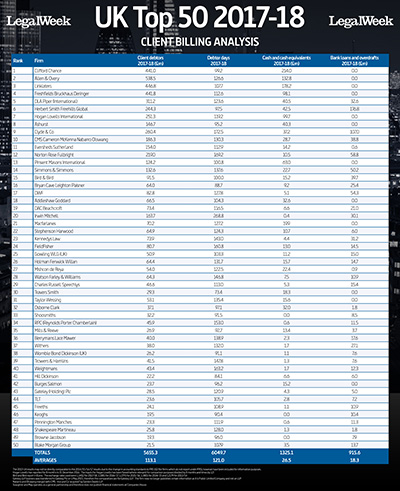

Research by Legal Week, in conjunction with Smith & Williamson, found that the top 50 LLPs, which does not include Slaughter and May, had £5.6 billion due from clients at the end of the last financial year.

The figure has been increasing annually despite dwindling cash reserves at law firms. This year's figure marks a 9% increase on the 2016-17 figure of £5.19 billion.

Click on the table to see the full client billing analysis

Click on the table to see the full client billing analysisAllen & Overy had the highest value of unpaid client bills, with £538.5 million due to the firm. Browne Jacobson had the lowest at £19.3 million.

CMS, meanwhile, marked the highest percentage change year on year, measuring a 91% increase in unpaid bills to £186.3 million, up from £97.5 million, after its three-way merger went live in September 2017. Revenues for the firm's U.K. LLP were £521.9 million following the merger, up 88% from CMS Cameron McKenna's 2016-17 revenues of £277.5 million.

According to the data, which was compiled by accountancy firm Smith & Williamson, the top 50 firms collected £17.3 billion in fees during the financial year 2017-18, meaning that unpaid invoices amounted to almost a third of their total combined revenue.

U.K. firms have traditionally been slower to chase payments than U.S. firms operating in the City, with clients taking on average 121 days to pay U.K. top 50 firms last year.

Travers Smith has been paid had its bills paid the fastest for the last three years, with an average turnaround time of 73 days last year. That figure is increasing steadily, however – it is up from 61 days in 2015-16.

Travers senior partner Chris Hale said: "We do focus on trying to get our bills out as quickly as possible and once they're out, getting them paid. Why ours would be paid faster than others is difficult to explain, but quite a significant number of bills will be paid when they are issued because they are part of the transaction. What that means is that [the bill] will be paid either on completion or a day or two after completion."

Irwin Mitchell clients took the longest to pay the firm last year, taking on average 268.8 days to do so. The firm has had the longest wait time for payment out of the top 50 for the past three years.

A spokesperson for Irwin Mitchell said in a statement: "The time it takes a law firm to get paid depends on the type and mix of work it does. We undertake a considerable amount of commercial work through our business legal services division, however our average payment day figure is influenced significantly by the use of conditional fee agreements and unbilled disbursements on large, complex, personal injury cases.

"We agree to manage these disbursements during these often lengthy cases and then receive payment when they are finalised and settled. If these unbilled disbursements aren't included, the payment day figure falls considerably and in fact it compares favourably with published accounts in the previous year."

Combined, the top 50 firms had £1.325 billion in cash on their balance sheets at the year-end, alongside bank loans and overdrafts totalling £875 million, leaving them with about £450 million in net cash.

However, monthly staff costs came in at £610 million, meaning that firms are relatively thinly capitalised and vulnerable to volatile market conditions – something that faster client bill payments could help to offset.

Nick Randall, associate director at Smith & Williamson, said: "Law firms are and have always been notoriously bad at their lock-up cycle, which is fairly obvious as seen by measuring the balance sheet against the turnover at these firms.

"If clients were to stop paying the law firms for a couple of weeks or a month because there were shocks to the economy, and because firms may hold onto their cash and not pay suppliers, some of these law firms could face significant cashflow problems because it's all wrapped up in things that clients could withhold, so they wouldn't have enough cash to pay their wage bill at the end of the month."

In a videoed interview with Legal Week, Smith & Williamson head of professional services Giles Murphy said: "I think from a position of protecting the firm and making it resilient, the best scenario is to have assets in the form of cash. The debtors are convertible into cash at a period in time, but I think the concern is that is a significant sum of money that is still outstanding.

"If you were to contrast that with perhaps other professional services, or even other just services industries, how many of them would allow a third of their annual revenue to still be due from their clients and customers at the year-end? I think you would say that the legal market is at the extreme, and it's the wrong end of that extreme."

Murphy added that based on the numbers his firm had seen, if firms were able to reduce their outstanding bills by just 10% by the year-end, that would more than double their net cash positions.

"Being realistic, we're not suggesting that they're suddenly going to change their historic practices, but fairly minor changes can have a significant impact… It's all about ensuring that the gap between when they do the work and when the client pays gets minimised."

To view the full analysis of the top 50′s unpaid bills, click here.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid To Practice Law in US On Hold As Arizona Court Exercises Caution

Law Firms 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Trending Stories

- 1Gunderson Dettmer Opens Atlanta Office With 3 Partners From Morris Manning

- 2Decision of the Day: Court Holds Accident with Post Driver Was 'Bizarre Occurrence,' Dismisses Action Brought Under Labor Law §240

- 3Judge Recommends Disbarment for Attorney Who Plotted to Hack Judge's Email, Phone

- 4Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 5Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250