The Firms With The Largest Pension Liabilities

One top firm has by far the largest defined benefit pension scheme liability and will pay in at least £18 million a year to plug the gap.

June 21, 2019 at 05:50 AM

2 minute read

Pensions.

Pensions.

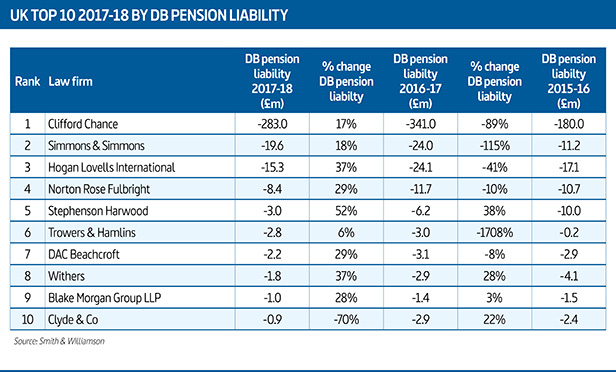

Clifford Chance has the largest pension liability in the U.K. top 50 and is one of just nine other firms with such deficits, according to research by Legal Week and Smith & Williamson.

CC had a defined benefit pension scheme liability of £283 million by the end of the financial year 2017-18, a 17% improvement on the previous year when it had a liability of £341 million, according to information in its LLP accounts.

In its filings, the Magic Circle firm wrote that it was aiming to eliminate its deficit by May 2026. It added that actuaries had estimated that employer contributions set to be paid to the pension scheme by April 2019 were £18 million, after which contributions will increase year on year in line with retail price index inflation levels.

The statement continued: "Funding levels are monitored on an annual basis and the next triennial valuation is due to be completed as at 30 April 2019. The weighted average duration of the defined benefit obligation is around 26 years."

CC's liability dwarves those of the other nine firms in the top 50 with liabilities. Simmons & Simmons had the next largest liability with £19.6 million, an 18% improvement on 2016-17.

The other firms in the top 10 to have a liability at the end of financial year 2017-18 were Hogan Lovells International (£15.3 million), Norton Rose Fulbright (£8.4 million), Stephenson Harwood (£3 million), Trowers & Hamlins (£2.8 million), DAC Beachcroft (£2.2 million), Withers (£1.8 million), Blake Morgan (£1 million) and Clyde & Co (£900,000).

A spokesperson for DAC Beachcroft said in a statement that its liability arose from a defined benefit pension scheme operated by legacy firm Davies Arnold Cooper, which Beachcroft merged with in 2011, adding that the scheme is now in run-off.

The statement continued: "The firm has an approved plan in place to address the current deficit and will continue to meet the running costs of the scheme during the run-off period. The firm now operates a defined contribution pension scheme."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Hengeler Advises On €7B Baltica 2 Wind Farm Deal Between Ørsted and PGE

2 minute read

A&O Shearman To Lose Another Five Lawyers, Including Madrid Practice Head, to EY

3 minute read

Rosenblatt Breaks Away From RBG, Becomes 40-Strong Standalone Firm

Trending Stories

- 1Meta’s New Content Guidelines May Result in Increased Defamation Lawsuits Among Users

- 2State Court Rejects Uber's Attempt to Move IP Suit to Latin America

- 3Florida Supreme Court Disciplined 17 Attorneys

- 4Sex Work at Wyndham? Judge Allows 10th Human-Trafficking Suit

- 5A&O Shearman To Lose Another 5 Lawyers

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250