Amid Deal Slowdown, King & Wood Mallesons Keeps APAC M&A Crown So Far in 2019

Chinese firm Zhong Lun also broke into the top 5 in the M&A league table for Asia Pacific, excluding Japan, by deal value, thanks to its role as Chinese counsel on SoftBank's deals.

July 04, 2019 at 07:15 AM

5 minute read

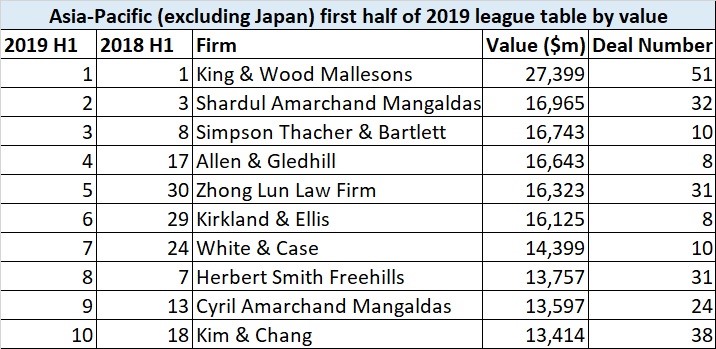

King & Wood Mallesons held onto the top spot as the leading legal adviser for mergers and acquisitions so far this year in the Asia-Pacific, according to data compiled by Mergermarket, as the U.S.-China trade war slowed down M&A activity to its lowest level since 2013.

Only Indian firm Shardul Amarchand Mangaldas and Herbert Smith Freehills stayed in the top 10 in the Asia-Pacific, excluding Japan, by deal value, compared to the same period last year.

There were 1,525 deals in Asia-Pacific, excluding Japan, with a combined value of $241 billion in the first half of 2019, according to Mergermarket, down from $370 billion from 1,850 deals in the same period last year.

The slowdown in regional M&A activity was chiefly caused by a downturn in China, where deal value dropped 45% year over year. For more than a year now, the country has been in trade disputes with the U.S., where deal count also dropped year over year, albeit by just 21% to 2,530, while deal value actually rose by 15% to $957.3 billion.

"Clients are unable to make decisions because there is no predictability," Stephen Kho, a Washington, D.C.-based international trade partner at Akin Gump Strauss Hauer & Feld, told The Asian Lawyer in May after U.S. President Donald Trump suddenly threatened to raise tariffs from 10% to 25% on an additional $200 billion worth of Chinese imports. Last week at the Group of 20 summit meeting in Japan, Trump promised to hold off on his 25% tariff threat and agreed with Chinese President Xi Jinping to resume trade talks.

Still, the first half of 2019 saw Chinese firm Zhong Lun Law Firm jump up the M&A league table by value to fifth from 30th in the first half last year, though largely because of its role as Chinese counsel to the acquisitive Japanese conglomerate SoftBank Group Corp. on a $2 billion investment in the New York-based co-working company WeWork Cos. Inc. in January and a $1.5 billion investment in the Chinese used car trading platform Guazi.com Inc. in March. King & Wood Mallesons, the Sino-Australian firm that focuses on major economic plans by the Chinese government, also kept its top spot.

M&A activity in India also decreased, to $33.5 billion – a 53% year-over-year drop. The first quarter was slow in India as businesses were cautious ahead of the general elections, Mergermarket's report said; the elections started on April for six weeks and ended with Prime Minister Narendra Modi holding onto his seat for another five-year term.

While southeast Asia saw fewer deals compared to the first half of last year, total deal value rose thanks to Singaporean developer CapitaLand Ltd.'s $8.7 billion acquisition of logistics and industrial assets from Singaporean sovereign wealth fund Temasek Holdings Pte. Ltd.'s real estate developer arm Ascendas-Singbridge Pte. Ltd.; WongPartnership advised CapitaLand while Allen & Gledhill acted for Ascendas-Singbridge. The deal helped Allen & Gledhill jump up the first half of 2019 M&A league table by value to fourth from 17th the same period last year.

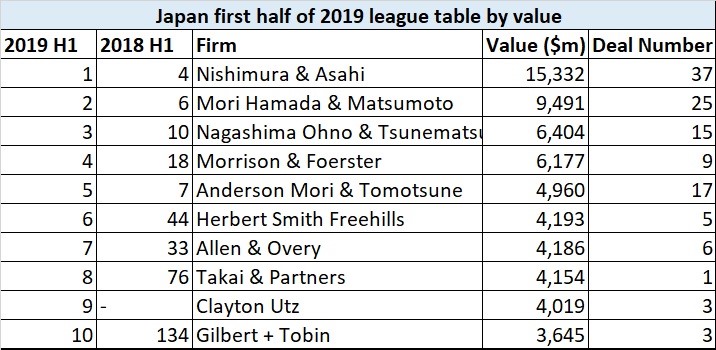

Meanwhile, Japanese M&A activity increased slightly year over year by 2.4% to $18.1 billion, led by SoftBank. In addition to its investments in WeWork and Guazi, the Japanese conglomerate increased its stake in search engine Yahoo Japan Corp. by investing $4.2 billion in May – the largest Japanese deal in the first half of 2019, according to Mergermarket.

Not surprisingly, Japan's Big Four law firms – Nishimura & Asahi, Mori Hamada & Matsumoto, Nagashima Ohno & Tsunematsu and Anderson Mori & Tomotsune – and Morrison & Foerster, which is one of the largest international firms in Japan, took the top five spots in the league table by deal value.

Japanese outbound activity declined 59% in value year over year to $42.6 billion from 160 deals, largely because of Japanese pharmaceutical giant Takeda Pharmaceutical Co.'s $78.2 billion takeover of Irish drugmaker Shire Plc. the previous year – the largest M&A deal globally in 2018. In the first half of 2017 and 2016, Japanese outbound M&A was $33 billion and $16.9 billion, respectively

Despite the drop, Japan's half-yearly outbound value again surpassed China's $21.5 billion for the third straight time. With the U.S.-China trade war expected to continue for some time, Japanese companies will have more opportunities for deals as there will be less competition from Chinese counterparts, the Mergermarket report said.

"With little signs of reaching a deal to end the trade war and negotiations constantly falling apart between [China and the U.S.], the outbound activities led by Japanese bidders are expected to remain strong in [the second half of 2019]," said the report.

Related Stories:

Asian Law Firms Lead 2019 Q1 Asia M&A Activity

Australian, Indian Law Firms Had Strong Year in 2018 APAC M&A

Japan Leads Asia M&A Activity Amid Strongest Year in Nearly 4 Decades

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Malaysia’s Shearn Delamore Set To Expand Local Footprint With New Office Launch

CMA Uses New Competition Powers to Investigate Google Over Search Advertising

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Trending Stories

- 1FTC Chair Lina Khan Sues John Deere Over 'Right to Repair,' Infuriates Successor

- 2‘Facebook’s Descent Into Toxic Masculinity’ Prompts Stanford Professor to Drop Meta as Client

- 3Pa. Superior Court: Sorority's Interview Notes Not Shielded From Discovery in Lawsuit Over Student's Death

- 4Kraken’s Chief Legal Officer Exits, Eyes Role in Trump Administration

- 5DOT Nominee Duffy Pledges Safety, Faster Infrastructure Spending in Confirmation Hearing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250