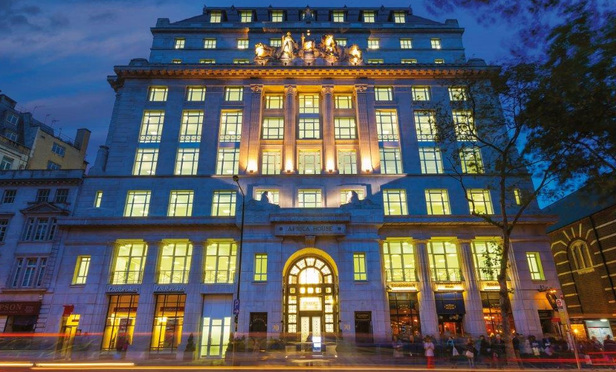

Mishcon de Reya Mulls Capital-Raising

The firm is exploring a public listing or stake sale to fund its growth strategy, in what would be one of the industry's most closely watched test cases for taking third party investment.

July 22, 2019 at 05:31 AM

2 minute read

Mishcon de Reya is exploring options to raise capital, including a potential float on the stock market or a stake sale to a private equity investor.

Sky News, which first broke the story on Saturday (July 20), reported that the firm is potentially looking to hire bankers in the coming months to explore options.

In a statement, a spokesperson at the firm responded: "Mishcon de Reya has delivered significant growth over the past 15 years. As a financially robust and dynamic firm we have ambitious plans for the next phase of growth and to achieve this [we] are considering all options for raising capital. No decisions have yet been made."

A listing by the firm would likely be valued at hundreds of millions of pounds and would be one of the industry's most closely watched test cases for taking third-party investment. The firm has revenues of more than £160 million and profit per equity partner of about £1 million.

Last year, Mishcon launched a brand management arm to advise companies on reputation, launches and strategy matters across 10 locations worldwide.

In March, DWF raised just over £95 million following its listing on the London Stock Exchange, but the IPO did not value the business as highly as was expected.

In 2015, Gateley became the first UK law firm to float, after it was listed on London's AIM market with a market capitalisation of £100 million. The move helped raise £30 million in capital for the firm. Other firms to have listed include Rosenblatt and Keystone Law.

In February, Fieldfisher ruled out an initial public offering in the near future.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Morgan Lewis to Relocate to Former Goldman Sachs UK Building in £6.6M Annual Deal

1 minute read

Australian Class Action to be Launched Against Google Over Display Advertising

4 minute read

Reed Smith Bolsters Corporate Team With Markets Partner Hire in London

2 minute read

Trinity International Expands With Singapore Office, Eyes Growth in Infrastructure and Energy

Trending Stories

- 1Apply Now: Superior Court Judge Sought for Mountain Judicial Circuit Bench

- 2Harrisburg Jury Hands Up $1.5M Verdict to Teen Struck by Underinsured Driver

- 3Former Director's Retaliation Suit Cleared to Move Forward Against Hospice Provider

- 4New York Judge Steps Down After Conviction for Intoxicated Driving

- 5Keys to Maximizing Efficiency (and Vibes) When Navigating International Trade Compliance Crosschecks

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250