WeWork offices in Tysons, Virginia. (Photo: Diego M. Radzinschi/ALM)

WeWork offices in Tysons, Virginia. (Photo: Diego M. Radzinschi/ALM)Skadden, Simpson Thacher Advise on Long-Awaited WeWork IPO

The shared workspace giant reported a loss of $1.62 billion between 2016 and 2018 as part of the filing.

August 14, 2019 at 03:30 PM

3 minute read

The original version of this story was published on The American Lawyer

The We Company, WeWork's parent company, finally took the IPO plunge on Wednesday, in the process reporting 2016 to 2018 revenue of $1.82 billion and losses of $1.62 billion. The company would be traded under the symbol "We.".

Skadden, Arps, Slate, Meagher & Flom advised the co-working pioneer and real estate giant on its filing, with New York capital markets partner Ryan Dzierniejko heading a team that included partners Graham Robinson and Laura Knoll in Boston.

Simpson Thacher & Bartlett partners John Ericson and Roxane Reardon in Boston advised an underwriter group that includes JPMorgan, Goldman Sachs, Bank of America, Barclays Capital, Citigroup Global Markets, Credit Suisse Securities (USA), HSBC Securities (USA), UBS Securities and Wells Fargo Securities.

Skadden has advised WeWork in the past, notably representing it during Japanese telecommunications company SoftBank's $4.4 billion capital infusion in July 2017.

WeWork, which has been valued as high as $47 billion in the private market, has seen massive revenue growth during the past several years. During the first half of 2019 the company reported revenue of $1.54 billion, almost outpacing its total revenue from the prior two years. But the losses have mounted as well, as the company attempts to rapidly expand. It reported losses in the first half of 2019 of $689.7 million.

The company's Wednesday filing revealed some interesting numbers around its expansion. According to the filing, WeWork now has 528 locations in 111 cities around the world, with a total membership of more than half a million.

The growth hasn't only been geographical. The We Company umbrella has launched several different subsidiary companies as well, ranging from "wellness experience" company Rise by We, to WeGrow elementary schools and the dorm-like WeLive communal living facilities.

The IPO underwriter group is kicking in up to $6 billion in the planned offering. Sources told The Wall Street Journal that the banks are asking We Company to raise $4 billion from the public equity market to continue to fund its growth.

The company, based in New York, is styled after Silicon Valley tech startups despite its significant real estate focus. Like many tech upstarts, it has been wracked with culture issues as it has grown, ranging from accusations of a toxic culture to sexual harassment to ageism.

Nonetheless, the company is shooting for a September debut, hoping to capitalise on markets that are near record highs and that global indicators say might not stay there.

|Read More

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

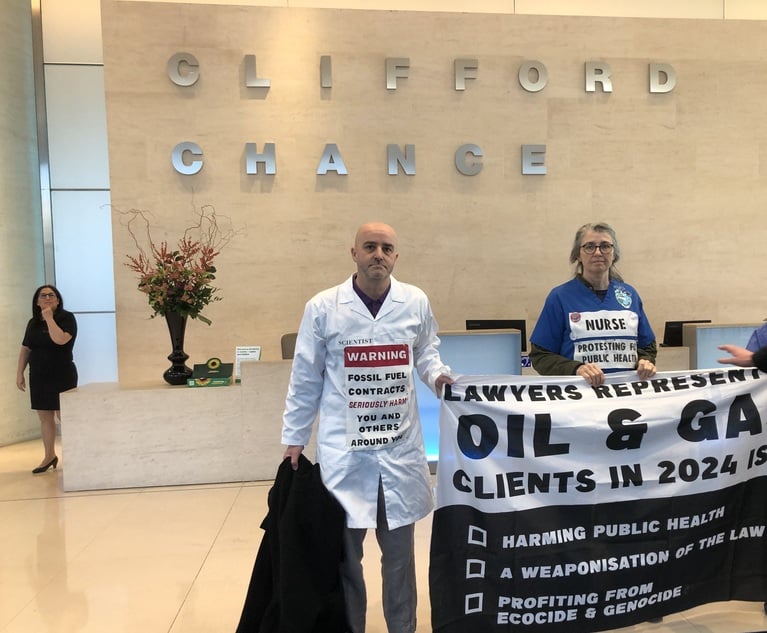

Doctors and Scientists Lead Climate Protests at Each Magic Circle Firm

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250