Indonesia's Economy Grows – and So Does Its Global Appeal

Indonesia is Asia's fifth-largest economy and it's growing steadily.

September 12, 2019 at 04:34 PM

6 minute read

This article is one in an occasional series on markets around the world, examining the legal, regulatory and corporate environment for businesses.

Global firms such as Dentons, Norton Rose Fulbright and White & Case, as well as Big Four accounting firms KPMG and PricewaterhouseCoopers, have in recent years formed alliances with Jakarta-based firms so they can have access to the Indonesian market.

The appeal of Indonesia is clear: the country's economy is worth more than $1 trillion, a milestone reached in 2017, making it Asia's fifth-largest economy and the largest in all of southeast Asia.

The appeal of Indonesia is clear: the country's economy is worth more than $1 trillion, a milestone reached in 2017, making it Asia's fifth-largest economy and the largest in all of southeast Asia.

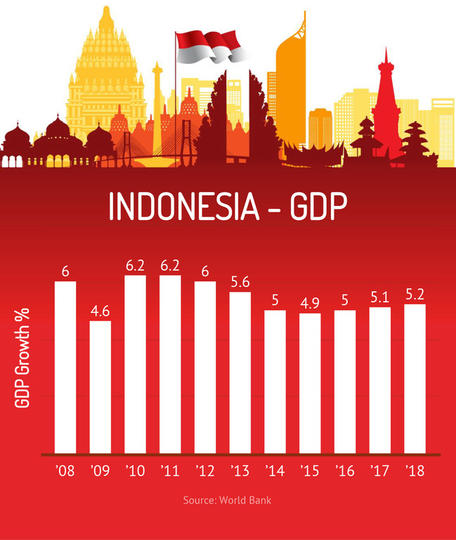

And it's growing steadily. According to World Bank data, Indonesia has maintained growth of about 5% since 2014. And the World Bank forecasts the country will grow 5.1% this year and 5.2% next year.

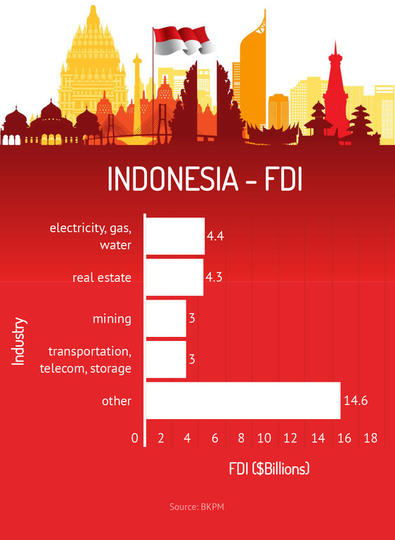

Fuelling that growth is investment valued at tens of billions of dollars. Last year, $29.3 billion worth of foreign direct investment went to Indonesia from 21,972 projects, according to data from the country's Investment Coordinating Board (BKPM); Singapore and Japan were the top two investors.

Indonesia is rich in natural resources, including coal, gold, silver, copper and nickel as well as oil and gas. Plus, the southeast Asian country's tropical climate and highly fertile soil support agriculture products, including palm oil, rubber, coffee and cocoa.

In addition to foreign investment, deals worth billions of dollars are generated by domestic companies. Indonesia is home to four unicorns: ride-hailing app Go-Jek, online booking platform Traveloka and e-commerce platforms Tokopedia and Bukalapak.

Just earlier this year, Go-Jek raised $1 billion in a funding round led by Google and Chinese tech giants JD.com and Tencent, valuing the company at about $10 billion, according to media reports. And last December, Tokopedia raised $1.1 billion in a funding round led by Chinese e-commerce giant Alibaba and Japanese conglomerate SoftBank, valuing the company at more than $7 billion, according to media reports.

The startups are supported by Indonesia's large population of more than 260 million people, the world's fourth most populous country, with a rising middle class. There's also work to come from Indonesia moving its capital from the crowded and polluted megacity of Jakarta on Java island to the forested island of Borneo. The relocation of the capital will take a decade and cost as much as $32.5 billion, which will be mostly funded by public-private partnerships and private investment.

Legal market

While multinational companies are entering Indonesia, it is difficult for global law firms to follow their clients into the country. Indonesia has one of the most restrictive legal markets in Asia: foreign firms are not allowed to open offices or practise local law in Indonesia, or share profits with their local counterparts. Indonesia is among a handful of countries that uses a civil law system based on the Roman-Dutch model.

The only way global firms can access the Indonesian market is through an association with a local firm. Recent examples include:

2019: KPMG with Lubis Ganie Surowidjojo, one of the largest Indonesian firms, with more than 100 lawyers. LGS had a six-year association with Clyde & Co, which ended in April.

2018: Dentons with Hanafiah Ponggawa & Partners, a former alliance firm of Taylor Wessing.

2017: Holman Fenwick Willan with Rahayu & Partners; PwC with Melli Darsa & Co., which previously had an alliance with Squire Patton Boggs until 2016.

2016: Hogan Lovells with Dewi Negara Fachri & Partners. The firm replaced its previous Indonesian association, which was with Hermawan Juniarto, after three years; Norton Rose Fulbright with TNB & Partners. It replaced its previous Indonesian association, which was with Susandarini & Partners, after five years.

2015: White & Case with Witara Cakra Advocates, the U.S. firm's third alliance. It was previously associated with MD & Partners for two years and with Ali, Budiardjo, Nugroho, Reksodiputro for six years.

However, several major global firms that previously had Indonesian alliances are no longer affiliated with an Indonesian firm.

2017: Clifford Chance ended its alliance with Linda Widyati and Partners after three years.

2016: DLA Piper ended its alliance with Ivan Almaida Baely & Firmansyah after three years; Squire Patton Boggs ended an alliance with Melli Darsa & Co. after two years.

Most of the legal work in Indonesia relates to banking, capital markets, corporate, mergers and acquisition and project finance.

Top firms

Assegaf Hamzah & Partners, one of the largest firms in Indonesia, with more than 100 lawyers. Has had an alliance with leading Singaporean firm Rajah & Tann since 2014.

In 2018, AHP served as local counsel to the Indonesia government on a $1.25 billion Islamic green bond issue.

In 2017, AHP advised U.S. private equity giant KKR & Co. on a $75 million acquisition of a 12.64% stake in breadmaker PT Nippon Indosari Corpindo Tbk.

Ali, Budiardjo, Nugroho, Reksodiputro, another 100-plus firm. The Indonesian member firm for legal network Lex Mundi.

In 2018, ABNR served as Indonesian counsel on Uber Technologies Inc.'s merger with southeast Asian rival Grab Inc.

ABNR is advising state-owned railway operator PT Kerata Api Indonesia on a $1.38 billion syndicated loan toward financing the development of a rail project in Jakarta, which is expected to be completed in 2021.

Ginting & Reksodiputro, the Indonesian associate firm of Allen & Overy since 2010, with about 40 lawyers.

Ginting represented Tokopedia on the $1.1 billion funding round last year led by Alibaba and SoftBank.

In 2018, Ginting served as Indonesian counsel to Melbourne-based private equity firm EMR Capital and other exiting investors on a $1.21 billion sale of one of Indonesia's largest gold mines to local equipment lessor PT United Tractors Tbk.

Hadiputranto, Hadinoto & Partners, the Indonesian member firm of Baker McKenzie. One of the largest Indonesian firms with about 100 lawyers.

In 2017, HHP represented a consortium of Indonesian and Chinese companies on a $4.5 billion loan by China Development Bank to build Indonesia's first high-speed railway, connecting its capital Jakarta to the textile hub of Bandung.

Hiswara Bunjamin & Tandjung, the Indonesian associate firm of Herbert Smith Freehills since 2001. Has about 70 lawyers.

In 2018, HBT served as Indonesian counsel to Australian mining giant Rio Tinto on a $3.5 billion sale of a 40% stake in Grasberg, the world's second-largest copper mine, to Indonesian state-owned mining company Inalum.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

More than Half of South Australian Lawyers Report Suffering Harassment

3 minute read

King & Spalding, Weil, Gotshal & Manges Launch Pro Bono Legal Initiative for Tennis Players

2 minute read

Trump Ordered to Pay Legal Bill Within 28 Days After Rejecting Costs Order

2 minute readTrending Stories

- 1Trump's DOJ Files Lawsuit Seeking to Block $14B Tech Merger

- 2'No Retributive Actions,' Kash Patel Pledges if Confirmed to FBI

- 3Justice Department Sues to Block $14 Billion Juniper Buyout by Hewlett Packard Enterprise

- 4A Texas Lawyer Just Rose to the Trump Administration

- 5Hogan Lovells Hires White & Case Corporate and Finance Team in Italy

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250