Simpson Thacher Tops Peers For Roles on Europe's Biggest Private Equity Fundraisings

The US firm has advised on many of the biggest buyout funds that have been raised so far in 2019 according to Preqin data.

October 07, 2019 at 07:43 AM

2 minute read

Credit: iStock/iamnoonmai

Credit: iStock/iamnoonmai

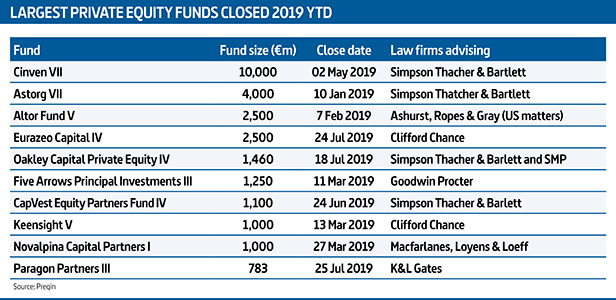

Simpson Thacher & Bartlett has cemented its reputation as Europe's top funds firm, after advising on four of the region's 10 biggest fundraisings of the year so far.

The firm scooped roles on private equity funds raising a total of €16.6 billion, according to bespoke data from Preqin compiled for Legal Week. Mandates included the year's biggest fund so far, Cinven VII, which raised €10 billion. In total, the 10 funds' value hit €25.6 billion.

The firm also advised on capital raisings for Astorg VII, Oakley Capital Private Equity IV, and CapVest Equity Partners Fund IV.

Clifford Chance, meanwhile, advised on two of the top 10 funds – Keensight V and Eurazeo Capital IV, both of which are managed out of France.

Other firms to have advised on top European fundraisings include Goodwin Procter, which took a role on Five Arrows Principal Investments III, Ashurst for Altor Fund V, Macfarlanes for Novalpina Capital Partners I, and K&L Gates for Paragon Partners III.

Simpson Thacher managing partner Jason Glover commented: "An interesting thing about each of these funds is that all four were effectively raised in a single closing, whereas normally you would expect multiple closings over a period of months. As a result, all of these funds were raised in a very short timeframe of a few months, as compared to the more usual nine to 12 months from launch."

When asked why this was happening, Glover said: "I think it's because investors are very keen on this asset class and in particular investing with fund managers who have generated historic top-quartile performance. Each of the funds was oversubscribed and that in turn drives the speed of fundraising, with investors worried that unless they secure participation in such funds quickly, then they will miss out."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

The Africa Top 30, 2024: A Headcount Ranking of the Largest Law Firms on the Continent

5 minute read

Macfarlanes Remains Number 1 UK Firm By Profit Margin, Rankings Show

The 2024 Global 200: The Top 45 Chinese Firms, Ranked By Gross Revenue, RPL and PEP

4 minute read

The 2024 Global 200: The Largest Firms in the Asia Pacific Ranked By Head Count

5 minute readTrending Stories

- 1Family Court 2024 Roundup: Part I

- 2In-House Lawyers Are Focused on Employment and Cybersecurity Disputes, But Looking Out for Conflict Over AI

- 3A Simple 'Trial Lawyer' Goes to the Supreme Court

- 4Clifford Chance Adds Skadden Rainmaker in London

- 5Latham, Kirkland and Paul Weiss Climb UK M&A Rankings

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250