White & Case, Baker McKenzie Advise on $3.59B Sempra Energy Peru Sale to China Yangtze Power

China Yangtze Power, headquartered in Beijing, is the largest hydropower company in the world, with a market capitalization of approximately $58 billion.

October 11, 2019 at 02:07 PM

3 minute read

Part of Luz del Sur's Santa Teresa hydroelectric project in Urubamba valley, Peru. Photo: Matyas Rehak/Shutterstock.com

Part of Luz del Sur's Santa Teresa hydroelectric project in Urubamba valley, Peru. Photo: Matyas Rehak/Shutterstock.com

White & Case and Baker McKenzie have the lead roles in Sempra Energy's $3.59 billion sale of its Peruvian assets to China Yangtze Power – the largest outbound M&A transaction by a Chinese company so far this year.

White & Case is advising San Diego-based Sempra Energy on the deal as the company seeks to focus capital investments on its core businesses in the U.S. and Mexico. Baker McKenzie is representing China Yangtze Power. In addition, Muñiz, Olaya, Meléndez, Castro, Ono & Herrera is Peru counsel for China Yangtze Power.

Sempra announced plans to unload its South American businesses in January, amid pressure from activist investors who argued that Sempra's stock had underperformed because the company acquired valuable, but divergent, businesses. Sempra Energy reported more than $60 billion in total assets and approximately 40 million customers worldwide as of 2018.

The investors, Elliott and Bluescape, said they held a 4.9% stake in Sempra worth $1.3 billion in June 2018, when the activists began publicly lobbying for change at the California-based utility.

Baker McKenzie partner Lewis Popoff is counseling China Yangtze Power from the firm's Chicago office, with assistance from Federico Cuadra Del Carmen in the firm's Miami office. At White & Case, partners Thomas Lauria and Marwan Azzi are lead counsel for Sempra, with help from New York-based partners Greg Pryor, Michael Deyong, David Dreier, Henrik Patel, Arlene Arin Hahn, Damien Nyer and Seth Kerschner; partner Vivian Tsoi in Shanghai; and partners Grace Fan-Delatour and Shaohui Jiang in Beijing.

Partner Andres Kuan-Veng of Muñiz, Olaya, Meléndez, Castro, Ono & Herrera is Peru counsel for China Yangtze Power.

In addition to its Peruvian assets, Sempra aims to sell its Chilean properties, Chilquinta Energía and Tecnored.

Sempra CEO Jeffrey W. Martin made this pitch in his January announcement of the planned sales: "Luz del Sur in Peru, Chilquinta Energía in Chile and their affiliates have been strong-performing investments for us over the past two decades of our ownership. They've made significant contributions to Sempra Energy and offer exciting future growth opportunities."

Italian utility Enel earlier this year made a non-binding bid for the assets Sempra was looking to sell in Chile and Peru.

China Yangtze Power, headquartered in Beijing, is the largest hydropower company in the world, with a market capitalisation of approximately $58 billion.

Baker McKenzie said in a statement that the Peru acquisition represents the Chinese firm's first-ever purchase of power distribution assets from a mature market overseas and is an important step for the company's sustainable development.

China Yangtze Power will take an 83.6% stake in Luz del Sur, a utility company that serves southern Lima, the capital of Peru. Luz del Sur is the largest publicly listed power company in that country. The sale will also include Sempra's interest in Tecsur, which provides electric construction and infrastructure services to Luz del Sur and third parties, and Inland Energy, Luz del Sur's generation business. The sale is expected to close in the first quarter of 2020.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Trinity International Expands With Singapore Office, Eyes Growth in Infrastructure and Energy

Linklaters Continues Renewable Energy Hot Streak With Latest Offshore Wind Farm Project

2 minute read

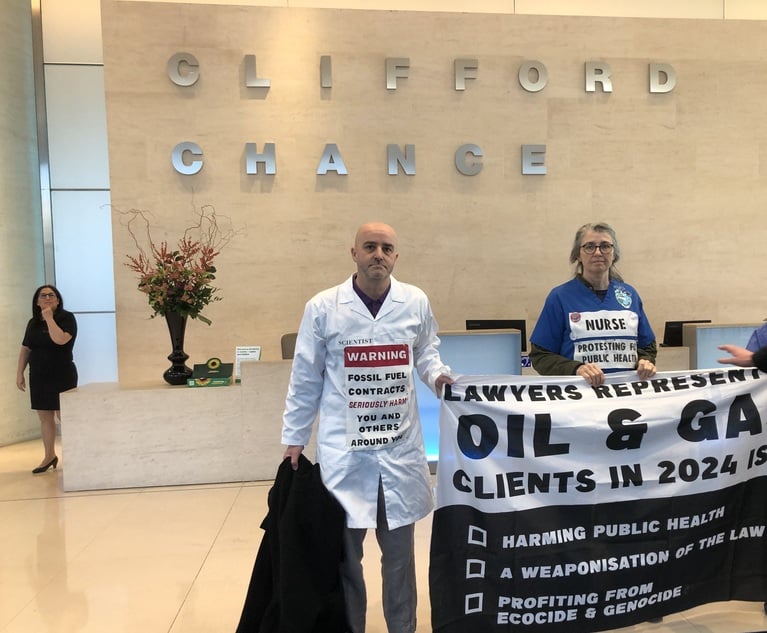

Doctors and Scientists Lead Climate Protests at Each Magic Circle Firm

Trending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250