Corporate Advisers: The Decade's Biggest Risers... and Fallers

Legal Week analyses the latest data to reveal those law firms that corporate U.K. has turned to time and again throughout the last decade.

December 18, 2019 at 04:01 AM

5 minute read

The FTSE 100 and 250 have for the last 10 years charted the fortunes of not just corporate Britain, but also the country's top corporate advisers.

The FTSE 100 and 250 have for the last 10 years charted the fortunes of not just corporate Britain, but also the country's top corporate advisers.

The FTSE 100 has been the bellwether of the nation's fortunes throughout a decade characterised by dynamism, as well as uncertainty. And whether prospering or confronting hard times, the U.K.'s public companies have turned to law firms whose own reputations have long been tied to the country's key share indices.

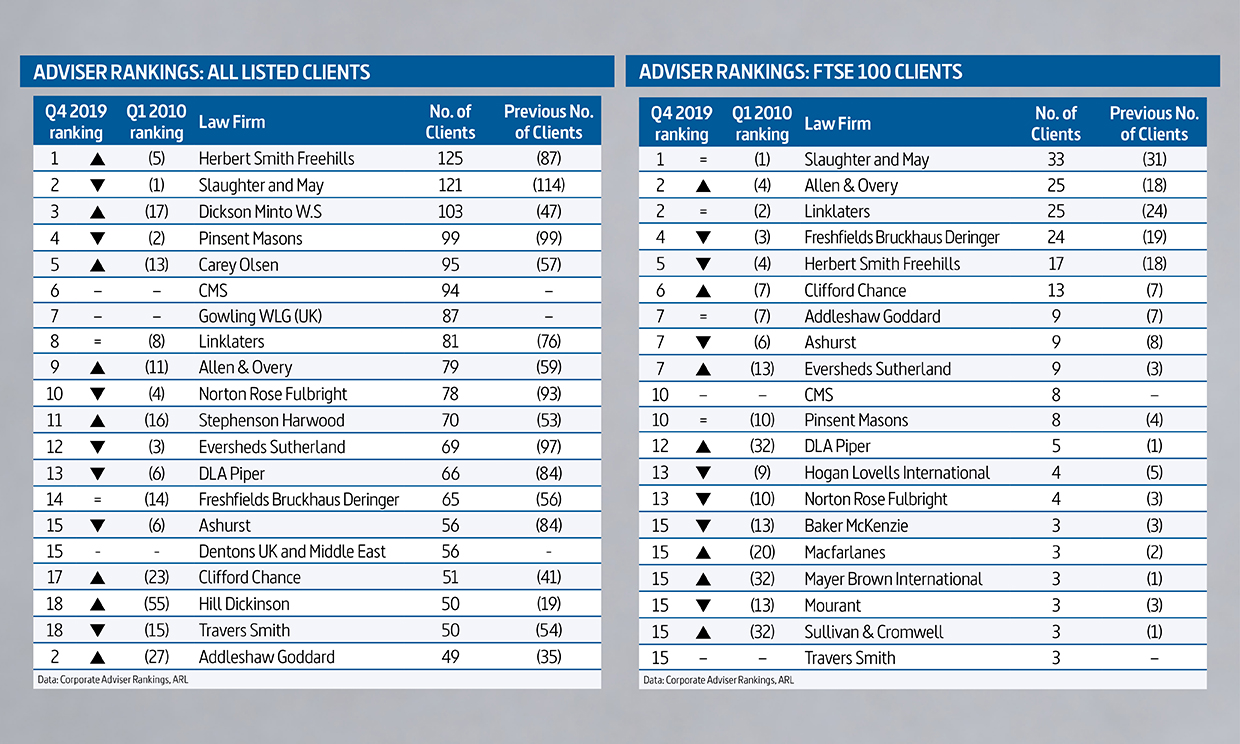

Using data provided by information company Adviser Rankings, Law.com's Legal Week compares figures from the first quarter of 2010 to the last quarter of 2019 to establish who among the country's top corporate advisers have managed to retain, or indeed gain, the most listed companies on their books over the course of the decade.

The 10-year period has seen some law firms demonstrate unrivaled consistency. Slaughter and May continues to dominate the tables, comfortably topping the FTSE 100 and 250 adviser rankings in the latest quarter. Having added a net of two listed clients in 10 years, the Magic Circle firm now counts a third of the top index's companies as its clients (33), and has added another eight clients to its FTSE 250 roster for a total of 46.

A similar story plays out over in the AIM market, where Pinsent Masons has overcome the Gowling WLG challenge to reaffirm its position at the top of the table, counting 54 AIM-listed companies on its books – just one less than a decade ago.

"We've probably had one of the worst years for AIM IPOs"

Elsewhere, many of the industry's biggest names such as Freshfields Bruckhaus Deringer, Clifford Chance and Addleshaw Goddard have held their ground in the FTSE 100. This quarter, Freshfields retains its top five place – fourth this year, third 10 years ago – while Clifford Chance moves up one to sixth, and Addleshaws holds fast the flag it pitched at seventh in 2010.

Yet the period has also witnessed seismic shifts amid intensifying competition.

Among the Magic Circle, Allen & Overy has expanded its FTSE 100 base by almost 40% since 2010, pushing it up to two places to second, overtaking Freshfields in the process.

DLA Piper and Eversheds Sutherland have also made concerted gains among FTSE 100 clients. The former has risen 20 places to 12th, while the latter's client list expanded threefold from three to nine, jumping six places to join top-table mainstays Addleshaws and Ashurst at seventh.

Across all listed U.K. companies, there have been some meteoric rises. Herbert Smith Freehills, which at the start of 2010 polled fifth with 87 clients on the stock exchange, has seen its listed client base swell by 44%. In doing so, the firm has leapfrogged Slaughter and May to the top for total listed clients, with 125 clients to Slaughters' 121.

Click on tables for larger view

Click on tables for larger viewHSF achieved this by overseeing rises in the FTSE 250, Small Cap and Fledgling markets – soaring into the top five in each.

Commenting on the results, HSF co-head of corporate Stephen Wilkinson noted how law firms' culture and diversity has risen up client agendas.

"Clients expect teams from law firms who are servicing them to share the same values and approach that they have in their own organisations," he said, "and that's something we're very keen to talk to our clients about.

"We have some clients who say they want to see just as many women as they do men – some want us to report in on these issues."

Offshore law firm Carey Olsen has also shot up the overall rankings, expanding its client base from 57 to 95 – an increase of two thirds.

On the AIM index, Hill Dickinson has rocketed up the table from 55th in 2010 to fifth this quarter, while Fieldfisher has risen from 12th to third during the same time period.

The reverse has happened elsewhere, according to the data. Eversheds Sutherland and Norton Rose Fulbright, once third and fourth respectively in the overall count, have shrunk to 12th and 10th, shedding a total of 43 clients between them.

Ashurst has also fallen from the top 10 both for overall clients and among FTSE 250 advisers.

According to Pinsent Masons corporate finance partner, Julian Stanier, the market conditions for the coming year might well prove positive after a year of uncertainty.

"We've probably had one of the worst years for AIM IPOs," Stanier said. "We're expecting to see a bounce in that market.

"I've got a number of AIM IPOs on the shelf ready to go, so to speak."

He also believes that private equity "is sitting on a lot of cash at the moment", and that "we're expecting to see an uptick of 'P2P' – public-to-private deals, where they take companies off the market".

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Jones Day, BCLP & Other Major Firms Boost European Teams with Key Partner Hires

4 minute read

$13.8 Billion Magomedov Claim Thrown Out by UK High Court

Law Firms Mentioned

Trending Stories

- 1South Florida Attorney Charged With Aggravated Battery After Incident in Prime Rib Line

- 2'A Death Sentence for TikTok'?: Litigators and Experts Weigh Impact of Potential Ban on Creators and Data Privacy

- 3Bribery Case Against Former Lt. Gov. Brian Benjamin Is Dropped

- 4‘Extremely Disturbing’: AI Firms Face Class Action by ‘Taskers’ Exposed to Traumatic Content

- 5State Appeals Court Revives BraunHagey Lawsuit Alleging $4.2M Unlawful Wire to China

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250