Asia Pacific 2019 League Tables: China Deals Plunge Further; Japan, Singapore on the Rise

Strong deal flow in Korea made Kim & Chang one of the top M&A legal advisers in the region.

January 07, 2020 at 01:56 PM

3 minute read

Mergers and acquisitions activity in the Asia Pacific continued to drop to a six-year low with China deals further affected by geopolitical tensions. Korea and Japan deals, meanwhile, saw strong momentum.

Overall M&A activity in the Asia Pacific, excluding Japan, totaled $565.3 billion in 2019, the lowest level since 2013, according to data compiled by Mergermarket. The region's share in the global M&A market shrank 17% in 2019 from 20.4% a year earlier. Deals involving mainland China and Hong Kong, negatively affected by the U.S.-China trade and economic disputes, totaled $294.5 billion, accounting for 8.8% of the total global value, down 27.6% from 2018.

Meanwhile, South Korean deals hit a decade high according to Bloomberg data. Deal value was significantly boosted in the fourth quarter when several multibillion-dollar deals were announced. Notably, SoftBank Corp. launched a joint venture with Korean tech company Naver Corp. and merged SoftBank-owned Yahoo Japan and Naver-owned Line Corp. in a $30 billion deal. In December, Korean online delivery services operator Woowa Brothers Corp. was acquired by German rival Delivery Hero S.E. in a $4 billion deal.

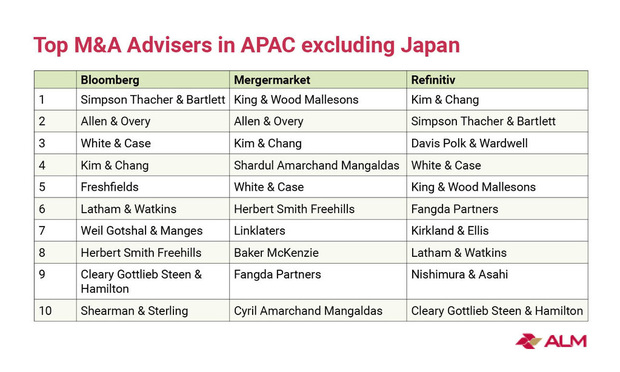

The Korean deals helped put Kim & Chang, the country's largest law firm, in the top five of the region's M&A legal advisers in 2019, according to three major ranking organizations. Kim & Chang worked on both of the big Korean deals. The Korean firm also topped last year's M&A legal adviser ranking by Refinitiv and was No. 3 and 4 by Mergermarket and Bloomberg. The rest of the rankings varied because of differences in methodologies.

The Mergermarket report also noted the rise of Singapore M&As. Continued political unrest in Hong Kong helped turn investors' attention to the Southeast Asian financial hub. Total M&A value in Singapore hit $35.3 billion in 2019, more than doubling the amount from 2018. Singaporean developer CapitaLand Ltd.'s January 2019 acquisition of sovereign wealth fund Temasek Holdings Pte. Ltd.'s logistics and industrial assets was one of the biggest deals in the region.

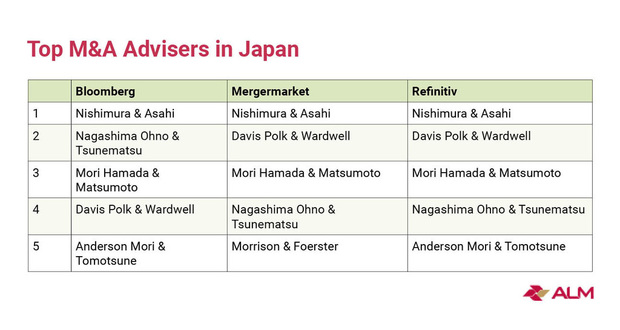

Japan's M&A activity continued to outperform the overall Asia Pacific region last year. According to Mergermarket data, deals involving Japanese parties totaled $75.4 billion, up nearly 60% year-on-year and accounting for 11.8% of the overall deal value in the region—the largest share since 2012. In addition to the Line Corp.-Yahoo Japan merger, Japanese brewer Asahi Group Holdings Ltd.'s $11.3 billion acquisition of Anheuser-Busch InBev's Australia business is also one of the largest M&As in the region.

In October, Law.com's The Asian Lawyer reported that Japan has seen both outbound and inbound deal activity pick up in recent years.

Related Stories:

Japan M&A Activity Ramps Up, Prompting Movement for M&A Lawyers

US Duo Pick Up Roles on Multibillion-Dollar SoftBank Deal

Sullivan & Cromwell, Latham & Watkins on $4B Korea Ecommerce Deal

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Goodwin's Singapore Private Equity Partner Leaves to Join Key Client Hillhouse Investment

Law Firms Mentioned

Trending Stories

- 1'Didn't Notice Patient Wasn't Breathing': $13.7M Verdict Against Anesthesiologists

- 2'Astronomical' Interest Rates: $1B Settlement to Resolve Allegations of 'Predatory' Lending Cancels $534M in Small-Business Debts

- 3Senator Plans to Reintroduce Bill to Split 9th Circuit

- 4Law Firms Converge to Defend HIPAA Regulation

- 5Judge Denies Retrial Bid by Ex-U.S. Sen. Menendez Over Evidentiary Error

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250