Cadwalader London Revenue Slips Again Amid Global Profits Hike

The profit surge comes as Cadwalader closed its Brussels office and saw another down year in London office revenue.

February 11, 2020 at 03:15 PM

7 minute read

The original version of this story was published on New York Law Journal

Cadwalader offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Cadwalader offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

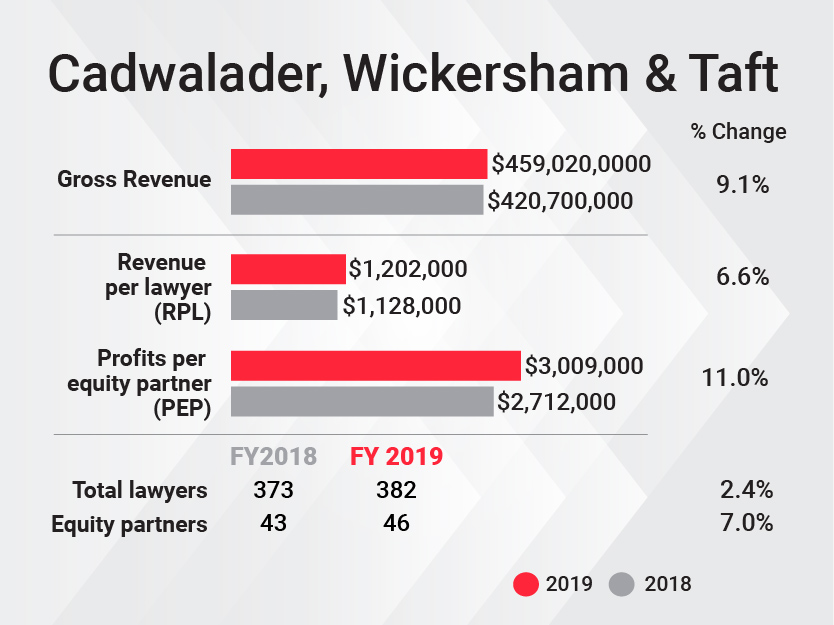

Cadwalader Wickersham & Taft's profits shot up last year, hitting $3 million in average profits per equity partner, a stronger performance than 2018.

Cadwalader's gross revenue grew 9.1%, hitting $459 million last year. With a higher profit margin at the firm, net income grew much faster, rising 18.7% to $138.4 million, helping to push up profits per equity partner by 11%.

Meanwhile, the firm's equity-partner count rose to 46, a net gain of three, while the average full time lawyer head count was only 2.4% higher than in 2018.

The profit hike comes as Cadwalader consolidated offices. The firm has now closed its Brussels office, which had opened in 2011 and tallied an average of just one lawyer in recent years. Cadwalader plans to serve Europe from London, managing partner Patrick Quinn said. The firm's lone office on continental Europe was "basically a conference center" by the time it closed, Quinn added, and anyone in Brussels was also working out of the London office.

London is now Cadwalader's only office outside the U.S., after the firm in recent years also closed offices in Beijing and Hong Kong.

In London, office revenue was down for a second year running, slipping from $43.1 million to $41.3 million last year. But Quinn said the firm remains "very bullish on London," having added three lateral partners there in 2020. The firm is preparing for a move into London office space that can accommodate "almost double" the office's current headcount, he said.

Cadwalader, whose clients have included banks like J.P. Morgan and Goldman Sachs, is in its fourth year of a strategy that has entailed focusing on its core clients in the banking, investment and financial services industries, said Quinn, who took the reins in 2015. Besides banks, its core client base also includes large corporations and funds.

Overall, the firm was "firing on all cylinders" last year, Quinn said, adding the strongest year-over-year growth was in its corporate mergers and acquisitions and litigation groups and said the firm's traditionally strong capital markets and finance groups also delivered. About two-thirds of the firm's work came from transactional or corporate work, rather than litigation, he said, roughly in line with Cadwalader's head count breakdown.

"The numbers are great, but the numbers are more validation of the other good things the firm is doing," Quinn said.

In line with its focus on the financial industry, the firm's presence in Charlotte, North Carolina, continued to grow. While it originally opened an office there at the request of clients NationsBank—Bank of America's predecessor—and First Union, now part of Wells Fargo, Quinn said, its average lawyer head count last year rose to 80, from 73 the year before. The firm's website now lists 91 attorneys in Charlotte.

The firm's Libor Preparedness Team has also been busy, Quinn said. While most of the work it did last year was for the Alternative Reference Rates Committee, which was created by U.S. regulators to help transition away from Libor, "we're expecting a tremendous amount of work for financial institutions" this year and the next, he said.

Notable hires in 2019 included four attorneys formerly of O'Shea Partners, who had joined Boies Schiller Flexner in 2016 before moving as a group to Cadwalader in March. Other prominent hires in 2019 included corporate fintech partner Vivian Maese from Latham & Watkins and Buckley's Douglas Gansler, who deals with state attorneys general investigations.

A transition

Cadwalader has had a successful past few years, but the firm is not without its battle scars. The financial crisis prompted a tide of layoffs at Cadwalader, with some 120 jobs cut in 2008 as the real estate finance and securitization industries slumped. At the end of 2007, the firm had some 720 lawyers; for 2013, it reported an average attorney head count of 435.

While its head count rose slightly in 2014 and 2015, the firm still wasn't done shrinking. The strategy of focusing on the finance industry was settled in late 2016; several litigation and antitrust partners moved to new firms, and offices in Houston, Beijing and Hong Kong closed. While Cadwalader's revenue dropped, profits per partner rose in 2017, and the climb has continued since then.

Quinn said he's not worried about a downturn now. Even if the economy turned south, he said, it would not necessarily hit the same industries that cratered in 2007 and 2008, and the changing nature of financial products means Cadwalader has an edge, he said.

"If credits [loans] start to default, then it looks like you need an awful lot of structured products expertise if you're going to deal with an increase in defaults of credits that are held within structured products," he said. "Much more of those kinds of credits, which might have been held on banks' balance sheets … precredit crisis are now very often held within structured products—CLOs, and so forth."

Quinn has said the firm isn't done executing on the strategy it embarked on three years ago and said there is no set end date. In the meantime, though, he said the firm has been working to transition its business to a rising generation of rainmakers.

Cadwalader doesn't have a rule book when it comes to retirement, Quinn said, but older partners have also been passing on and developing client relationships with newer ones. Younger partners like Richard Brand, co-chair of the corporate practice, and Michael Mascia, co-chair of the finance practice, have big roles at the firm, said Quinn, who said he tries to involve rising lawyers in firm management.

"Maybe it sounds too good to be true, but we have very senior, very productive people who are more interested in reinvesting in younger partners than taking the last dime off the table for themselves," he said.

A rising tide

One of Cadwalader's mainstays has been advising issuers and underwriters on commercial mortgage-backed securities and collateralized loan obligations. The firm lists 37 lawyers in its securitization and asset-backed securities practice, and a firm spokesman said it once again topped the league tables for representing issuers in CMBS transactions for a 20th straight year.

The firm also said its capital markets group, led by Michael Gambro and Stuart Goldstein, represented issuers or underwriters in transactions worth over $90 billion last year, according to data from Commercial Mortgage Alert.

In the M&A space, the firm advised on the $1.1 billion acquisition of Corindus Vascular Robotics by Siemens Healthineers AG and the $430 million merger between the jet-parts-and-repair company AerSale Corp. and a special-purpose acquisition company called Monocle Acquisition Corp.

The firm's litigators have also been busy. They represented Kingsland Holdings Ltd. in litigation and negotiations with Avianca, a South American airline in which it is a major investor. The firm was appointed as a monitor in federal prosecutors' settlement with drug distributor Rochester Drug Co-Operative over its sales of oxycodone and fentanyl.

One major matter the O'Shea group brought with it was the representation of restructuring guru Jay Alix and affiliated entities in a multicourt dispute with McKinsey & Co. In that matter, Alix went to trial last week in Houston bankruptcy court over allegations that McKinsey hid conflicts in its work for Westmoreland Coal Co.

Read More:

After Retrenchment, Cadwalader Reverses Revenue Slide and Boosts Profits

Cadwalader to pull out of Asia with Beijing and Hong Kong office closures

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Malaysia’s Shearn Delamore Set To Expand Local Footprint With New Office Launch

CMA Uses New Competition Powers to Investigate Google Over Search Advertising

‘A Slave Drivers' Contract’: Evri Legal Director Grilled by MPs

Law Firms Mentioned

Trending Stories

- 1Supreme Court Appears Sympathetic to Law Requiring Porn Sites to Verify Users' Age

- 2Cybersecurity Breaches, Cyberbullying, and Ways to Help Protect Clients From Both

- 3AI in 2025: Five Key Predictions on How It Will Reshape International Law Firms

- 4Justice Known for Asking 'Tough Questions' Resolves to Improve Civility

- 5Robinson & Cole Elects New Partners and Counsel

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250